Region:Global

Author(s):Geetanshi

Product Code:KRAB0020

Pages:97

Published On:August 2025

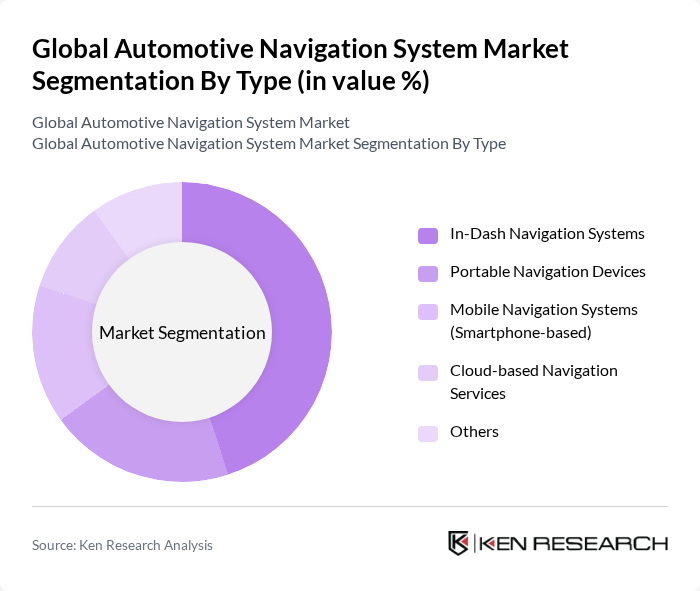

By Type:The market is segmented into In-Dash Navigation Systems, Portable Navigation Devices, Mobile Navigation Systems (Smartphone-based), Cloud-based Navigation Services, and Others. In-Dash Navigation Systems lead the market due to their seamless integration into modern vehicles, offering advanced connectivity, real-time updates, and user-friendly interfaces. The shift toward smart vehicles, increased demand for built-in navigation, and the adoption of cloud-based and AI-driven navigation features are driving the growth of this segment .

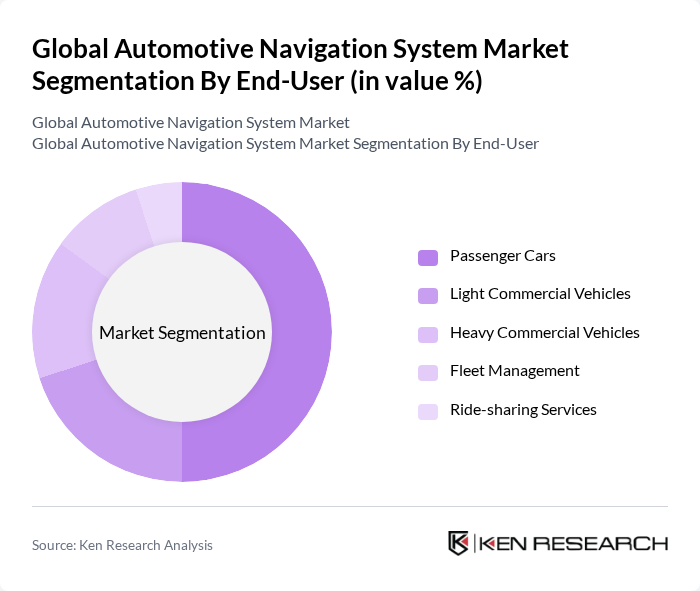

By End-User:This segmentation includes Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Fleet Management, Ride-sharing Services, and Others. The Passenger Cars segment dominates the market, driven by increasing consumer preference for personal vehicles equipped with advanced navigation features. Urbanization, rising vehicle ownership, and the demand for efficient commuting solutions further bolster this segment's growth .

The Global Automotive Navigation System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Garmin Ltd., TomTom N.V., HERE Technologies, Bosch Mobility Solutions (Robert Bosch GmbH), Continental AG, Denso Corporation, Pioneer Corporation, Mitsubishi Electric Corporation, Panasonic Holdings Corporation, Qualcomm Technologies, Inc., Apple Inc., Google LLC, Harman International Industries, Inc., LG Electronics Inc., Ford Motor Company, Tesla, Inc., and Audi AG contribute to innovation, geographic expansion, and service delivery in this space.

The automotive navigation system market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance navigation accuracy and personalization, while the shift towards subscription-based models will provide consumers with flexible payment options. Additionally, the expansion of electric vehicle infrastructure will create new opportunities for navigation systems tailored to electric vehicles, ensuring that the market remains dynamic and responsive to emerging trends and consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | In-Dash Navigation Systems Portable Navigation Devices Mobile Navigation Systems (Smartphone-based) Cloud-based Navigation Services Others |

| By End-User | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Fleet Management Ride-sharing Services Others |

| By Application | Personal Navigation Commercial Navigation Emergency Services Logistics and Transportation Others |

| By Distribution Channel | OEM (Original Equipment Manufacturer) Aftermarket Online Retail Offline Retail Direct Sales Distributors Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Vehicle Type | SUVs Sedans Trucks Vans Others |

| By Pricing Model | Subscription-based One-time Purchase Freemium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Navigation Systems | 120 | Product Managers, Automotive Engineers |

| Commercial Vehicle Navigation Solutions | 90 | Fleet Managers, Logistics Coordinators |

| Aftermarket Navigation Systems | 60 | Retail Managers, Automotive Accessory Buyers |

| Connected Vehicle Technologies | 50 | IT Managers, Connectivity Specialists |

| Smartphone Integration in Vehicles | 70 | Consumer Electronics Managers, Automotive UX Designers |

The Global Automotive Navigation System Market is valued at approximately USD 36.5 billion, driven by the increasing demand for advanced navigation solutions, connected cars, and real-time traffic updates. This growth reflects a significant trend towards integrating sophisticated navigation technologies in vehicles.