Global Baby Carrier Market Overview

- The Global Baby Carrier Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing number of working parents, rising awareness about the benefits of babywearing, and the growing trend of outdoor activities among families. The market has seen a surge in demand for ergonomic and versatile baby carriers that cater to the needs of modern parents. Recent trends also highlight the influence of e-commerce, the introduction of smart baby carriers with biomonitoring features, and the use of breathable, sustainable materials to enhance comfort and safety .

- Key players in this market include the United States, Germany, and Japan, which are prominent due to strong consumer spending, established retail infrastructure, and a high demand for premium baby products. However, North America currently holds the largest market share, while Asia-Pacific is the fastest-growing region, driven by rising middle-class incomes and rapid e-commerce adoption .

- In 2023, the European Union implemented regulations mandating safety standards for baby carriers, ensuring that all products meet stringent safety and quality benchmarks. This regulation aims to enhance consumer confidence and reduce the risk of accidents associated with babywearing, thereby promoting safer products in the market .

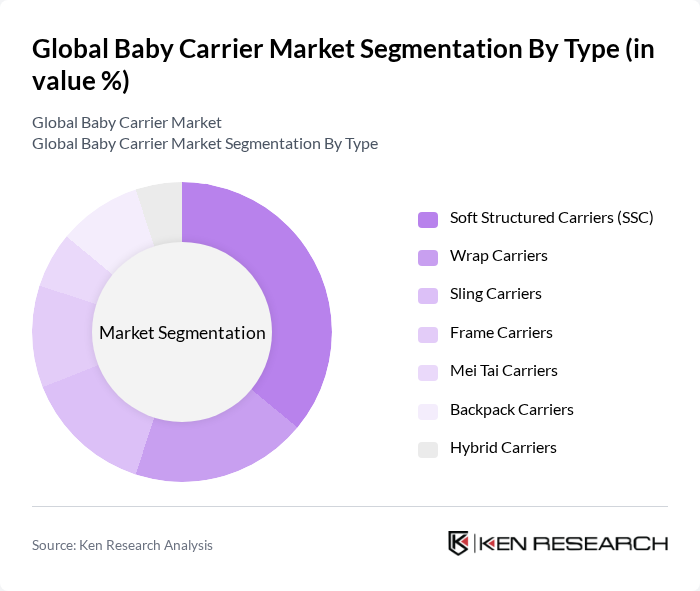

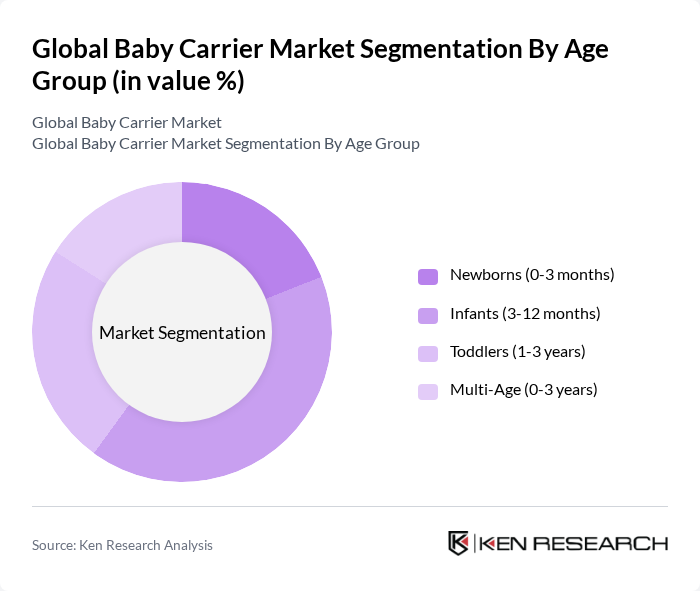

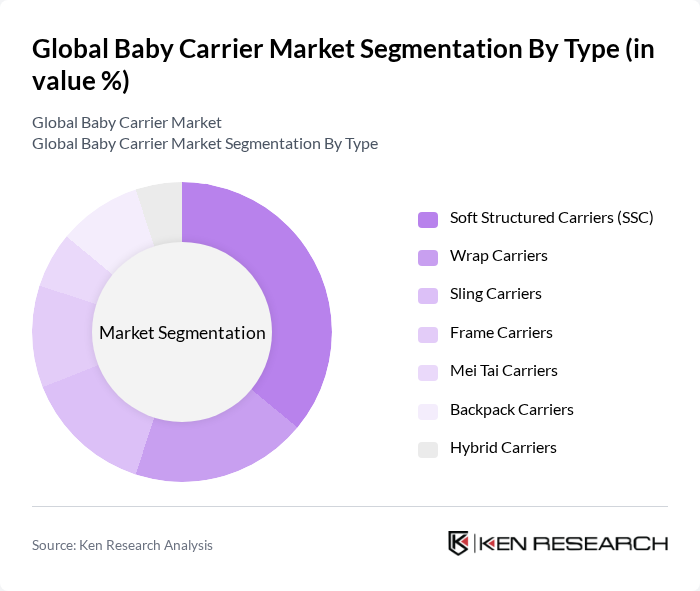

Global Baby Carrier Market Segmentation

By Type:The market is segmented into various types of baby carriers, including Soft Structured Carriers (SSC), Wrap Carriers, Sling Carriers, Frame Carriers, Mei Tai Carriers, Backpack Carriers, and Hybrid Carriers. Among these,Soft Structured Carriers (SSC)are the most popular due to their ease of use, comfort, and ergonomic design, which appeals to a wide range of consumers. The demand for SSC has been bolstered by their versatility, allowing parents to carry their babies in multiple positions, making them suitable for different activities and environments. Structured buckled carriers (a category that includes SSCs) account for the largest market share, favored for their ergonomic support and convenience .

By Age Group:The market is also segmented by age group, including Newborns (0-3 months), Infants (3-12 months), Toddlers (1-3 years), and Multi-Age (0-3 years). The segment forInfants (3-12 months)is currently leading the market due to the high demand for carriers that provide comfort and support for babies during this critical growth phase. Parents are increasingly seeking carriers that offer safety features and ease of use, which has led to a rise in the popularity of products designed specifically for infants .

Global Baby Carrier Market Competitive Landscape

The Global Baby Carrier Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ergobaby, BabyBjörn AB, Boba Inc., Baby Tula, Infantino LLC, Chicco (Artsana S.p.A.), LÍLLÉbaby, Manduca (Wickelkinder GmbH), CuddleBug, Baby K'tan LLC, Blue Box Company, Moby Wrap Inc., Boppy Company LLC, Onya Baby, BECO Baby Carrier contribute to innovation, geographic expansion, and service delivery in this space.

Global Baby Carrier Market Industry Analysis

Growth Drivers

- Increasing Demand for Hands-Free Parenting Solutions:The global trend towards hands-free parenting is driving the baby carrier market, with an estimated 60% of parents in urban areas opting for carriers to facilitate mobility. According to the World Bank, urbanization rates are projected to reach 57% in future, increasing the need for convenient parenting solutions. This shift is further supported by a 15% rise in dual-income households, leading to a greater demand for products that allow parents to multitask effectively while ensuring child safety.

- Rising Awareness of Babywearing Benefits:The benefits of babywearing, including enhanced bonding and developmental advantages for infants, are becoming widely recognized. A study by the American Academy of Pediatrics indicates that 70% of pediatricians now recommend babywearing for its developmental benefits. Additionally, the global parenting community is increasingly sharing experiences through social media, with a 40% increase in online discussions about babywearing, further driving consumer interest and market growth.

- Growth in E-Commerce and Online Retail:The e-commerce sector is significantly impacting the baby carrier market, with online sales projected to account for 30% of total sales in future. The International Monetary Fund reports that global e-commerce sales are expected to reach USD 6.4 trillion, facilitating easier access to a variety of baby carrier options. This trend is particularly pronounced in regions with high internet penetration, where online shopping is becoming the preferred method for purchasing baby products, including carriers.

Market Challenges

- Safety Concerns and Regulatory Compliance:Safety remains a paramount concern in the baby carrier market, with stringent regulations governing product safety. In future, the Consumer Product Safety Commission reported over 1,000 incidents related to baby carrier safety, prompting manufacturers to invest heavily in compliance. The cost of meeting these safety standards can be substantial, with estimates suggesting that compliance testing can add up to 15% to production costs, impacting overall profitability.

- Competition from Alternative Baby Products:The baby carrier market faces stiff competition from alternative products such as strollers and baby slings. In future, the stroller market was valued at approximately USD 3 billion, with a projected growth rate of 5% annually. This competition can dilute market share for baby carriers, as parents often prioritize multifunctional products that offer greater versatility. The challenge lies in differentiating baby carriers in a crowded marketplace where alternatives are readily available.

Global Baby Carrier Market Future Outlook

The future of the baby carrier market appears promising, driven by evolving consumer preferences and technological advancements. As parents increasingly seek ergonomic and multifunctional designs, manufacturers are likely to innovate continuously. Additionally, the rise of eco-conscious consumers will push brands to develop sustainable products. With the expansion of online retail, companies can reach a broader audience, particularly in emerging markets, enhancing their growth potential and market presence in the coming years.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets present significant growth opportunities for baby carriers, with a projected increase in birth rates and urbanization. Countries like India and Brazil are experiencing a rise in disposable income, leading to a 25% increase in demand for baby products. Targeting these markets can yield substantial returns for manufacturers willing to adapt their offerings to local preferences and cultural practices.

- Development of Eco-Friendly Products:The demand for eco-friendly baby products is on the rise, with 45% of parents indicating a preference for sustainable options. Manufacturers can capitalize on this trend by developing carriers made from organic materials and recyclable components. This shift not only meets consumer demand but also aligns with global sustainability goals, potentially increasing brand loyalty and market share among environmentally conscious consumers.