Region:Global

Author(s):Dev

Product Code:KRAA1537

Pages:86

Published On:August 2025

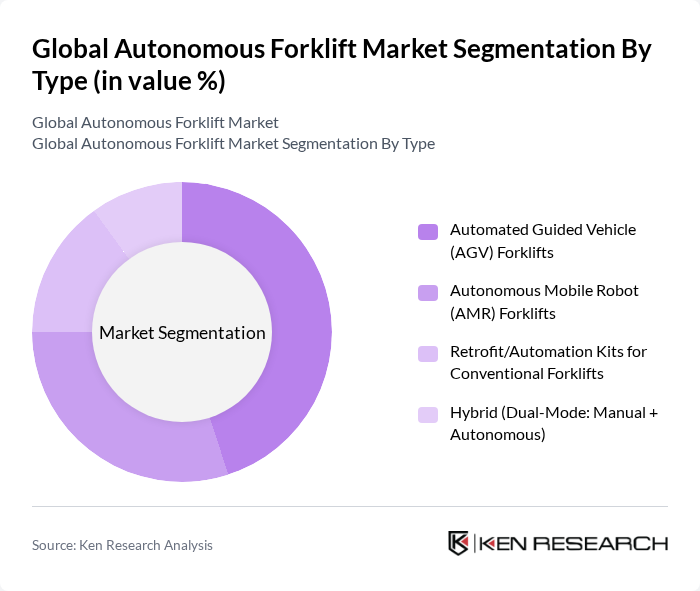

By Type:

The segmentation by type includes Automated Guided Vehicle (AGV) Forklifts, Autonomous Mobile Robot (AMR) Forklifts, Retrofit/Automation Kits for Conventional Forklifts, and Hybrid (Dual-Mode: Manual + Autonomous). AGV forklifts historically have strong penetration in manufacturing and high-throughput logistics due to fixed-path operations and mature safety-certified navigation, while AMR forklifts have been rapidly adopted for flexible workflows, dynamic routing, and faster reconfiguration in e-commerce and 3PL environments. The growing trend toward software-driven fleet orchestration and vision/LiDAR SLAM has expanded use cases for both AGV and AMR formats across brownfield sites.

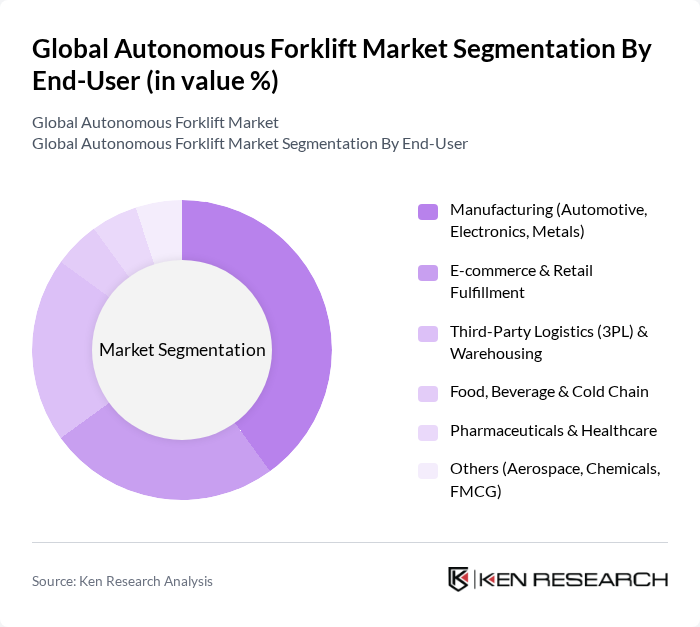

By End-User:

The end-user segmentation includes Manufacturing (Automotive, Electronics, Metals), E-commerce & Retail Fulfillment, Third-Party Logistics (3PL) & Warehousing, Food, Beverage & Cold Chain, Pharmaceuticals & Healthcare, and Others (Aerospace, Chemicals, FMCG). Manufacturing, particularly automotive and electronics, maintains strong demand given repetitive, high-volume material flows and precision requirements, while e-commerce and 3PL are accelerating adoption to address labor constraints and peak season variability through automated pallet movement and trailer unloading. Food and cold chain deployments are supported by consistent throughput needs and safety/hygiene advantages of automation in controlled environments.

The Global Autonomous Forklift Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Industries Corporation, KION Group AG (Linde Material Handling, STILL), Jungheinrich AG, Hyster-Yale Materials Handling, Inc. (Hyster, Yale), Crown Equipment Corporation, Mitsubishi Logisnext Co., Ltd. (UniCarriers, Nichiyu), Daifuku Co., Ltd., Seegrid Corporation, BALYO SA, AGILOX Services GmbH, Oceaneering International, Inc. (Mobile Robotics), SSI Schäfer Group, Rocla Solutions Oy (Mitsubishi Logisnext Europe), E&K Automation GmbH (EK Robotics), OTTO Motors by Rockwell Automation contribute to innovation, geographic expansion, and service delivery in this space, with OEMs and robotics firms collaborating on AI-powered navigation, digital twins, and trailer loading automation.

The future of the autonomous forklift market appears promising, driven by technological advancements and increasing automation needs. As companies continue to prioritize operational efficiency, the integration of IoT and AI technologies will enhance the functionality of autonomous forklifts. Additionally, the growing emphasis on sustainability will likely lead to the development of electric and eco-friendly models, further propelling market growth. The focus on smart warehousing solutions will also create new avenues for innovation and investment in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Automated Guided Vehicle (AGV) Forklifts Autonomous Mobile Robot (AMR) Forklifts Retrofit/Automation Kits for Conventional Forklifts Hybrid (Dual-Mode: Manual + Autonomous) |

| By End-User | Manufacturing (Automotive, Electronics, Metals) E-commerce & Retail Fulfillment Third-Party Logistics (3PL) & Warehousing Food, Beverage & Cold Chain Pharmaceuticals & Healthcare Others (Aerospace, Chemicals, FMCG) |

| By Payload Capacity | Light Duty (Up to 1,000 kg) Medium Duty (1,000 kg - 3,000 kg) Heavy Duty (Above 3,000 kg) |

| By Application | Pallet Handling & Putaway (Indoor) Dock-to-Stock & Cross-Docking Replenishment & Order Picking Outdoor Yard & Trailer Loading Inventory Moves in Cold Storage |

| By Powertrain | Lithium-Ion Electric Lead-Acid Electric Hydrogen Fuel Cell Others (Diesel/LP with Autonomous Retrofit) |

| By Navigation Technology | LiDAR & SLAM-Based Vision-Based (Cameras/AI) QR/Reflector/Inductive Guidance GPS/RTK-Assisted (Outdoor) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Sales Channel | Direct (OEM) System Integrators & Distributors Online & Marketplace |

| By Price Band | Budget (Entry-Level) Mid-Range Premium (High-End) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Automation Adoption | 120 | Warehouse Managers, Operations Directors |

| Logistics and Supply Chain Optimization | 100 | Supply Chain Analysts, Logistics Coordinators |

| Technology Integration in Material Handling | 80 | IT Managers, Automation Engineers |

| Market Trends in Autonomous Vehicles | 70 | Industry Analysts, Business Development Managers |

| Investment in Robotics for Warehousing | 90 | Financial Analysts, Procurement Managers |

The Global Autonomous Forklift Market is valued at approximately USD 5.3 billion, reflecting a significant growth trend driven by increased automation in warehouses and manufacturing facilities, as well as the rise in e-commerce and logistics demands.