Region:Global

Author(s):Dev

Product Code:KRAB0504

Pages:100

Published On:August 2025

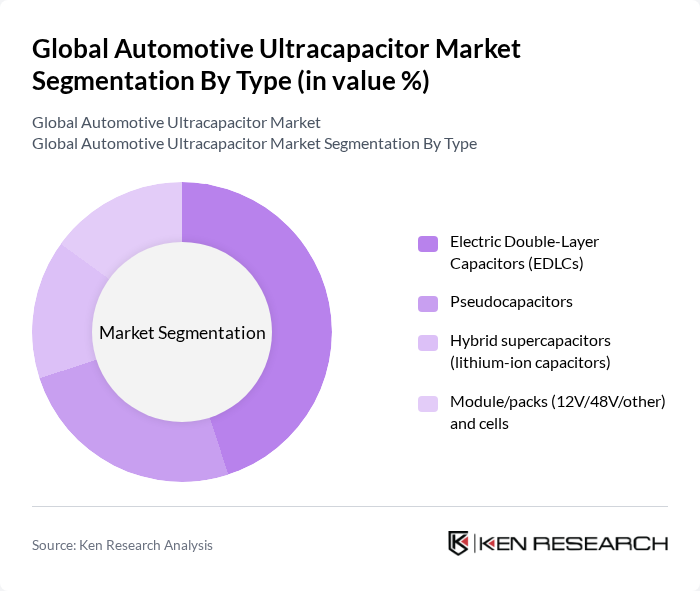

By Type:The ultracapacitor market is segmented into various types, including Electric Double-Layer Capacitors (EDLCs), Pseudocapacitors, Hybrid supercapacitors (lithium-ion capacitors), and Module/packs (12V/48V/other) and cells. Among these, Electric Double-Layer Capacitors (EDLCs) are leading the market due to their high power density and cycle life in energy storage applications. The growing demand for energy-efficient solutions in automotive applications, particularly in electric and hybrid vehicles, has significantly contributed to the dominance of EDLCs. Their ability to provide quick bursts of energy makes them ideal for applications such as regenerative braking and start-stop systems.

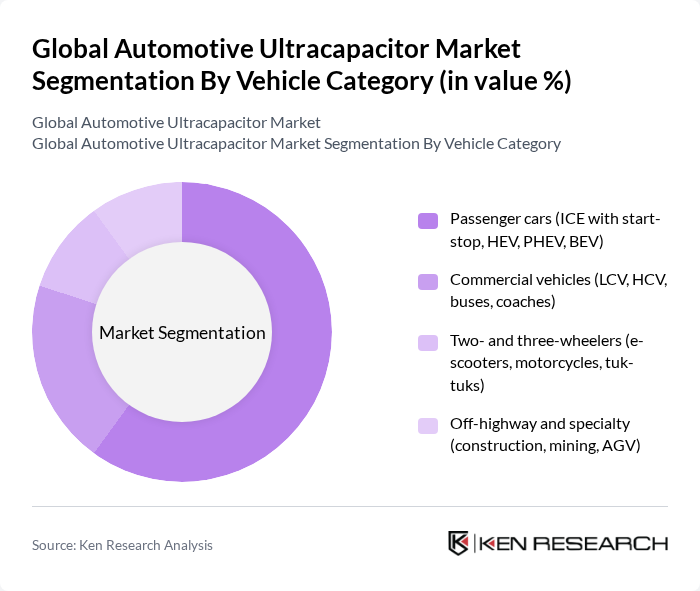

By Vehicle Category:The market is also segmented by vehicle category, including Passenger cars (ICE with start-stop, HEV, PHEV, BEV), Commercial vehicles (LCV, HCV, buses, coaches), Two- and three-wheelers (e-scooters, motorcycles, tuk-tuks), and Off-highway and specialty (construction, mining, AGV). The Passenger cars segment is currently leading the market, driven by the increasing adoption of electric and hybrid vehicles. The growing consumer preference for environmentally friendly transportation options and government incentives for electric vehicle purchases are key factors contributing to the growth of this segment.

The Global Automotive Ultracapacitor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maxwell Technologies (a Tesla company), Skeleton Technologies, KYOCERA AVX Components Corporation, Nesscap Energy (Maxwell/Tesla legacy brand), Ioxus, Inc. (XS Power/Ioxus), CAP-XX Limited, Panasonic Holdings Corporation, Eaton Corporation plc, Nippon Chemi-Con Corporation, Rubycon Corporation, LS Materials Co., Ltd. (formerly LS Mtron ultracapacitors), Shanghai Aowei Technology Development Co., Ltd. (Aowei/Shanghai Putailai), Jianghai Capital (Nantong Jianghai Capacitor Co., Ltd.), Shenzhen Jinrui Energy Technology Co., Ltd. (JRE), and Ningbo CRRC New Energy Technology Co., Ltd. (CRRC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive ultracapacitor market appears promising, driven by technological advancements and increasing environmental regulations. As automakers prioritize sustainability, ultracapacitors are likely to play a role in specific energy storage and power management use cases (e.g., regenerative braking, start-stop, peak power support), complementing batteries rather than replacing them. The integration of ultracapacitors in electric and hybrid vehicles can enhance performance in high-power transients, while ongoing research and development aims to improve efficiency and reduce costs. This evolving landscape presents opportunities for growth and innovation in the automotive sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Double-Layer Capacitors (EDLCs) Pseudocapacitors Hybrid supercapacitors (lithium-ion capacitors) Module/packs (12V/48V/other) and cells |

| By Vehicle Category | Passenger cars (ICE with start-stop, HEV, PHEV, BEV) Commercial vehicles (LCV, HCV, buses, coaches) Two- and three-wheelers (e-scooters, motorcycles, tuk-tuks) Off-highway and specialty (construction, mining, AGV) |

| By Automotive Application | Start-stop and cold-cranking assist Regenerative braking and kinetic energy recovery V/48V mild-hybrid systems and power smoothing Peak power assist for acceleration and torque fill Power steering, suspension, and e-turbo/e-compressor Backup power, SLI replacement/augmentation, and ADAS power buffer |

| By Sales Channel | OEM (factory fit) Aftermarket (retrofit kits/modules) Tier-1 integration partners Distributors/online |

| By Form Factor | Cylindrical cells Prismatic/pouch cells Modules and packs Embedded/board-level capacitors |

| By Technology & Materials | Activated carbon (AC) EDLC Graphene-enhanced EDLC Lithium-ion capacitor (LIC) Metal oxide/conducting polymer pseudocapacitors |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Rest of World (RoW) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Manufacturers | 120 | Product Development Managers, Battery Engineers |

| Ultracapacitor Suppliers | 90 | Sales Directors, Technical Support Engineers |

| Automotive Research Institutions | 70 | Research Scientists, Automotive Analysts |

| Government Regulatory Bodies | 50 | Policy Makers, Energy Analysts |

| Automotive Component Manufacturers | 80 | Supply Chain Managers, Quality Assurance Officers |

The Global Automotive Ultracapacitor Market is valued at approximately USD 2.1 billion, reflecting a significant growth trend driven by the increasing demand for energy-efficient solutions in electric and hybrid vehicles.