Region:Global

Author(s):Dev

Product Code:KRAC0485

Pages:94

Published On:August 2025

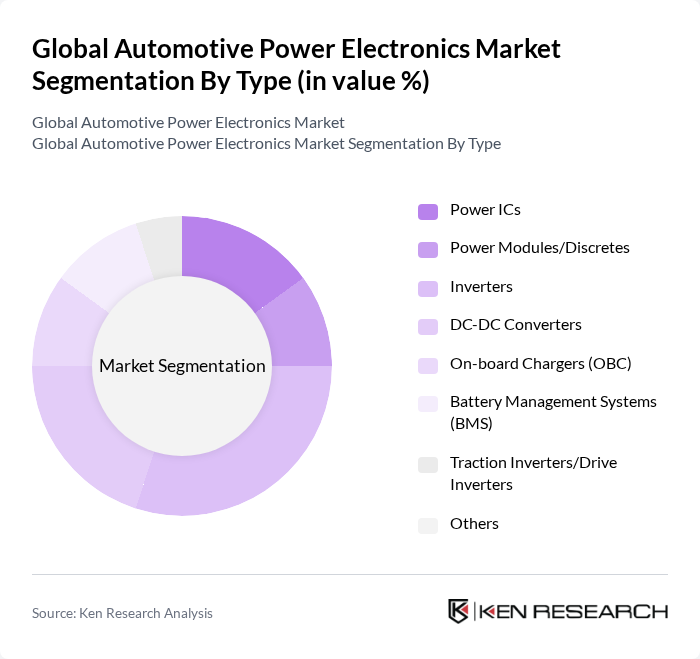

By Type:The automotive power electronics market is segmented into various types, including Power ICs, Power Modules/Discretes, Inverters, DC-DC Converters, On-board Chargers (OBC), Battery Management Systems (BMS), Traction Inverters/Drive Inverters, and Others. Among these, Inverters are currently the leading sub-segment due to their critical role in electric and hybrid vehicles, converting DC power from batteries to AC power for electric motors. The increasing adoption of electric vehicles and the need for efficient energy conversion systems are driving the demand for inverters, making them a focal point in the automotive power electronics landscape.

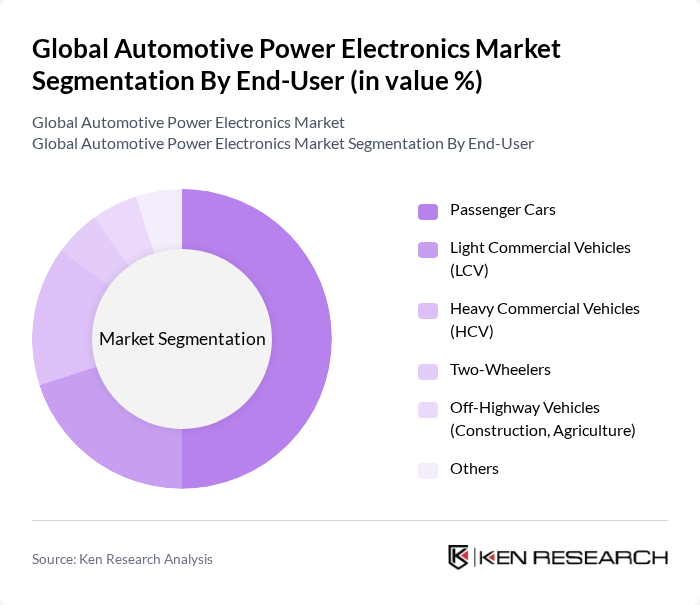

By End-User:The end-user segmentation of the automotive power electronics market includes Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Two-Wheelers, Off-Highway Vehicles (Construction, Agriculture), and Others. The Passenger Cars segment is the dominant sub-segment, driven by the increasing consumer preference for electric and hybrid vehicles. The growing trend towards sustainable transportation and government incentives for EV adoption are propelling the demand for power electronics in passenger vehicles, making this segment a key focus for manufacturers.

The Global Automotive Power Electronics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Infineon Technologies AG, Texas Instruments Incorporated, NXP Semiconductors N.V., STMicroelectronics N.V., onsemi (ON Semiconductor Corporation), Renesas Electronics Corporation, Mitsubishi Electric Corporation, Robert Bosch GmbH (Bosch Automotive Electronics), Analog Devices, Inc., BorgWarner Inc., DENSO Corporation, Continental AG, Valeo SE, Aisin Corporation, ZF Friedrichshafen AG, Wolfspeed, Inc., ROHM Co., Ltd., Fuji Electric Co., Ltd., Vishay Intertechnology, Inc., Danfoss A/S contribute to innovation, geographic expansion, and service delivery in this space.

The automotive power electronics market is poised for transformative growth, driven by technological advancements and increasing regulatory pressures. The integration of smart grid technologies and vehicle-to-grid systems is expected to enhance energy management and efficiency. Additionally, the rise of autonomous vehicles will necessitate sophisticated power electronics solutions, further expanding market potential. As manufacturers adapt to these trends, the focus on sustainable practices and innovative technologies will shape the future landscape of the automotive power electronics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Power ICs Power Modules/Discretes Inverters DC-DC Converters On-board Chargers (OBC) Battery Management Systems (BMS) Traction Inverters/Drive Inverters Others |

| By End-User | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) Two-Wheelers Off-Highway Vehicles (Construction, Agriculture) Others |

| By Component | Power Semiconductors (IGBT, MOSFET, Diodes) Microcontrollers (MCU) & DSP Power ICs (Driver ICs, Gate Drivers) Capacitors Inductors & Magnetics Sensors Others |

| By Application | Powertrain (Traction Inverter, OBC, DC-DC) Battery Management Body Electronics & Comfort ADAS & Safety Infotainment & Telematics Thermal Management Charging Infrastructure Interface Others |

| By Sales Channel | Direct Sales to OEMs Tier-1 Suppliers Distributors Online Sales Others |

| By Distribution Mode | OEM Aftermarket (Service/Replacement) E-commerce Others |

| By Price Range | Entry-Level Mid-Range Premium Others |

| By Material | Silicon (Si) Silicon Carbide (SiC) Gallium Nitride (GaN) Others |

| By Electric Vehicle Type | Battery Electric Vehicles (BEV) Hybrid Electric Vehicles (HEV) Plug-in Hybrid Electric Vehicles (PHEV) Fuel Cell Electric Vehicles (FCEV) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Power Electronics | 120 | Product Engineers, R&D Managers |

| Commercial Vehicle Electronics | 90 | Fleet Managers, Procurement Specialists |

| Electric Vehicle Components | 110 | Supply Chain Managers, Technical Directors |

| Hybrid Vehicle Systems | 80 | Design Engineers, Quality Assurance Managers |

| Power Electronics in Automotive Manufacturing | 70 | Operations Managers, Manufacturing Engineers |

The Global Automotive Power Electronics Market is valued at approximately USD 4.1 billion, driven by the increasing demand for electric vehicles, advancements in semiconductor technology, and stricter vehicle efficiency and emissions standards.