Region:Global

Author(s):Dev

Product Code:KRAA1604

Pages:98

Published On:August 2025

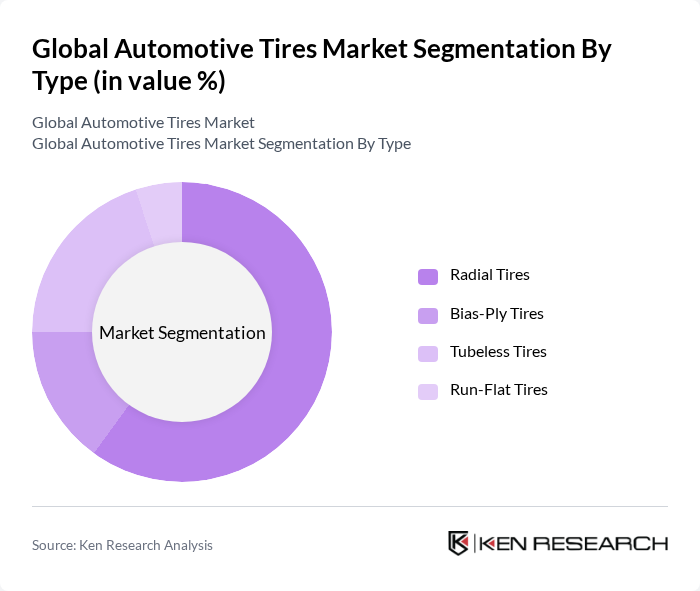

By Type:The market is segmented into various types of tires, each catering to different consumer needs and vehicle specifications. The primary subsegments include Radial Tires, Bias-Ply Tires, Tubeless Tires, and Run-Flat Tires.Radial tiresdominate the market for on-road applications due to better tread life, fuel efficiency from lower rolling resistance, ride comfort, and heat management—attributes favored by both OEM and replacement channels globally . The increasing demand for high-performance, durable, and energy-efficient tires—especially for EVs—continues to reinforce radial adoption across passenger and commercial categories .

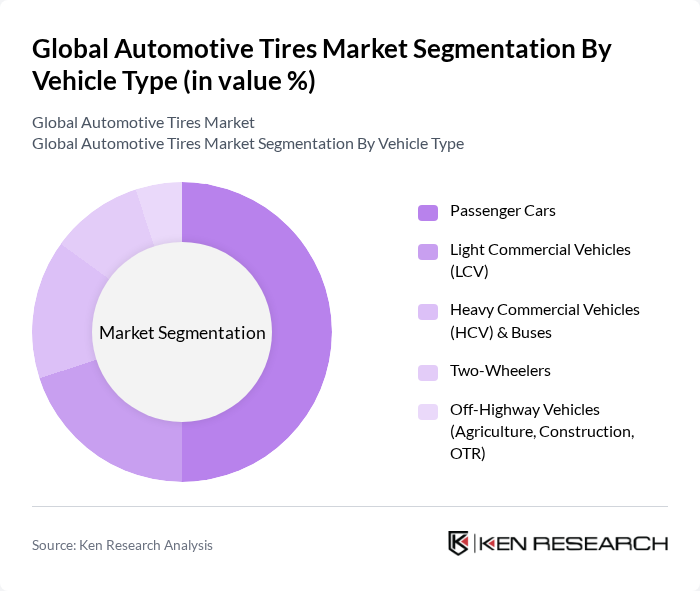

By Vehicle Type:This segmentation includes Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV) & Buses, Two-Wheelers, and Off-Highway Vehicles (Agriculture, Construction, OTR).Passenger carshold the largest share of the market, supported by the sizable global replacement cycle and OE fitments in high-volume segments. Rapid e-commerce growth and last-mile delivery networks are sustaining LCV tire demand, while infrastructure and construction activity underpin HCV/OTR consumption .

The Global Automotive Tires Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bridgestone Corporation, Michelin Group, The Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. S.p.A., Sumitomo Rubber Industries, Ltd. (Dunlop, Falken), The Yokohama Rubber Co., Ltd., Hankook Tire & Technology Co., Ltd., Kumho Tire Co., Inc., Apollo Tyres Ltd., MRF Ltd. (Madras Rubber Factory), Nokian Tyres plc, Toyo Tire Corporation, Zhongce Rubber Group Co., Ltd. (Westlake, Chaoyang), Giti Tire Pte. Ltd., CEAT Ltd., JK Tyre & Industries Ltd., Sailun Group Co., Ltd., Maxxis International (Cheng Shin Rubber Ind. Co., Ltd.), Linglong Tire (Shandong Linglong Tire Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The automotive tires market is poised for significant transformation driven by technological advancements and changing consumer preferences. The integration of smart technologies in tire manufacturing is expected to enhance performance and safety, while the shift towards sustainable materials will align with global environmental goals. Additionally, the increasing adoption of electric vehicles will create new demand dynamics, necessitating innovative tire solutions tailored for electric mobility. These trends will shape the market landscape, fostering growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Radial Tires Bias-Ply Tires Tubeless Tires Run-Flat Tires |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) & Buses Two-Wheelers Off-Highway Vehicles (Agriculture, Construction, OTR) |

| By Application | On-Road/Highway (All-Season, Summer, Winter) Off-Road/All-Terrain Performance/Racing EV-Specific Tires |

| By Distribution Channel | OEM Aftermarket – Online Aftermarket – Offline (Dealers, Specialty Retail) Wholesale/Distributors |

| By Price Range | Economy Mid-Range Premium/Ultra-High Performance Specialty (Winter, Run-Flat, OTR) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Rim Size | ?15 Inches –18 Inches –21 Inches ?22 Inches |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Tire Market | 150 | Product Managers, Retail Buyers |

| Commercial Vehicle Tire Market | 100 | Fleet Managers, Procurement Specialists |

| Specialty Tires (e.g., agricultural, industrial) | 80 | Operations Managers, Equipment Dealers |

| Tire Recycling and Sustainability Initiatives | 70 | Sustainability Officers, Environmental Managers |

| Emerging Markets Tire Demand | 90 | Market Analysts, Regional Sales Directors |

The Global Automotive Tires Market is valued at approximately USD 115 billion, with recent assessments indicating values between USD 113.9 billion and USD 129.6 billion. This reflects strong demand across both passenger and commercial vehicle segments.