Region:Global

Author(s):Shubham

Product Code:KRAB0781

Pages:89

Published On:August 2025

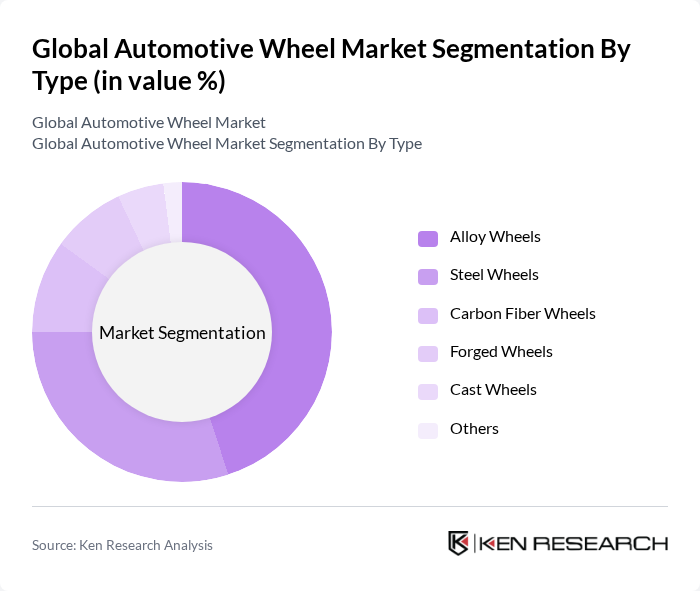

By Type:The automotive wheel market is segmented into various types, including alloy wheels, steel wheels, carbon fiber wheels, forged wheels, cast wheels, and others. Among these, alloy wheels are the most popular due to their lightweight nature, corrosion resistance, and aesthetic appeal, making them a preferred choice for both OEMs and consumers. Steel wheels, while heavier, are favored for their durability and cost-effectiveness, particularly in commercial vehicles. The demand for carbon fiber wheels is growing, driven by the performance and racing segments, where weight reduction and strength are critical. Forged wheels are increasingly adopted in premium and sports vehicles for their superior strength-to-weight ratio and customizability. Cast wheels remain prevalent in mass-market vehicles due to their production efficiency and cost advantages .

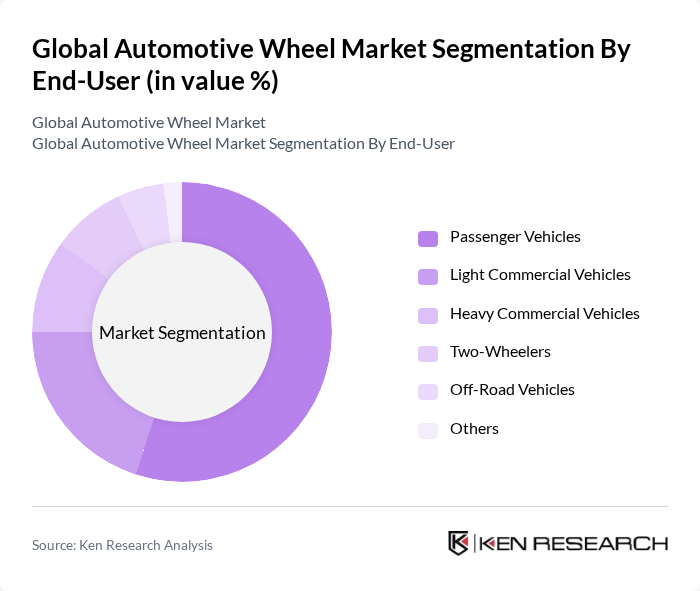

By End-User:The end-user segmentation includes passenger vehicles, light commercial vehicles, heavy commercial vehicles, two-wheelers, off-road vehicles, and others. Passenger vehicles dominate the market due to the high volume of sales, growing trend of vehicle personalization, and the increasing adoption of advanced wheel technologies. Light commercial vehicles are also significant, as they require durable wheels for various applications, including logistics and fleet operations. The off-road segment is witnessing growth due to the increasing popularity of recreational vehicles and off-road adventures, while heavy commercial vehicles and two-wheelers continue to represent stable demand segments .

The Global Automotive Wheel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Maxion Wheels, Borbet GmbH, Ronal Group, Uniwheels AG, Superior Industries International, Inc., Alcoa Corporation, Hayes Lemmerz International, Inc., Enkei Corporation, Topy Industries Limited, BBS Kraftfahrzeugtechnik AG, OZ S.p.A. (OZ Racing), Momo S.p.A., Rota Wheels (Philippine Aluminum Wheels, Inc.), Wheel Pros, American Racing, Forgeline Motorsports, HRE Performance Wheels, and TSW Alloy Wheels contribute to innovation, geographic expansion, and service delivery in this space.

The automotive wheel market is poised for significant transformation driven by technological advancements and evolving consumer preferences. As electric vehicle adoption accelerates, manufacturers will increasingly focus on developing specialized wheels that enhance performance and efficiency. Additionally, the trend towards sustainable materials will likely reshape production processes, with a growing emphasis on eco-friendly alternatives. These factors, combined with the expansion into emerging markets, will create a dynamic landscape for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Alloy Wheels Steel Wheels Carbon Fiber Wheels Forged Wheels Cast Wheels Others |

| By End-User | Passenger Vehicles Light Commercial Vehicles Heavy Commercial Vehicles Two-Wheelers Off-Road Vehicles Others |

| By Application | OEM (Original Equipment Manufacturer) Aftermarket Racing Custom Builds Others |

| By Material | Aluminum Steel Magnesium Carbon Fiber Composite Materials Others |

| By Rim Size | "-15" "-18" "-21" Above 21" |

| By Distribution Channel | Direct Sales Online Retail Auto Parts Stores Dealerships Others |

| By Price Range | Budget Wheels Mid-Range Wheels Premium Wheels Luxury Wheels Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Wheel Manufacturers | 100 | Production Managers, Quality Control Engineers |

| Commercial Vehicle Wheel Suppliers | 80 | Supply Chain Managers, Procurement Specialists |

| Aftermarket Wheel Retailers | 60 | Sales Managers, Marketing Directors |

| Automotive Design and Engineering Firms | 50 | Design Engineers, Product Development Managers |

| Recycling and Sustainability Initiatives in Wheel Production | 40 | Sustainability Officers, Environmental Compliance Managers |

The Global Automotive Wheel Market is valued at approximately USD 28 billion, driven by increasing demand for lightweight vehicles, customization trends, and advancements in manufacturing technologies. This market is expected to grow further with the rise of electric vehicle production and smart wheel technologies.