Region:Global

Author(s):Shubham

Product Code:KRAC0806

Pages:94

Published On:August 2025

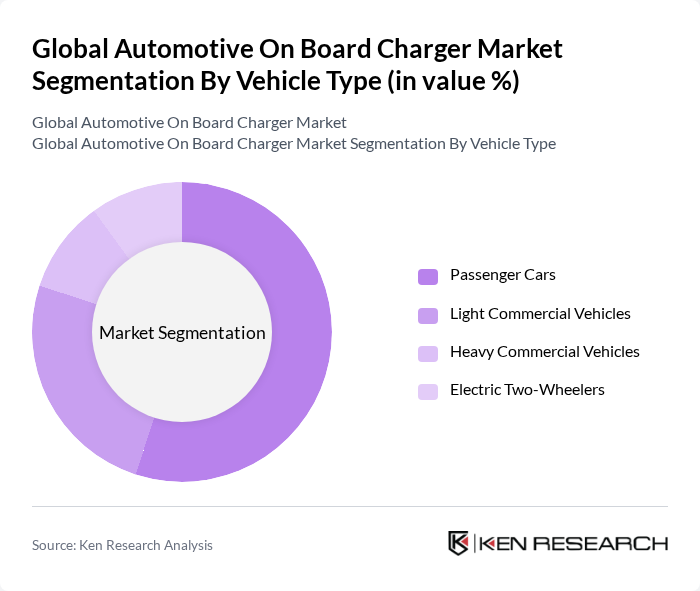

By Vehicle Type:

The vehicle type segmentation includes Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, and Electric Two-Wheelers. Passenger Cars continue to dominate the market, driven by rising consumer preference for electric sedans and hatchbacks, urbanization trends, and the demand for eco-friendly transportation. Light Commercial Vehicles are gaining momentum, especially in logistics and delivery sectors, as businesses prioritize reducing their carbon footprint. Commercial vehicle adoption is supported by regulatory incentives and fleet electrification programs in key markets.

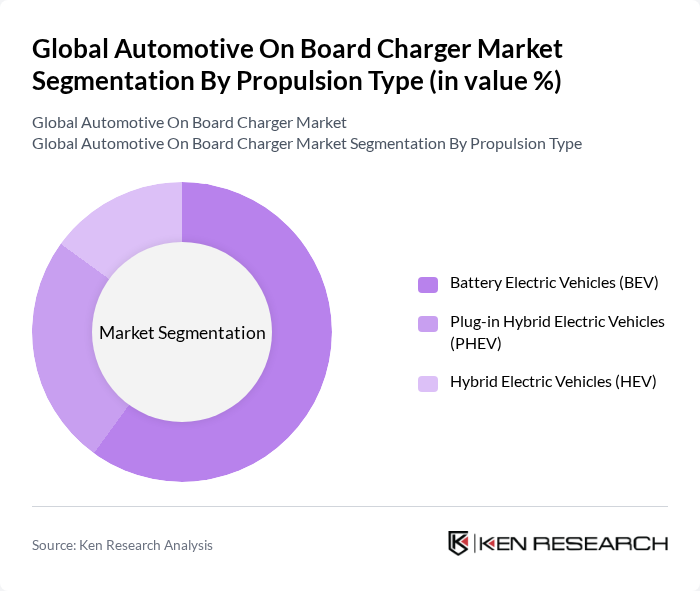

By Propulsion Type:

This segmentation includes Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), and Hybrid Electric Vehicles (HEV). The Battery Electric Vehicles segment leads the market, propelled by advancements in battery technology, increased consumer awareness of environmental issues, and government incentives for EV purchases. The expansion of charging infrastructure and the introduction of high-voltage fast charging systems further support BEV growth. PHEVs are also gaining popularity, offering flexibility for consumers with limited access to charging stations and benefiting from emission reduction policies.

The Global Automotive On Board Charger Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tesla, Inc., BYD Company Limited, BorgWarner Inc., LG Electronics Inc., Ficosa International S.A., Delta Electronics, Inc., Panasonic Corporation, Eaton Corporation plc, Siemens AG, ABB Ltd., Webasto SE, Bosch Automotive Service Solutions, ClipperCreek, Inc., Nuvve Holding Corp., Enel X S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive on-board charger market appears promising, driven by technological advancements and increasing consumer demand for electric vehicles. As manufacturers focus on integrating smart charging solutions and enhancing charging speeds, the market is expected to witness significant growth. Additionally, the rise of vehicle-to-grid (V2G) technology will create new opportunities for energy management, allowing EVs to contribute to grid stability while optimizing charging processes, further enhancing market dynamics.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Cars Light Commercial Vehicles Heavy Commercial Vehicles Electric Two-Wheelers |

| By Propulsion Type | Battery Electric Vehicles (BEV) Plug-in Hybrid Electric Vehicles (PHEV) Hybrid Electric Vehicles (HEV) |

| By Power Output | Less than 11 kW kW to 22 kW More than 22 kW |

| By Application | Residential Charging Commercial/Public Charging |

| By Distribution Channel | OEMs Aftermarket |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Electric Vehicle Manufacturers | 100 | Product Development Managers, R&D Engineers |

| Commercial Vehicle Charging Solutions | 60 | Fleet Managers, Operations Directors |

| EV Charging Infrastructure Providers | 50 | Business Development Managers, Technical Leads |

| Consumer Insights on EV Charging | 70 | EV Owners, Charging Station Users |

| Regulatory Bodies and Policy Makers | 40 | Policy Analysts, Regulatory Affairs Managers |

The Global Automotive On Board Charger Market is valued at approximately USD 6.7 billion, driven by the increasing adoption of electric vehicles (EVs) and the demand for efficient charging solutions, alongside government incentives and advancements in charging technology.