Region:Global

Author(s):Dev

Product Code:KRAC0433

Pages:80

Published On:August 2025

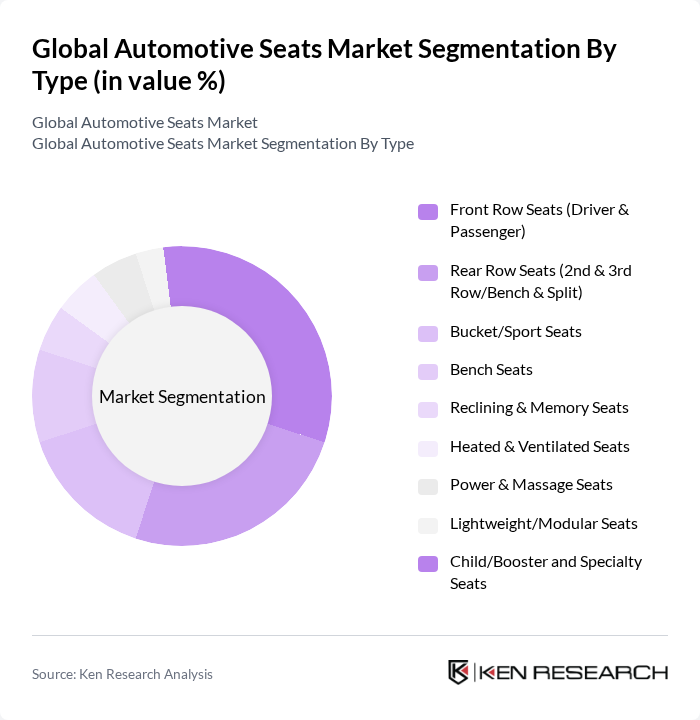

By Type:The automotive seats market is segmented into various types, including Front Row Seats (Driver & Passenger), Rear Row Seats (2nd & 3rd Row/Bench & Split), Bucket/Sport Seats, Bench Seats, Reclining & Memory Seats, Heated & Ventilated Seats, Power & Massage Seats, Lightweight/Modular Seats, and Child/Booster and Specialty Seats. Each of these sub-segments caters to different consumer preferences and vehicle types, with specific features that enhance comfort, safety, and functionality. Industry trends emphasize lightweight structures, modularity, and integration of comfort features such as heating, ventilation, and memory functions, especially in higher trims and luxury segments .

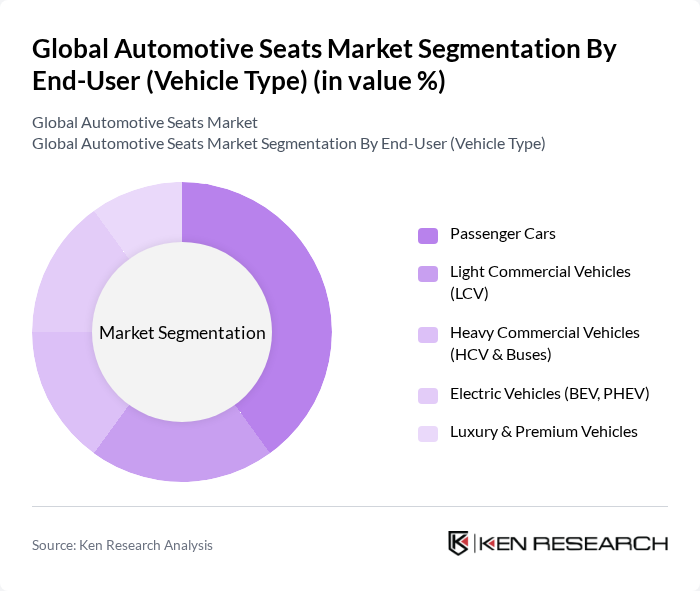

By End-User (Vehicle Type):The market is also segmented by end-user vehicle types, which include Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV & Buses), Electric Vehicles (BEV, PHEV), and Luxury & Premium Vehicles. Each segment reflects the specific needs and preferences of consumers in different vehicle categories, influencing the design and functionality of automotive seats. Electrification and premiumization trends are increasing adoption of advanced seating features (e.g., powered adjustments, ventilation, massage) in passenger cars and luxury segments, while commercial vehicles focus on durability and ergonomic driver comfort .

The Global Automotive Seats Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adient plc, Lear Corporation, FORVIA Faurecia, Toyota Boshoku Corporation, Magna International Inc., TS Tech Co., Ltd., Tachi-S Co., Ltd., NHK Spring Co., Ltd., Gentherm Incorporated, Kongsberg Automotive ASA, RECARO Automotive GmbH, Grupo Antolin, Seoyon E-Hwa Co., Ltd., Johnson Controls International (legacy seating business divested), Aisin Corporation, Faurecia Clarion Electronics (seat electronics/comfort integration), Brose Fahrzeugteile SE & Co. KG (seat structures/adjusters), Grammer AG, Shigeru Co., Ltd., Yanfeng Automotive Interiors (seat trim/complete interiors) contribute to innovation, geographic expansion, and service delivery in this space. Industry leaders emphasize lightweight architectures, modular frames, integrated electronics (heating/ventilation), and sustainability in materials, reflecting OEM requirements and regulations .

The future of the automotive seats market appears promising, driven by ongoing innovations and shifting consumer preferences. As electric vehicle adoption accelerates, manufacturers are likely to focus on lightweight and sustainable materials, enhancing seat efficiency and comfort. Furthermore, the integration of smart technology into seating solutions is expected to gain traction, catering to health and wellness trends. These developments will create a dynamic landscape, fostering growth and adaptation in the automotive seating sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Front Row Seats (Driver & Passenger) Rear Row Seats (2nd & 3rd Row/Bench & Split) Bucket/Sport Seats Bench Seats Reclining & Memory Seats Heated & Ventilated Seats Power & Massage Seats Lightweight/Modular Seats Child/Booster and Specialty Seats |

| By End-User (Vehicle Type) | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV & Buses) Electric Vehicles (BEV, PHEV) Luxury & Premium Vehicles |

| By Material | Fabric/Textile Genuine Leather Synthetic Leather (PU/PVC) Foams (PU Foam, Memory Foam) Structural Components (Steel, Aluminum, Composites) Sustainable/Recycled Materials |

| By Functionality/Technology | Manual Adjustment Seats Power Adjustment & Memory Seats Climate Seats (Heated, Ventilated) Massage & Wellness Seats Occupant Sensing & Safety Integration (Airbags, Seatbelt Reminders) Lightweight/Fixed-Back EV Seats Foldable/Removable & Stowable Seats |

| By Distribution Channel | OEM Aftermarket/Retrofitting Online Retail Offline Retail |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Seat Manufacturers | 120 | Product Development Managers, Operations Directors |

| Commercial Vehicle Seat Suppliers | 90 | Supply Chain Managers, Procurement Specialists |

| Automotive Interior Design Firms | 80 | Design Engineers, Ergonomics Experts |

| Automotive Aftermarket Seat Retailers | 60 | Sales Managers, Marketing Directors |

| End-User Consumer Insights | 100 | Car Owners, Automotive Enthusiasts |

The Global Automotive Seats Market is valued at approximately USD 9598 billion, reflecting steady growth driven by global vehicle production and the adoption of premium features. This valuation is supported by multiple industry sources indicating market sizes in the mid-to-high USD 90 billion range.