Region:Global

Author(s):Shubham

Product Code:KRAA1915

Pages:100

Published On:August 2025

By Type:The automotive transmission market is segmented into various types, including Manual Transmission (MT), Automatic Transmission (AT), Continuously Variable Transmission (CVT), Dual-Clutch Transmission (DCT), Automated Manual Transmission (AMT)/Semi-Automatic, Hybrid Transmissions (eCVT/Power-Split for HEVs), and Dedicated EV Reduction Gear/2-Speed EV Transmission. Among these, Automatic Transmission (AT) is the leading segment due to its growing popularity among consumers seeking convenience and ease of driving. The shift towards electric and hybrid vehicles has also bolstered the demand for advanced transmission systems, particularly eCVT and DCT, which offer improved efficiency and performance.

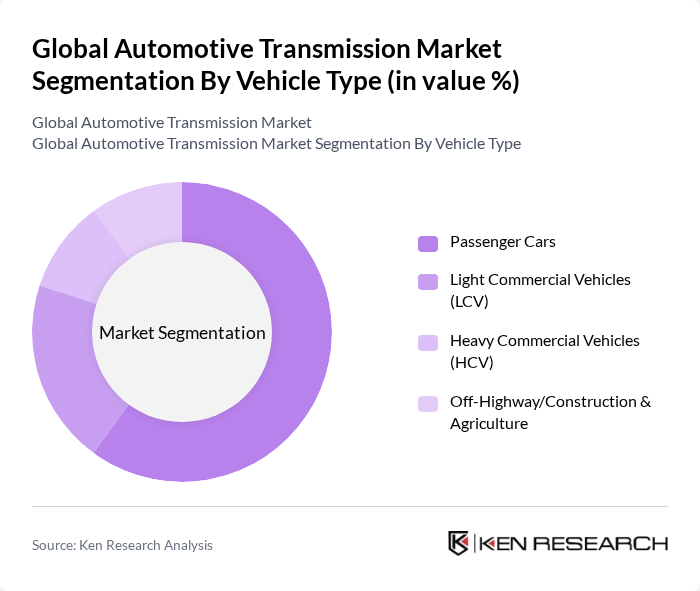

By Vehicle Type:The market is also segmented by vehicle type, which includes Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), and Off-Highway/Construction & Agriculture vehicles. The Passenger Cars segment holds the largest share, driven by the increasing demand for personal vehicles and the growing trend of urbanization. Additionally, the rise in disposable income and changing consumer preferences towards more comfortable and technologically advanced vehicles have further fueled the growth of this segment.

The Global Automotive Transmission Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aisin Corporation, ZF Friedrichshafen AG, BorgWarner Inc., Jatco Ltd., Magna Powertrain (Magna International Inc.), Hyundai Transys Inc., Eaton Corporation plc, GKN Automotive, Ricardo plc, Valeo SA, BorgWarner (incl. former Delphi Technologies Driveline), TREMEC (Transmisiones y Equipos Mecánicos S.A. de C.V.), Allison Transmission Holdings Inc., Schaeffler Group, and Dana Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The automotive transmission market is poised for transformative growth driven by technological advancements and evolving consumer preferences. As manufacturers increasingly adopt automated and smart transmission systems, the integration of artificial intelligence and machine learning will enhance vehicle performance and efficiency. Additionally, the shift towards electric and hybrid vehicles will necessitate innovative transmission solutions, creating a dynamic landscape that encourages investment and collaboration among industry players to meet emerging demands and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Transmission (MT) Automatic Transmission (AT) Continuously Variable Transmission (CVT) Dual-Clutch Transmission (DCT) Automated Manual Transmission (AMT)/Semi-Automatic Hybrid Transmissions (eCVT/Power-Split for HEVs) Dedicated EV Reduction Gear/2?Speed EV Transmission |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) Off-Highway/Construction & Agriculture |

| By Propulsion | Internal Combustion Engine (Gasoline/Diesel) Hybrid Electric Vehicles (HEV/PHEV) Battery Electric Vehicles (BEV) |

| By Component | Gearbox/Casing Torque Converter Clutch/Clutch Packs Planetary Gears and Gear Sets Mechatronics/Valve Body Transmission Control Unit (TCU)/Software Bearings, Shafts, and Seals |

| By Sales Channel | OEM Aftermarket (Replacement & Remanufactured) |

| By Distribution Mode | Direct Sales (OEM Contracts) Distributor/Online Sales |

| By Price Range (Unit ASP at OEM) | Entry (Low) Mid Premium (High) |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Transmission Systems | 140 | Product Managers, R&D Engineers |

| Commercial Vehicle Transmission Solutions | 100 | Fleet Managers, Procurement Specialists |

| Electric Vehicle Transmission Technologies | 80 | EV Engineers, Technology Developers |

| Aftermarket Transmission Services | 70 | Service Center Owners, Automotive Technicians |

| Transmission Component Suppliers | 90 | Supply Chain Managers, Sales Directors |

The Global Automotive Transmission Market is valued at approximately USD 165 billion, reflecting a significant growth trend driven by the demand for fuel-efficient vehicles and advancements in transmission technologies.