Region:Global

Author(s):Shubham

Product Code:KRAC0691

Pages:92

Published On:August 2025

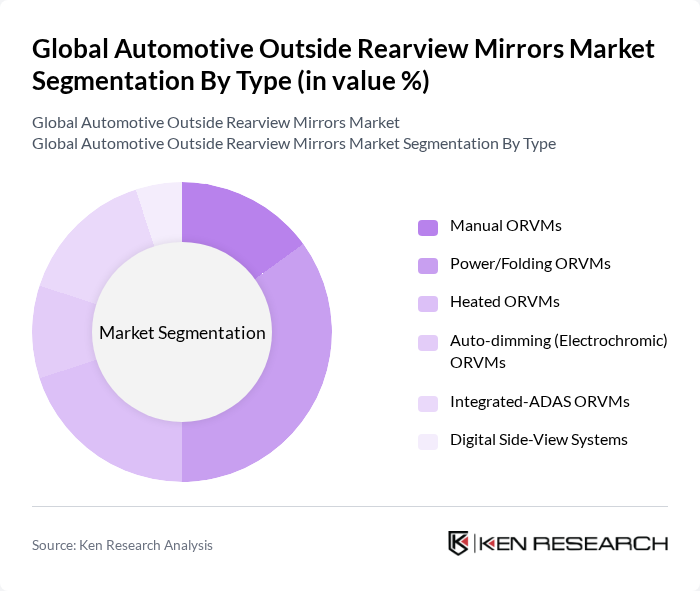

By Type:The market is segmented into various types of outside rearview mirrors, including Manual ORVMs, Power/Folding ORVMs, Heated ORVMs, Auto-dimming (Electrochromic) ORVMs, Integrated-ADAS ORVMs, and Digital Side-View Systems. Among these, Power/Folding ORVMs are gaining traction due to convenience, parking protection, and alignment with rising electrification and ADAS feature bundles on mass-market nameplates.

By Vehicle Category:The segmentation by vehicle category includes Passenger Cars, Light Commercial Vehicles (LCVs), Medium & Heavy Commercial Vehicles (M&HCVs), and Two-wheelers and Micro-mobility. Passenger Cars dominate due to higher global light-vehicle volumes and faster penetration of power-folding, heated, and auto-dimming mirror features in OEM trim packages.

The Global Automotive Outside Rearview Mirrors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gentex Corporation, Magna International Inc. (Magna Mirrors), Ficosa International, S.A. (a Panasonic company), Samvardhana Motherson Reflectec (Motherson Group), Valeo S.A., Murakami Corporation, Tokai Rika Co., Ltd., SL Corporation (SL Lighting/SL Mirrors), Ichikoh Industries, Ltd. (Valeo group), Lumax Auto Technologies Ltd. (Mirror division), SMR Automotive Systems India Ltd. (Motherson), Mitsuba Corporation, U-SHIN Ltd. (MinebeaMitsumi Group), Burco, Inc. (aftermarket mirror glass), MEKRA Lang GmbH & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive outside rearview mirrors market appears promising, driven by technological innovations and increasing consumer demand for safety features. As the automotive industry shifts towards electric and autonomous vehicles, the integration of advanced driver assistance systems (ADAS) will become crucial. Furthermore, the expansion into emerging markets presents significant growth potential, as these regions adopt modern vehicle technologies. The focus on sustainability will also drive the development of eco-friendly materials and manufacturing processes, shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual ORVMs Power/Folding ORVMs Heated ORVMs Auto-dimming (Electrochromic) ORVMs Integrated-ADAS ORVMs (with turn signal, BSM indicator, camera) Digital Side-View Systems (camera-based, where permitted) |

| By Vehicle Category | Passenger Cars Light Commercial Vehicles (LCVs) Medium & Heavy Commercial Vehicles (M&HCVs) Two-wheelers and Micro-mobility (where ORVMs applicable) |

| By Component | Mirror Glass (flat, convex, aspheric) Housings & Caps (plastic/composite) Actuators & Motors Sensors & Electronics (heaters, EC cells, cameras, indicators) Mounting & Control Modules |

| By Sales Channel | OEM Aftermarket (organized/offline) Online Aftermarket Authorized Service Networks |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Functionality | Manual Adjustment Power Adjustment Power Folding Memory & Auto-tilt Auto-dimming Heated/Defogging Integrated Turn Signal/BSM Indicator |

| By Price Range | Budget Mid-Range Premium Luxury/Performance |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Automotive Manufacturers | 120 | Product Development Managers, Procurement Specialists |

| Aftermarket Suppliers | 90 | Sales Managers, Distribution Coordinators |

| Automotive Technology Innovators | 70 | R&D Engineers, Technology Officers |

| Regulatory Bodies | 40 | Compliance Officers, Policy Makers |

| Consumer Insights | 110 | Automotive Enthusiasts, General Consumers |

The Global Automotive Outside Rearview Mirrors Market is valued at approximately USD 11.3 billion, reflecting a comprehensive analysis of the market over the past five years, with outside mirrors accounting for a significant share of total mirror revenue.