Region:Global

Author(s):Rebecca

Product Code:KRAB0220

Pages:99

Published On:August 2025

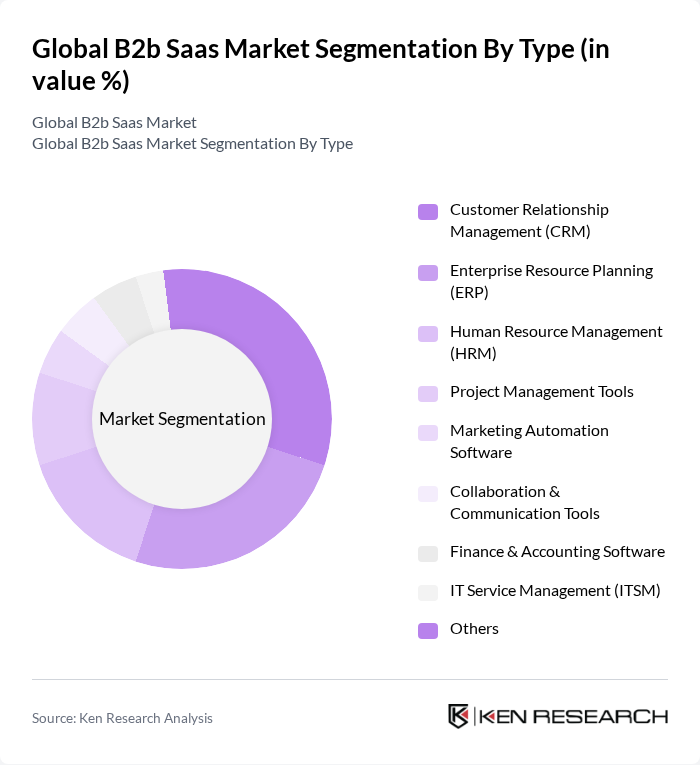

By Type:The B2B SaaS market can be segmented into various types, including Customer Relationship Management (CRM), Enterprise Resource Planning (ERP), Human Resource Management (HRM), Project Management Tools, Marketing Automation Software, Collaboration & Communication Tools, Finance & Accounting Software, IT Service Management (ITSM), and Others. Each of these segments addresses distinct business needs. CRM and ERP remain the most prominent segments, reflecting their essential roles in managing customer relationships and optimizing business resources. CRM software currently leads the market, with nearly one-third of overall share, driven by its critical function in sales, marketing, and customer service automation .

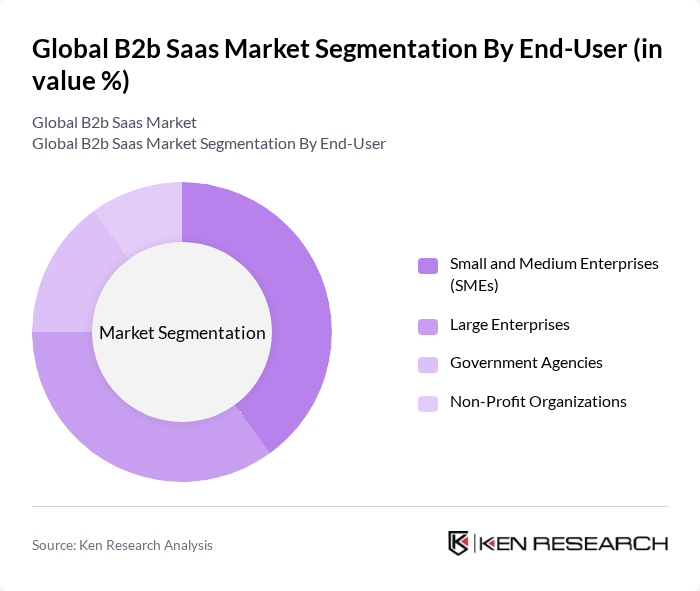

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, and Non-Profit Organizations. SMEs are increasingly adopting SaaS solutions due to their cost-effectiveness, scalability, and ease of deployment, while large enterprises leverage these tools for enhanced operational efficiency, advanced analytics, and integration with legacy systems. Government agencies and non-profits are also utilizing SaaS for improved service delivery, compliance, and resource management .

The Global B2B SaaS market is characterized by a dynamic mix of regional and international players. Leading participants such as Salesforce, Microsoft, Oracle, SAP, Adobe, HubSpot, ServiceNow, Workday, Atlassian, Zendesk, Freshworks, Box, Monday.com, Intercom, DocuSign, Intuit, Smartsheet, Zoom Video Communications, Shopify, Snowflake contribute to innovation, geographic expansion, and service delivery in this space.

The future of the B2B SaaS market appears promising, driven by technological advancements and evolving business needs. As companies increasingly prioritize digital transformation, the demand for innovative SaaS solutions will continue to rise. The integration of artificial intelligence and machine learning into SaaS applications is expected to enhance functionality and user experience. Additionally, the focus on sustainability will likely lead to the development of eco-friendly SaaS solutions, aligning with global environmental goals and corporate responsibility initiatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Customer Relationship Management (CRM) Enterprise Resource Planning (ERP) Human Resource Management (HRM) Project Management Tools Marketing Automation Software Collaboration & Communication Tools Finance & Accounting Software IT Service Management (ITSM) Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Profit Organizations |

| By Industry Vertical | Information Technology & Services Healthcare & Life Sciences Financial Services & Insurance Retail & E-commerce Manufacturing Education & E-learning Logistics & Transportation Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Pricing Model | Subscription-Based Pay-As-You-Go Freemium |

| By Customer Size | Small Businesses Medium Enterprises Large Corporations |

| By Geographic Presence | North America Europe Asia-Pacific Latin America Middle East and Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Resource Planning (ERP) Solutions | 100 | IT Managers, CFOs, Operations Directors |

| Customer Relationship Management (CRM) Systems | 90 | Sales Managers, Marketing Directors, Customer Success Managers |

| Human Resource Management Software | 60 | HR Managers, Talent Acquisition Specialists |

| Project Management Tools | 50 | Project Managers, Team Leaders, Product Owners |

| Collaboration and Communication Platforms | 70 | IT Directors, Operations Managers, Team Coordinators |

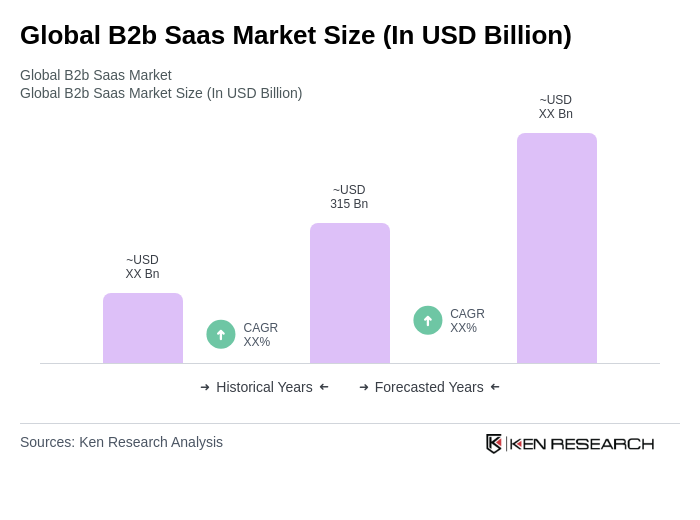

The Global B2B SaaS market is valued at approximately USD 315 billion, reflecting significant growth driven by the increasing adoption of cloud-based solutions and the demand for software that enhances operational efficiency and customer engagement.