Region:Global

Author(s):Geetanshi

Product Code:KRAA1239

Pages:83

Published On:August 2025

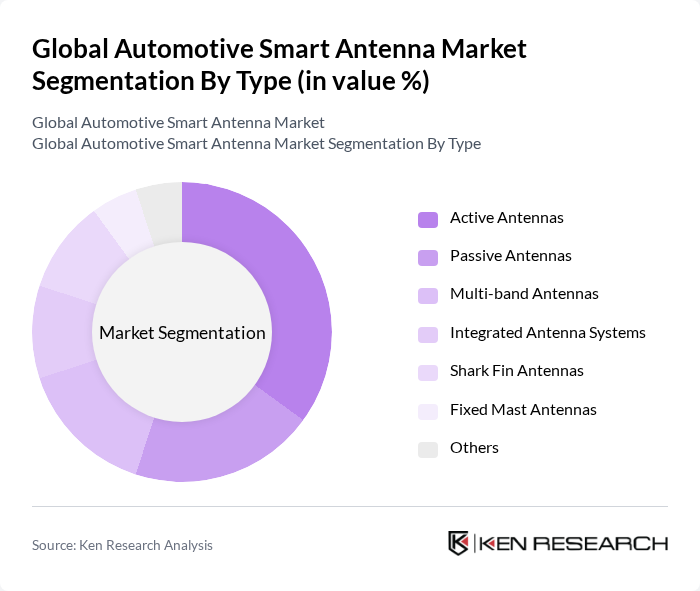

By Type:The market is segmented into various types of antennas, including Active Antennas, Passive Antennas, Multi-band Antennas, Integrated Antenna Systems, Shark Fin Antennas, Fixed Mast Antennas, and Others. Among these,Active Antennasare gaining traction due to their ability to enhance signal quality, reduce interference, and support multiple communication functions, making them a preferred choice for modern vehicles. The increasing complexity of vehicle communication systems and the adoption of 5G and V2X technologies are driving the demand for these advanced antenna types.

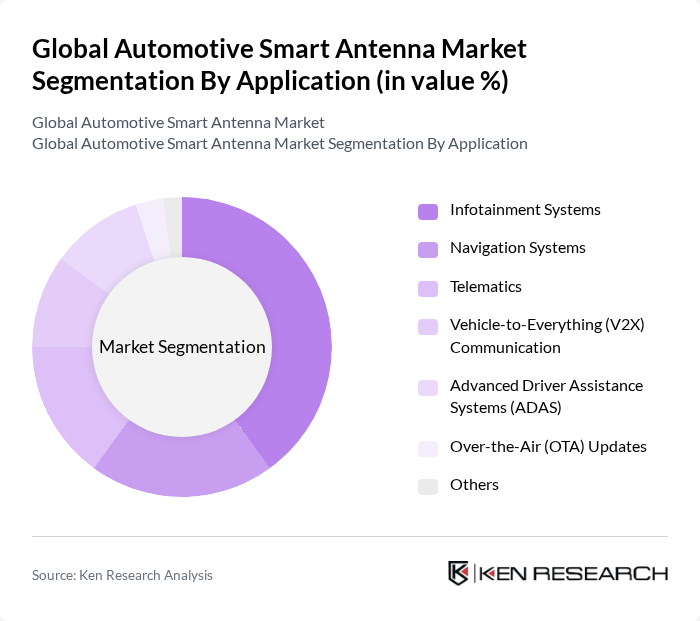

By Application:The applications of smart antennas in the automotive sector include Infotainment Systems, Navigation Systems, Telematics, Vehicle-to-Everything (V2X) Communication, Advanced Driver Assistance Systems (ADAS), Over-the-Air (OTA) Updates, and Others.Infotainment Systemsremain the leading application segment, driven by consumer demand for enhanced in-car entertainment, real-time streaming, and connectivity features. The integration of smart antennas is crucial for delivering high-quality audio, video, and data services. Additionally, the growth of telematics, V2X, and ADAS applications is accelerating as automakers prioritize safety, connectivity, and autonomous driving capabilities.

The Global Automotive Smart Antenna Market is characterized by a dynamic mix of regional and international players. Leading participants such as Continental AG, Robert Bosch GmbH, Denso Corporation, Harman International Industries, Inc., Laird Connectivity, Amphenol Corporation, TE Connectivity Ltd., NXP Semiconductors N.V., Qualcomm Technologies, Inc., ZTE Corporation, Mitsubishi Electric Corporation, Panasonic Corporation, Infineon Technologies AG, Texas Instruments Incorporated, Nokia Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The automotive smart antenna market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As electric and autonomous vehicles gain traction, the demand for integrated communication solutions will intensify. Furthermore, the expansion of 5G networks is expected to enhance connectivity, enabling real-time data exchange. Manufacturers will increasingly focus on developing lightweight, compact antenna designs that meet sustainability goals, ensuring compliance with stringent regulations while addressing consumer demands for enhanced infotainment and safety features.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Antennas Passive Antennas Multi-band Antennas Integrated Antenna Systems Shark Fin Antennas Fixed Mast Antennas Others |

| By Application | Infotainment Systems Navigation Systems Telematics Vehicle-to-Everything (V2X) Communication Advanced Driver Assistance Systems (ADAS) Over-the-Air (OTA) Updates Others |

| By End-User | OEMs (Original Equipment Manufacturers) Aftermarket Fleet Operators Government Agencies Others |

| By Component | Antenna Elements Transceivers Electronic Control Units (ECU) Wiring Harness Amplifiers Filters Connectors Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Distribution Mode | Offline Distribution Online Distribution Hybrid Distribution Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEMs in Automotive Manufacturing | 100 | Product Development Managers, R&D Engineers |

| Tier 1 Suppliers of Smart Antennas | 80 | Supply Chain Managers, Technical Sales Representatives |

| Automotive Technology Consultants | 60 | Industry Analysts, Technology Advisors |

| Automotive Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| End-Users in Connected Vehicles | 50 | Fleet Managers, Automotive IT Specialists |

The Global Automotive Smart Antenna Market is valued at approximately USD 3.6 billion, driven by the increasing demand for advanced connectivity solutions in vehicles, including infotainment systems and the integration of 5G technology.