Region:Global

Author(s):Dev

Product Code:KRAB0616

Pages:96

Published On:August 2025

By Type:The market is segmented into various types of pneumatic actuators, including Linear Pneumatic Actuators, Rotary Pneumatic Actuators, Pneumatic Cylinders (Single-acting, Double-acting), Pneumatic Valves & Solenoid Valves, Electro-Pneumatic Actuators, and Others. Among these, Linear Pneumatic Actuators are leading the market due to their widespread application in automotive systems, such as braking and steering mechanisms. Their ability to provide precise control and high force output makes them a preferred choice for manufacturers .

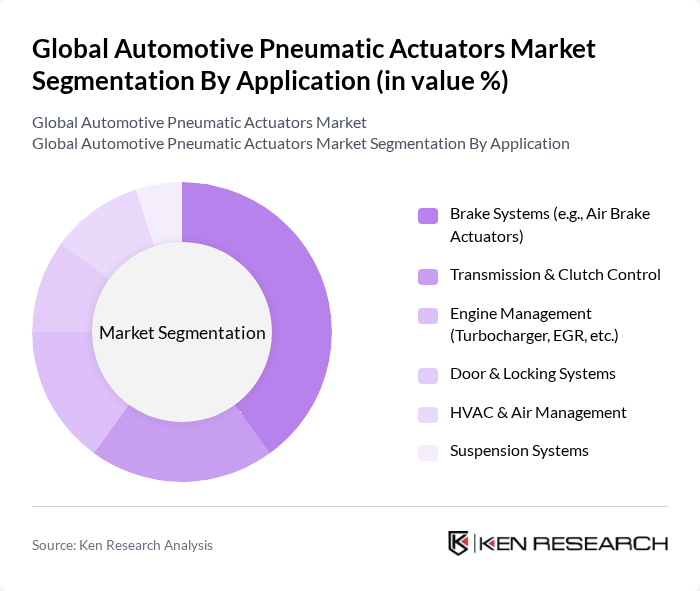

By Application:The applications of pneumatic actuators in the automotive sector include Brake Systems (e.g., Air Brake Actuators), Transmission & Clutch Control, Engine Management (Turbocharger, EGR, etc.), Door & Locking Systems, HVAC & Air Management, Suspension Systems, and Others. The Brake Systems application is particularly dominant, driven by the increasing focus on vehicle safety, regulatory requirements, and the need for reliable braking performance in modern vehicles .

The Global Automotive Pneumatic Actuators Market is characterized by a dynamic mix of regional and international players. Leading participants such as Parker Hannifin Corporation, SMC Corporation, Festo AG & Co. KG, Bosch Rexroth AG, Emerson Electric Co., Honeywell International Inc., Enerpac Tool Group (formerly Actuant Corporation), AVENTICS GmbH (Emerson Pneumatics), Bimba Manufacturing Company, Norgren Ltd. (IMI Precision Engineering), Pneumax S.p.A., ARO Fluid Management (Ingersoll Rand), Camozzi Automation S.p.A., Aignep S.p.A., Trelleborg AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive pneumatic actuators market appears promising, driven by ongoing technological advancements and increasing regulatory pressures for fuel efficiency and emissions reduction. As manufacturers continue to innovate, the integration of smart actuators and IoT solutions will enhance operational efficiency and vehicle performance. Additionally, the expansion into emerging markets will provide new avenues for growth, as these regions adopt modern automotive technologies to meet evolving consumer demands and regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Linear Pneumatic Actuators Rotary Pneumatic Actuators Pneumatic Cylinders (Single-acting, Double-acting) Pneumatic Valves & Solenoid Valves Electro-Pneumatic Actuators Others |

| By Application | Brake Systems (e.g., Air Brake Actuators) Transmission & Clutch Control Engine Management (Turbocharger, EGR, etc.) Door & Locking Systems HVAC & Air Management Suspension Systems Others |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV, Trucks, Buses) Off-road & Specialty Vehicles Electric & Hybrid Vehicles Others |

| By Sales Channel | OEM (Original Equipment Manufacturer) Aftermarket Online Sales Distributors Retailers Others |

| By Component | Actuator Body Control Systems & Electronics Sensors & Feedback Devices Accessories (Mounting, Fittings, etc.) Others |

| By Price Range | Low Price Mid Price High Price Premium Price Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 120 | Product Development Engineers, R&D Managers |

| Commercial Vehicle Manufacturers | 90 | Procurement Managers, Operations Directors |

| Suppliers of Pneumatic Actuators | 60 | Sales Managers, Technical Support Engineers |

| Automotive Component Distributors | 50 | Logistics Coordinators, Inventory Managers |

| Automotive Aftermarket Service Providers | 40 | Service Managers, Workshop Owners |

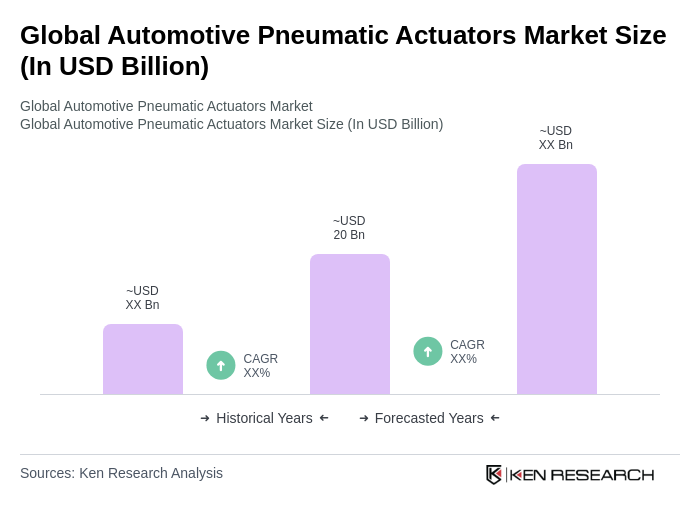

The Global Automotive Pneumatic Actuators Market is valued at approximately USD 20 billion, driven by increasing automation and electrification in the automotive sector, along with advancements in pneumatic technology that enhance vehicle performance and safety.