Region:Global

Author(s):Rebecca

Product Code:KRAA2148

Pages:95

Published On:August 2025

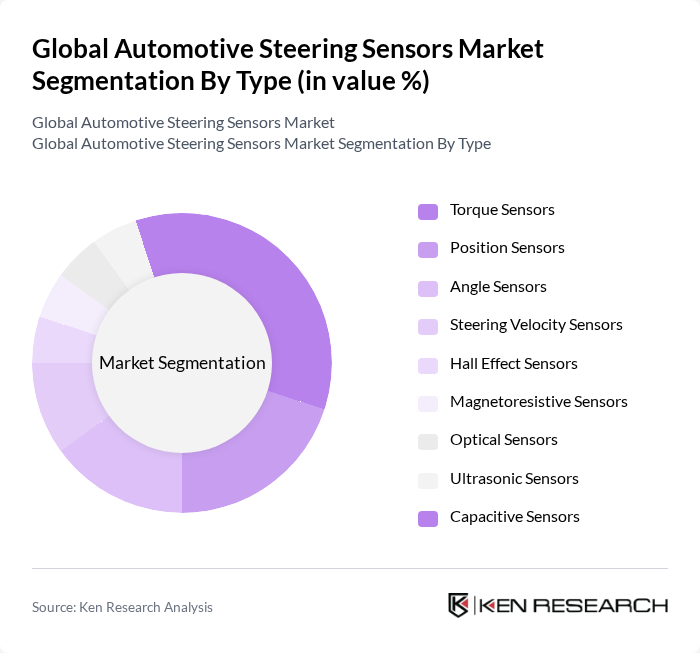

By Type:The market is segmented into various types of sensors, each serving specific functions in automotive steering systems. The primary types include Torque Sensors, Position Sensors, Angle Sensors, Steering Velocity Sensors, Hall Effect Sensors, Magnetoresistive Sensors, Optical Sensors, Ultrasonic Sensors, and Capacitive Sensors. Among these, Torque Sensors are gaining traction due to their critical role in providing feedback for steering control, which is essential for both traditional and electric vehicles. The adoption of Hall Effect and Magnetoresistive Sensors is also rising, driven by their reliability and precision in harsh automotive environments .

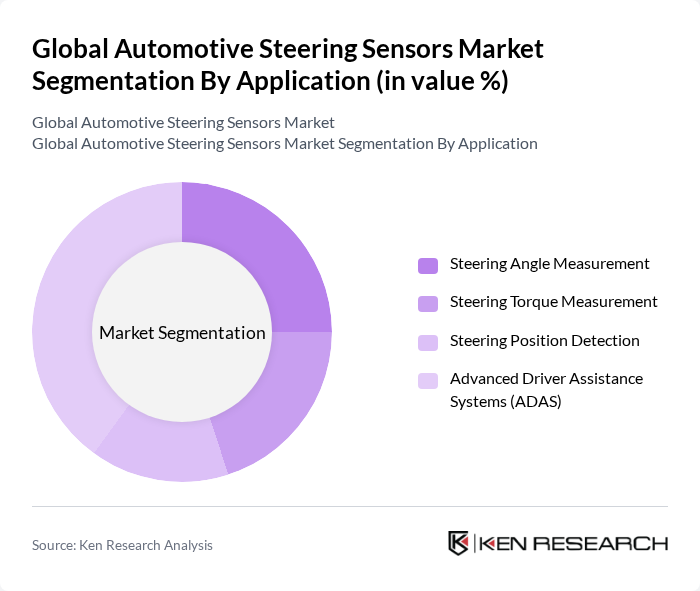

By Application:The applications of steering sensors are diverse, including Steering Angle Measurement, Steering Torque Measurement, Steering Position Detection, and Advanced Driver Assistance Systems (ADAS). The ADAS segment is particularly prominent, driven by the increasing focus on vehicle safety, regulatory mandates, and the integration of automated driving features, which require precise steering control and real-time feedback .

The Global Automotive Steering Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, DENSO Corporation, ZF Friedrichshafen AG, Honeywell International Inc., NXP Semiconductors N.V., Infineon Technologies AG, TE Connectivity Ltd., Analog Devices, Inc., STMicroelectronics N.V., Valeo SA, Mitsubishi Electric Corporation, Aisin Corporation, Nexteer Automotive Corporation, JTEKT Corporation, NSK Ltd., Mando Corporation, Hyundai Mobis Co., Ltd., Thyssenkrupp Presta AG, Texas Instruments Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive steering sensors market is poised for significant transformation, driven by the rapid evolution of electric and autonomous vehicles. As manufacturers increasingly prioritize safety and performance, the integration of advanced steering technologies will become essential. Furthermore, the rise of smart cities and connected vehicles will create new opportunities for innovation, fostering collaborations among industry players to enhance sensor capabilities and drive sustainable practices in automotive design and manufacturing.

| Segment | Sub-Segments |

|---|---|

| By Type | Torque Sensors Position Sensors Angle Sensors Steering Velocity Sensors Hall Effect Sensors Magnetoresistive Sensors Optical Sensors Ultrasonic Sensors Capacitive Sensors |

| By Application | Steering Angle Measurement Steering Torque Measurement Steering Position Detection Advanced Driver Assistance Systems (ADAS) |

| By Vehicle Type | Passenger Cars Commercial Vehicles Off-Highway Vehicles Electric Vehicles Autonomous Vehicles |

| By End-User | OEMs (Original Equipment Manufacturers) Aftermarket |

| By Level of Autonomy | Level 1 (Driver Assistance) Level 2 (Partial Automation) Level 3 (Conditional Automation) Level 4 (High Automation) Level 5 (Full Automation) |

| By Region | North America Europe Asia Pacific South America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Steering Sensors | 120 | Product Managers, Automotive Engineers |

| Commercial Vehicle Steering Systems | 90 | Fleet Managers, Technical Directors |

| Electric Vehicle Steering Technologies | 60 | R&D Specialists, Innovation Managers |

| Autonomous Vehicle Steering Solutions | 50 | Systems Engineers, Safety Compliance Officers |

| Aftermarket Steering Sensor Products | 40 | Sales Managers, Distribution Executives |

The Global Automotive Steering Sensors Market is valued at approximately USD 21.5 billion, reflecting a significant growth trend driven by advancements in automotive technologies and increasing demand for safety features in vehicles.