Region:Global

Author(s):Rebecca

Product Code:KRAD0223

Pages:83

Published On:August 2025

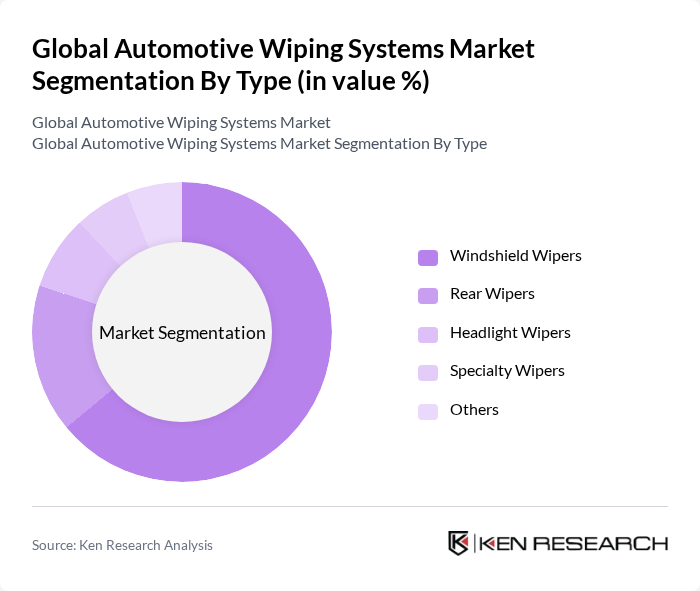

By Type:The market is segmented into Windshield Wipers, Rear Wipers, Headlight Wipers, Specialty Wipers, and Others. Windshield Wipers dominate the market, holding the largest share due to their essential role in ensuring driver visibility and safety. The segment is further propelled by the introduction of advanced features such as rain-sensing automation, adaptive wiping speeds, and the use of durable, high-performance materials including silicone and hybrid constructions. Flat blade and beam technologies are increasingly preferred for their superior performance and compatibility with modern vehicle designs .

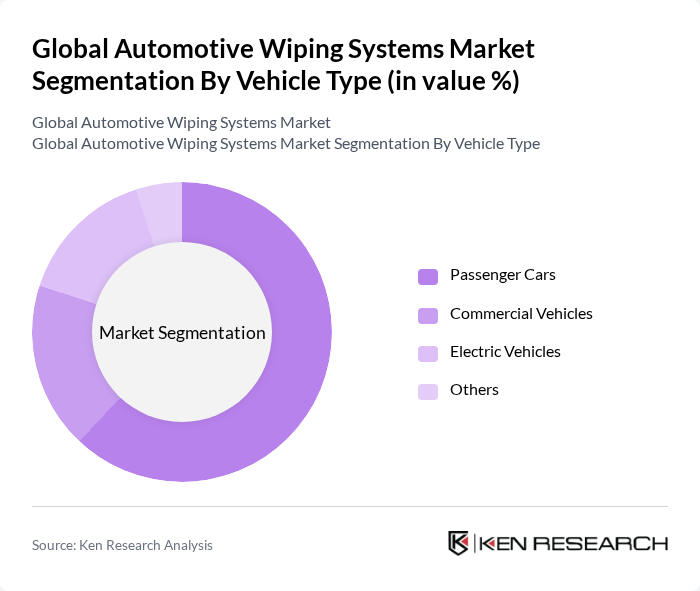

By Vehicle Type:The market is categorized into Passenger Cars, Commercial Vehicles, Electric Vehicles, and Others. Passenger Cars hold the largest share, driven by high global sales volumes and the growing trend of vehicle ownership. The integration of advanced wiper systems, such as rain-sensing and adaptive technologies, is increasingly common in new passenger car models. Commercial Vehicles and Electric Vehicles are also significant segments, as fleet operators and EV manufacturers prioritize safety and advanced features .

The Global Automotive Wiping Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Valeo S.A., Denso Corporation, Trico Products Corporation, Federal-Mogul Motorparts (now part of Tenneco Inc.), Aisin Corporation, HELLA GmbH & Co. KGaA, Marelli S.p.A., PIAA Corporation, ANCO Wiper Blades, Rain-X (ITW Global Brands), SWF (Valeo Group), Valeo Service, Sogefi Group, and TYC Brother Industrial Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The automotive wiping systems market is poised for significant transformation, driven by technological advancements and a heightened focus on sustainability. As manufacturers increasingly adopt automated wiping systems, efficiency and performance will improve, catering to consumer demands. Additionally, the integration of eco-friendly materials will align with global environmental goals, fostering innovation. The rise of e-commerce in automotive parts will also reshape distribution channels, enhancing accessibility and convenience for consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Windshield Wipers Rear Wipers Headlight Wipers Specialty Wipers Others |

| By Vehicle Type | Passenger Cars Commercial Vehicles Electric Vehicles Others |

| By Component | Wiper Blades Wiper Motors Wiper Linkages Pumps Connectors, Reservoirs, Hoses, and Others |

| By Sales Channel | OEMs Aftermarket/Replacement Online Retail Others |

| By Geography | North America Europe Asia-Pacific Rest of the World |

| By Price Range | Budget Mid-Range Premium |

| By Application | Automotive Manufacturing Vehicle Maintenance Automotive Repair Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive OEMs | 100 | Product Development Managers, Procurement Officers |

| Aftermarket Suppliers | 60 | Sales Directors, Marketing Managers |

| Automotive Service Centers | 50 | Service Managers, Workshop Owners |

| Raw Material Suppliers | 40 | Supply Chain Managers, Quality Control Officers |

| Industry Experts and Analysts | 40 | Market Analysts, Automotive Consultants |

The Global Automotive Wiping Systems Market is valued at approximately USD 4.2 billion, driven by increasing demand for vehicle safety and advancements in wiper technology, including smart sensors and improved blade materials.