Region:Global

Author(s):Dev

Product Code:KRAC0410

Pages:99

Published On:August 2025

By Type:The automotive wiring harness market can be segmented into various types, including Engine Wiring Harness, Body Wiring Harness, Chassis Wiring Harness, HVAC Wiring Harness, Lighting Wiring Harness, Battery and High-Voltage Wiring Harness, Sensors and ADAS Wiring Harness, and Infotainment and Communication Wiring Harness. Among these, the Engine Wiring Harness is a significant segment due to its critical role in vehicle functionality and performance. The increasing complexity of engine systems and the integration of advanced technologies have led to a higher demand for specialized wiring solutions. Concurrently, high-voltage harness content is rising with EV/hybrid platforms, and chassis/body applications remain sizable content holders as vehicle electronics proliferate .

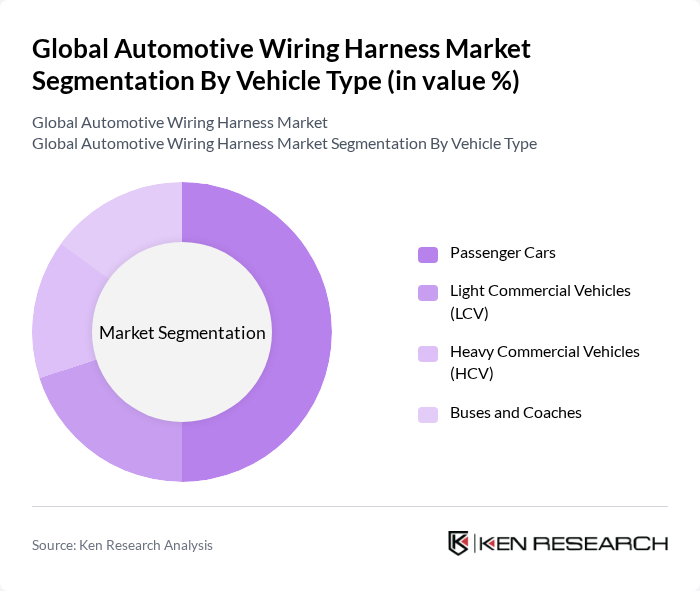

By Vehicle Type:The market can also be segmented by vehicle type, which includes Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), and Buses and Coaches. The Passenger Cars segment holds a significant share due to the high volume of production and the increasing consumer preference for personal vehicles. The rise in disposable income and urbanization has further fueled the demand for passenger cars, leading to a corresponding increase in the need for wiring harnesses. Industry sources consistently show passenger cars as the largest vehicle category for wiring harness demand .

The Global Automotive Wiring Harness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yazaki Corporation, Aptiv PLC, LEONI AG, Sumitomo Electric Industries, Ltd., Furukawa Electric Co., Ltd., Lear Corporation, Kromberg & Schubert GmbH & Co. KG, Motherson Wiring (Samvardhana Motherson Group), PKC Group (a Motherson company), Nexans S.A., TE Connectivity Ltd., Sumitomo Wiring Systems, Ltd., DRÄXLMAIER Group, Fujikura Ltd., Coroplast Group contribute to innovation, geographic expansion, and service delivery in this space.

Enhancements and validation notes:

The automotive wiring harness market is poised for significant transformation, driven by the increasing integration of smart technologies and a focus on sustainable manufacturing practices. As manufacturers adopt modular designs and lightweight materials, efficiency and performance will improve. Additionally, the expansion into emerging markets presents new growth avenues, with rising disposable incomes and urbanization driving vehicle demand. These trends will shape the future landscape of the automotive wiring harness industry, fostering innovation and collaboration among key players.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Wiring Harness Body Wiring Harness Chassis Wiring Harness HVAC Wiring Harness Lighting Wiring Harness Battery and High-Voltage Wiring Harness Sensors and ADAS Wiring Harness Infotainment and Communication Wiring Harness |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) Buses and Coaches |

| By Component | Wires and Cables Connectors Terminals Insulation and Sheathing Materials Protective Conduits, Tapes, and Grommets |

| By Sales Channel | OEM Aftermarket |

| By Material/Transmission Type | Copper Aluminum Optical Fiber (Data Transmission) |

| By Propulsion | Internal Combustion Engine (ICE) Hybrid Electric Vehicles (HEV/PHEV) Battery Electric Vehicles (BEV) |

| By Application | Body and Lighting Power Distribution Data and Signal Transmission Thermal Management and HVAC Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Wiring Harness | 120 | Product Managers, Design Engineers |

| Commercial Vehicle Wiring Solutions | 100 | Procurement Managers, Operations Directors |

| Electric Vehicle Wiring Systems | 80 | R&D Engineers, Sustainability Officers |

| Aftermarket Wiring Harness Components | 70 | Sales Managers, Technical Support Specialists |

| Wiring Harness Manufacturing Processes | 90 | Manufacturing Engineers, Quality Assurance Managers |

The Global Automotive Wiring Harness Market is valued at approximately USD 50 billion, reflecting strong demand driven by electrification, advanced driver-assistance systems (ADAS), and the integration of premium electronics in vehicles.