Region:Global

Author(s):Geetanshi

Product Code:KRAB0004

Pages:86

Published On:August 2025

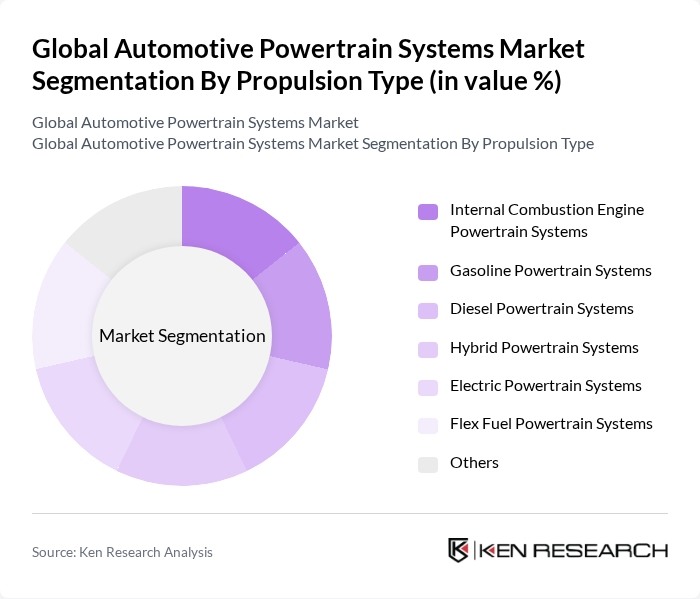

By Propulsion Type:The propulsion type segmentation includes Internal Combustion Engine Powertrain Systems, Gasoline Powertrain Systems, Diesel Powertrain Systems, Hybrid Powertrain Systems, Electric Powertrain Systems, Flex Fuel Powertrain Systems, and Others. Internal Combustion Engine Powertrain Systems remain dominant due to their established infrastructure and widespread consumer acceptance. However, Electric Powertrain Systems are rapidly gaining traction as consumers and manufacturers shift toward more sustainable and regulatory-compliant options, driven by advances in battery technology and supportive government policies .

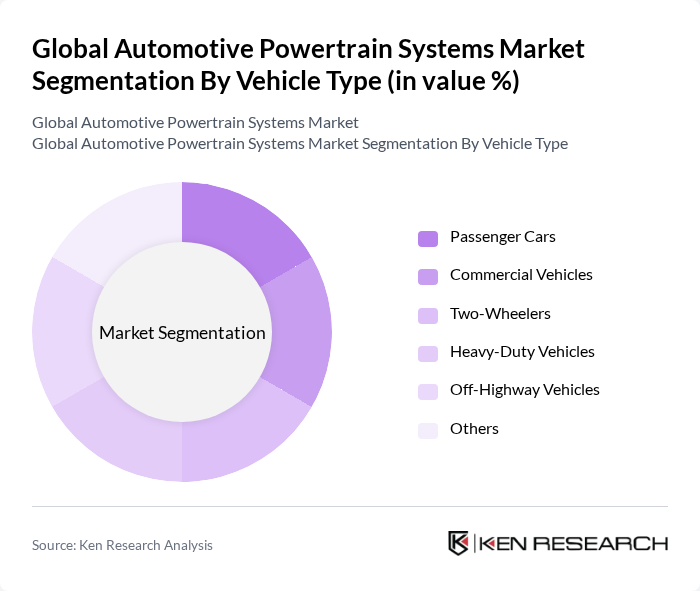

By Vehicle Type:The vehicle type segmentation encompasses Passenger Cars, Commercial Vehicles, Two-Wheelers, Heavy-Duty Vehicles, Off-Highway Vehicles, and Others. The Passenger Cars segment dominates the market, accounting for over seventy-five percent of the total market share, driven by high demand for personal vehicles, rapid urbanization, and increasing disposable income. Commercial Vehicles are also experiencing growth due to expanding logistics and transportation sectors .

The Global Automotive Powertrain Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Denso Corporation, ZF Friedrichshafen AG, Aisin Corporation, Magna International Inc., Continental AG, Hyundai Mobis Co., Ltd., Valeo SA, BorgWarner Inc., Eaton Corporation plc, Ricardo plc, Toyota Motor Corporation, Schaeffler AG, Cummins Inc., Marelli Holdings Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The automotive powertrain systems market is poised for transformative growth, driven by the ongoing shift towards electrification and sustainability. As governments worldwide implement stricter emission regulations, manufacturers are increasingly investing in innovative powertrain technologies. The integration of artificial intelligence in powertrain systems is expected to enhance efficiency and performance. Furthermore, the rise of shared mobility solutions is likely to reshape consumer preferences, creating new opportunities for manufacturers to develop versatile powertrain systems that cater to diverse mobility needs.

| Segment | Sub-Segments |

|---|---|

| By Propulsion Type | Internal Combustion Engine Powertrain Systems Gasoline Powertrain Systems Diesel Powertrain Systems Hybrid Powertrain Systems Electric Powertrain Systems Flex Fuel Powertrain Systems Others |

| By Vehicle Type | Passenger Cars Commercial Vehicles Two-Wheelers Heavy-Duty Vehicles Off-Highway Vehicles Others |

| By Component | Engine Transmission Differentials Driveshaft Electrical Components Cooling Systems Others |

| By Drive Type | Front-Wheel Drive (FWD) Rear-Wheel Drive (RWD) All-Wheel Drive (AWD) Four-Wheel Drive (4WD) Others |

| By Region | North America Europe Asia Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Powertrain Systems | 120 | Automotive Engineers, Product Managers |

| Commercial Vehicle Powertrain Solutions | 90 | Fleet Managers, Procurement Specialists |

| Electric Vehicle Powertrain Technologies | 60 | EV Specialists, Battery Engineers |

| Hybrid Powertrain Development | 50 | R&D Directors, Technology Analysts |

| Powertrain Component Suppliers | 70 | Supply Chain Managers, Sales Directors |

The Global Automotive Powertrain Systems Market is valued at approximately USD 830 billion, driven by the demand for fuel-efficient vehicles, advancements in electric powertrain technologies, and stringent emission regulations worldwide.