Region:Global

Author(s):Dev

Product Code:KRAA1660

Pages:80

Published On:August 2025

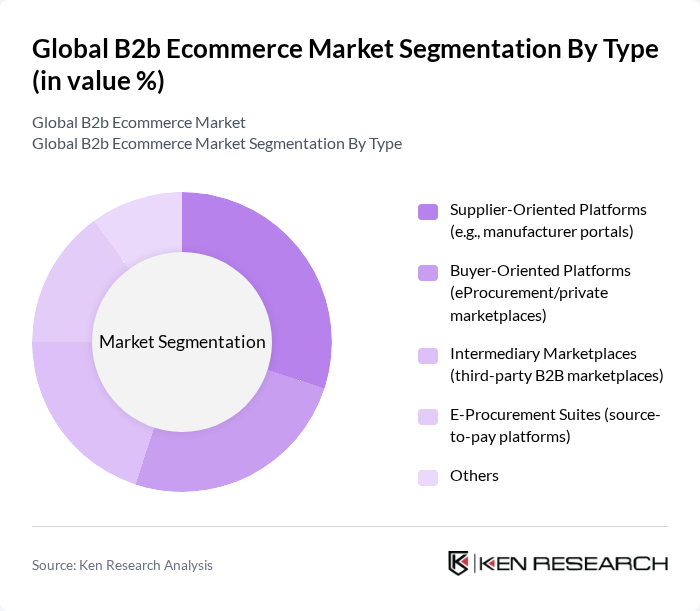

By Type:The B2B ecommerce market is segmented into various types, including Supplier-Oriented Platforms, Buyer-Oriented Platforms, Intermediary Marketplaces, E-Procurement Suites, and Others. Supplier-Oriented Platforms continue to gain traction as manufacturers and OEMs sell directly with self-service catalogs and negotiated pricing, while Buyer-Oriented Platforms support centralized, policy-compliant procurement. Intermediary Marketplaces and E-Procurement Suites are accelerated by API-first integrations with ERP/CRM, AI-driven sourcing, and automated order-to-cash workflows .

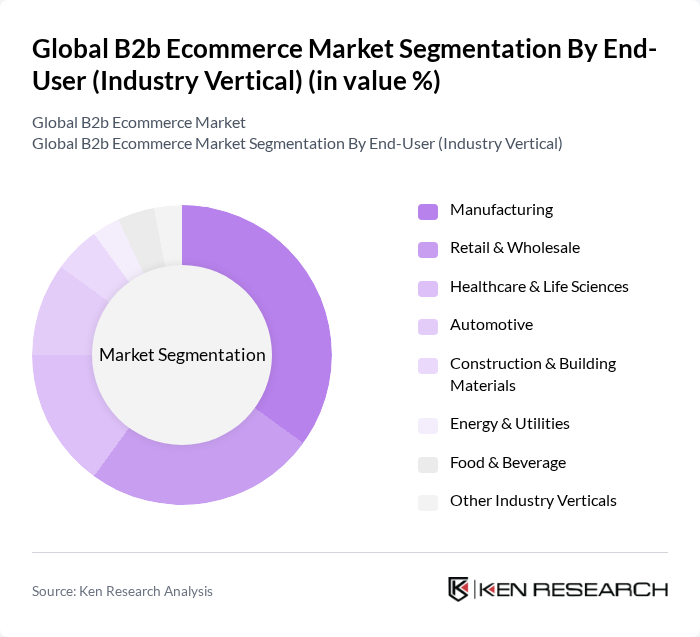

By End-User (Industry Vertical):The B2B ecommerce market is also segmented by end-user industries, including Manufacturing, Retail & Wholesale, Healthcare & Life Sciences, Automotive, Construction & Building Materials, Energy & Utilities, Food & Beverage, and Other Industry Verticals. The Manufacturing sector leads due to complex, high-volume sourcing and standardization via digital catalogs and punchout integrations. Retail & Wholesale maintains a significant share driven by multi-supplier procurement, inventory turns, and private-label sourcing on marketplaces .

The Global B2B Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alibaba Group (Alibaba.com, 1688.com), Amazon Business, IndiaMART InterMESH Ltd., Global Sources, Thomas (Thomasnet), Made-in-China.com (Focus Technology), DHgate, eBay Business Supply, BigCommerce B2B Edition, Adobe Commerce (Magento), Shopify Plus, SAP Business Network (Ariba), Coupa Software, EC21, and Rakuten Super Logistics (Rakuten Group) contribute to innovation, geographic expansion, and service delivery in this space. Platform growth is supported by AI-driven product discovery, ERP/CRM integration, and the shift from EDI to API-first connectivity in procurement and supplier management .

The future of B2B eCommerce is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt omnichannel strategies, the integration of AI and machine learning will enhance personalization and efficiency in transactions. Furthermore, the focus on sustainability will shape purchasing decisions, compelling companies to adopt ethical sourcing practices. These trends indicate a dynamic landscape where adaptability and innovation will be crucial for success in the B2B eCommerce sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Supplier-Oriented Platforms (e.g., manufacturer portals) Buyer-Oriented Platforms (eProcurement/private marketplaces) Intermediary Marketplaces (third-party B2B marketplaces) E-Procurement Suites (source-to-pay platforms) Others |

| By End-User (Industry Vertical) | Manufacturing Retail & Wholesale Healthcare & Life Sciences Automotive Construction & Building Materials Energy & Utilities Food & Beverage Other Industry Verticals |

| By Sales Channel | Direct Sales (brand.com, portals) Marketplace Sales (horizontal/vertical B2B marketplaces) Channel Partners (distributors/resellers) EDI/API Integrations Others |

| By Product Category | Industrial & MRO Supplies Electronics & Electricals Office & Stationery Raw Materials & Chemicals Packaging & Logistics Supplies Others |

| By Payment Method | Bank Transfers and ACH Credit and Debit Cards Digital Wallets Net Terms/Trade Credit (BNPL for B2B) Others |

| By Transaction Model | Domestic Cross-Border Export/Import-Focused Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Platform Deployment | Cloud/SaaS On-Premises Hybrid Others |

| By Geography | North America Europe Asia-Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector E-commerce Adoption | 120 | Supply Chain Managers, IT Directors |

| Wholesale Distribution Channels | 90 | Operations Managers, Sales Directors |

| Service Industry B2B Transactions | 70 | Procurement Officers, Business Development Managers |

| SME E-commerce Utilization | 110 | Business Owners, Marketing Managers |

| Technology Integration in B2B Platforms | 80 | CTOs, Digital Transformation Leads |

The Global B2B Ecommerce Market is valued at approximately USD 18.4 trillion, with estimates suggesting it could reach around USD 18.7 trillion. This growth reflects the rapid digitalization of procurement and the expansion of online B2B marketplaces.