Region:Global

Author(s):Shubham

Product Code:KRAD3617

Pages:84

Published On:November 2025

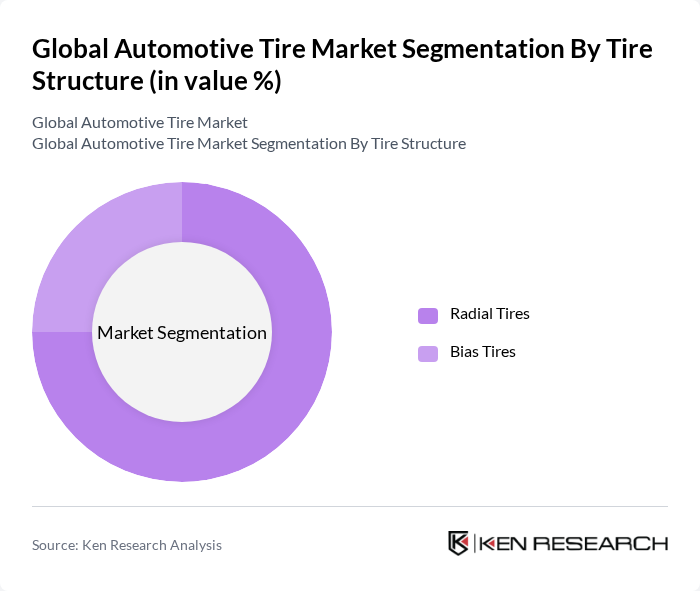

By Tire Structure:The market is segmented into Radial Tires and Bias Tires. Radial tires dominate the market due to their superior performance, fuel efficiency, and longer lifespan, making them the preferred choice for passenger vehicles and commercial applications. Bias tires, while still in use, are more common in specific applications such as agricultural and off-road vehicles.

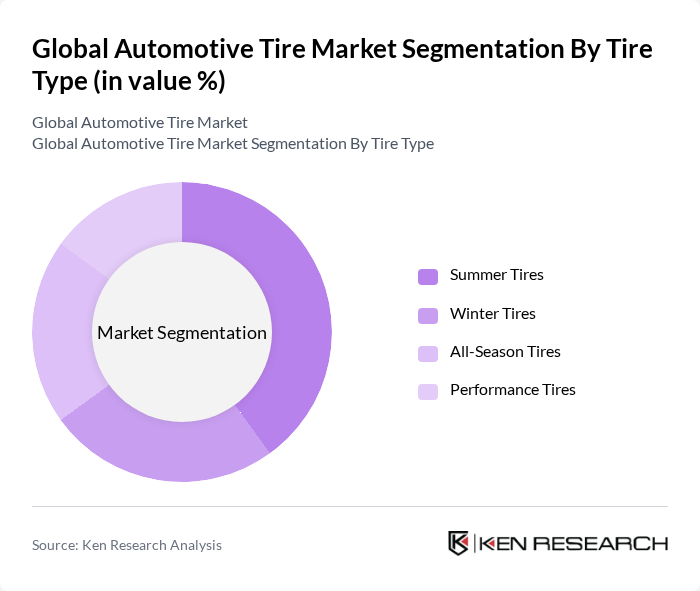

By Tire Type:The market is categorized into Summer Tires, Winter Tires, All-Season Tires, and Performance Tires. Summer tires lead the market due to their enhanced grip and handling in warm conditions, making them popular among consumers in temperate regions. Winter tires are essential in colder climates, while all-season tires offer versatility. Performance tires cater to high-performance vehicles, appealing to a niche market segment.

The Global Automotive Tire Market is characterized by a dynamic mix of regional and international players. Leading participants such as Michelin, Bridgestone Corporation, The Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. S.p.A., Sumitomo Rubber Industries, Ltd. (Dunlop), Yokohama Rubber Company, Ltd., Hankook Tire & Technology Co., Ltd., BFGoodrich (Michelin Group), Cooper Tire & Rubber Company (Goodyear), Nexen Tire Corporation, Toyo Tire Corporation, Kumho Tire Co., Inc., Apollo Tyres Ltd., Trelleborg AB contribute to innovation, geographic expansion, and service delivery in this space.

The automotive tire market is poised for transformative growth driven by technological advancements and evolving consumer preferences. The integration of smart technologies in tire manufacturing, such as IoT for real-time monitoring, is expected to enhance product performance and safety. Additionally, the increasing focus on sustainability will likely drive innovation in eco-friendly tire materials. As electric vehicle adoption accelerates, the demand for specialized tires tailored for EVs will also rise, shaping the future landscape of the tire industry.

| Segment | Sub-Segments |

|---|---|

| By Tire Structure | Radial Tires Bias Tires |

| By Tire Type | Summer Tires Winter Tires All-Season Tires Performance Tires |

| By Sales Channel | Original Equipment Manufacturer (OEM) Aftermarket/Replacement |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles (Light, Medium, Heavy-Duty) Two-Wheelers Off-the-Road Vehicles |

| By Vehicle Class | Economy Mid-Range Premium |

| By Rim Size | Less Than 15 Inches to 20 Inches More Than 20 Inches |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Tire Market | 100 | Product Managers, Sales Directors |

| Commercial Vehicle Tire Market | 70 | Fleet Managers, Procurement Specialists |

| Two-Wheeler Tire Market | 50 | Retail Managers, Distribution Heads |

| Specialty Tire Market (Agricultural, Industrial) | 40 | Operations Managers, Industry Experts |

| Emerging Markets Tire Demand | 60 | Market Analysts, Regional Sales Managers |

The Global Automotive Tire Market is valued at approximately USD 151 billion, driven by increasing vehicle demand, advancements in manufacturing technology, and a focus on safety and performance. This market is expected to grow further with the rise of electric vehicles and sustainable tire solutions.