Region:Global

Author(s):Dev

Product Code:KRAB0587

Pages:93

Published On:August 2025

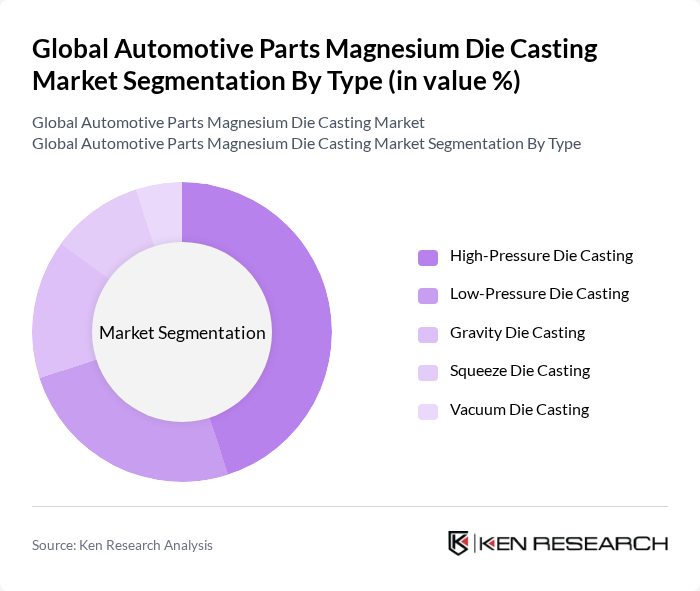

By Type:The market is segmented into various types of die casting processes, including High-Pressure Die Casting, Low-Pressure Die Casting, Gravity Die Casting, Squeeze Die Casting, and Vacuum Die Casting. Each type has its unique advantages and applications, catering to different manufacturing needs in the automotive industry. High-pressure die casting remains the dominant process due to its ability to produce complex, high-precision components at scale, while other methods are selected for specific performance or design requirements .

TheHigh-Pressure Die Castingsegment dominates the market due to its ability to produce complex shapes with high precision and minimal waste. This method is particularly favored in the automotive industry for manufacturing components that require high strength and durability, such as engine blocks and transmission housings. The efficiency and speed of high-pressure die casting processes align well with the automotive industry's demand for rapid production cycles and cost-effective solutions. Technological advancements, including automation and improved mold materials, have further enhanced the competitiveness of this segment .

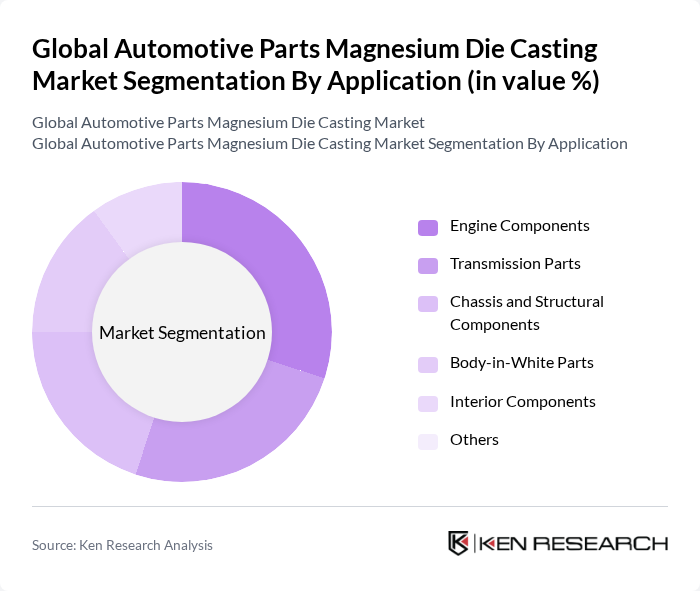

By Application:The applications of magnesium die casting in the automotive sector include Engine Components, Transmission Parts, Chassis and Structural Components, Body-in-White Parts, Interior Components, and Others. Each application serves a specific function, contributing to the overall performance and efficiency of vehicles. The use of magnesium die casting is expanding beyond traditional powertrain and structural parts to include interior and exterior applications, supporting vehicle lightweighting and design flexibility .

Engine Componentsare the leading application segment, driven by the need for lightweight and high-strength materials that enhance fuel efficiency and performance. Magnesium die casting provides an excellent solution for producing intricate engine parts that can withstand high temperatures and pressures. The growing trend towards electric vehicles further boosts the demand for lightweight engine components, solidifying this segment's market leadership. Increasing adoption of magnesium for chassis and structural parts is also observed, reflecting the industry's focus on comprehensive vehicle lightweighting .

The Global Automotive Parts Magnesium Die Casting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Georg Fischer AG, Shiloh Industries Inc., Pace Industries, Gibbs Die Casting Group, Sundaram Clayton Limited, Ryobi Limited, Nemak S.A.B. de C.V., Dynacast (Form Technologies), Meridian Lightweight Technologies, Martinrea Honsel Germany GmbH, Endurance Technologies Limited, Alcoa Corporation, GF Casting Solutions, Teksid S.p.A., ZF Friedrichshafen AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the magnesium die casting market in the automotive sector appears promising, driven by the increasing emphasis on sustainability and lightweight materials. As manufacturers adopt advanced technologies and focus on reducing emissions, the demand for magnesium components is expected to rise. Additionally, the integration of Industry 4.0 technologies will enhance production efficiency, enabling companies to meet evolving consumer preferences for customized automotive parts while maintaining environmental compliance.

| Segment | Sub-Segments |

|---|---|

| By Type | High-Pressure Die Casting Low-Pressure Die Casting Gravity Die Casting Squeeze Die Casting Vacuum Die Casting |

| By Application | Engine Components Transmission Parts Chassis and Structural Components Body-in-White Parts Interior Components Others |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Vehicles Two-Wheelers Others |

| By Component | Castings Machined Parts Assemblies Sub-Assemblies Others |

| By Sales Channel | OEM (Original Equipment Manufacturer) Aftermarket Distributors Online Sales Others |

| By Distribution Mode | B2B B2C Others |

| By Price Range | Low Price Mid Price High Price Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 100 | Product Development Managers, Procurement Directors |

| Tier 1 Suppliers | 80 | Operations Managers, Quality Control Engineers |

| Magnesium Die Casting Manufacturers | 60 | Production Supervisors, R&D Engineers |

| Industry Analysts | 50 | Market Research Analysts, Economic Advisors |

| Regulatory Bodies | 40 | Compliance Officers, Policy Makers |

The Global Automotive Parts Magnesium Die Casting Market is valued at approximately USD 14.7 billion, reflecting a significant growth trend driven by the demand for lightweight materials in the automotive sector, enhancing fuel efficiency and reducing emissions.