Region:Global

Author(s):Geetanshi

Product Code:KRAA1168

Pages:96

Published On:August 2025

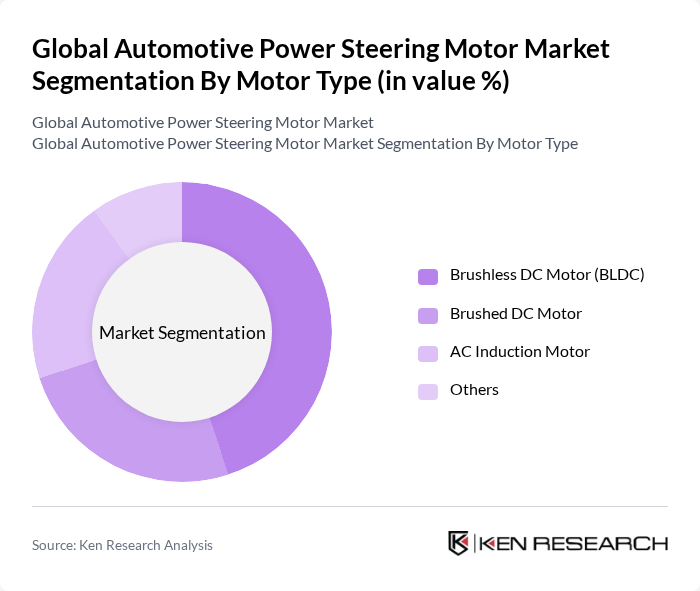

By Motor Type:

The motor type segmentation includes Brushless DC Motor (BLDC), Brushed DC Motor, AC Induction Motor, and Others. Among these, Brushless DC Motors (BLDC) are dominating the market due to their high efficiency, low maintenance requirements, and superior performance characteristics. The increasing trend towards electric vehicles and the demand for lightweight components are further propelling the adoption of BLDC motors. As consumers and manufacturers prioritize energy efficiency and performance, BLDC motors are becoming the preferred choice in the automotive sector.

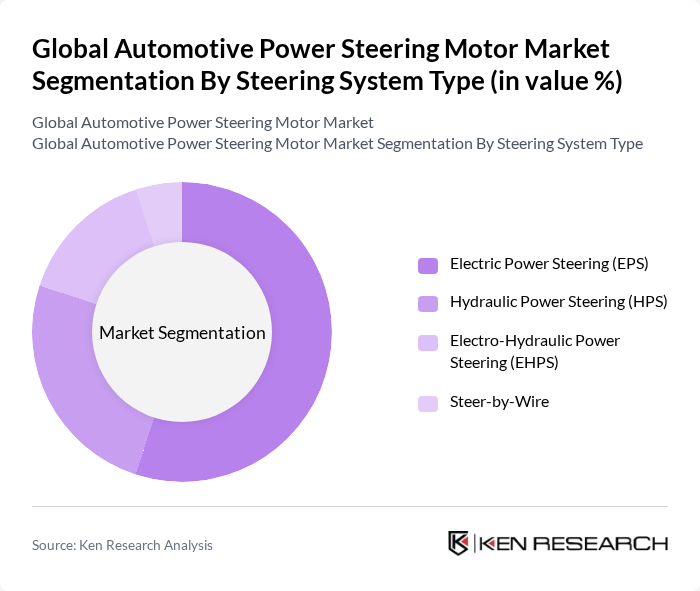

By Steering System Type:

This segmentation includes Electric Power Steering (EPS), Hydraulic Power Steering (HPS), Electro-Hydraulic Power Steering (EHPS), and Steer-by-Wire. Electric Power Steering (EPS) is the leading segment, driven by its advantages such as improved fuel efficiency, reduced weight, and enhanced vehicle control. The shift towards electric vehicles and the growing emphasis on sustainability are further boosting the EPS segment, making it the preferred choice for modern automotive applications. EPS systems are increasingly integrated with ADAS features, further driving adoption.

The Global Automotive Power Steering Motor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, ZF Friedrichshafen AG, JTEKT Corporation, Nexteer Automotive Corporation, Mitsubishi Electric Corporation, thyssenkrupp AG, DENSO Corporation, Hitachi Astemo, Ltd., Hyundai Mobis Co., Ltd., Aisin Corporation, Valeo S.A., Mando Corporation, NSK Ltd., Johnson Electric Holdings Limited, Brose Fahrzeugteile SE & Co. KG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive power steering motor market appears promising, driven by ongoing technological advancements and a strong push towards sustainability. As electric vehicle adoption continues to rise, manufacturers are likely to invest heavily in innovative steering solutions that enhance performance and efficiency. Additionally, the integration of IoT technologies will further transform steering systems, enabling real-time data analysis and improved vehicle dynamics. These trends suggest a dynamic market landscape, with significant opportunities for growth and development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Motor Type | Brushless DC Motor (BLDC) Brushed DC Motor AC Induction Motor Others |

| By Steering System Type | Electric Power Steering (EPS) Hydraulic Power Steering (HPS) Electro-Hydraulic Power Steering (EHPS) Steer-by-Wire |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs) Others |

| By Voltage | V V V Others |

| By Sales Channel | OEMs Aftermarket |

| By Region | North America Europe Asia Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 100 | Product Development Engineers, R&D Managers |

| Commercial Vehicle Manufacturers | 60 | Procurement Managers, Operations Directors |

| Aftermarket Parts Suppliers | 40 | Sales Managers, Supply Chain Coordinators |

| Automotive Repair Shops | 50 | Service Managers, Technicians |

| Automotive Component Distributors | 50 | Distribution Managers, Inventory Analysts |

The Global Automotive Power Steering Motor Market is valued at approximately USD 5.7 billion, reflecting a significant growth trend driven by advancements in automotive technology and increasing demand for fuel-efficient vehicles.