Region:Global

Author(s):Shubham

Product Code:KRAC0579

Pages:84

Published On:August 2025

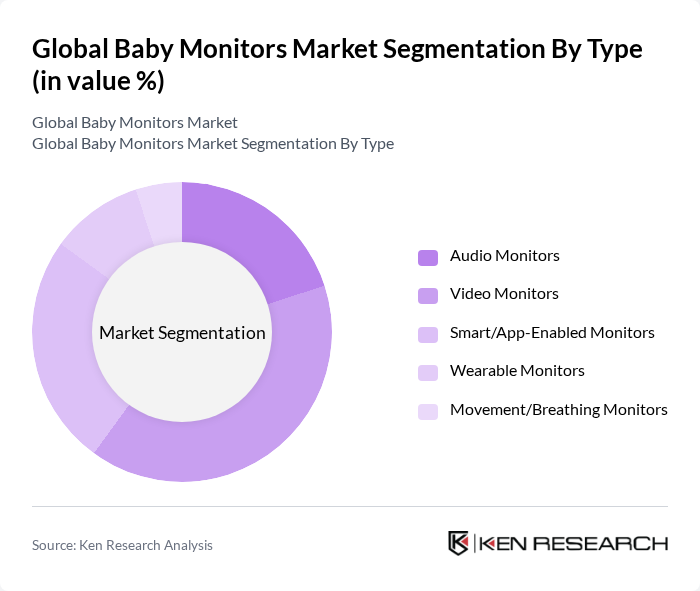

By Type:The market is segmented into various types of baby monitors, including audio monitors, video monitors, smart/app-enabled monitors, wearable monitors, and movement/breathing monitors. Among these,video monitorshave gained significant traction due to real-time visual feedback and night vision, and are the largest product category, especially within smart audio-video formats . The increasing integration of smart technology into baby monitors has also led to a rise in demand forsmart/app-enabledmonitors, which offer remote access, alerts, sleep analytics, and voice assistant integrations via Wi?Fi/mobile apps .

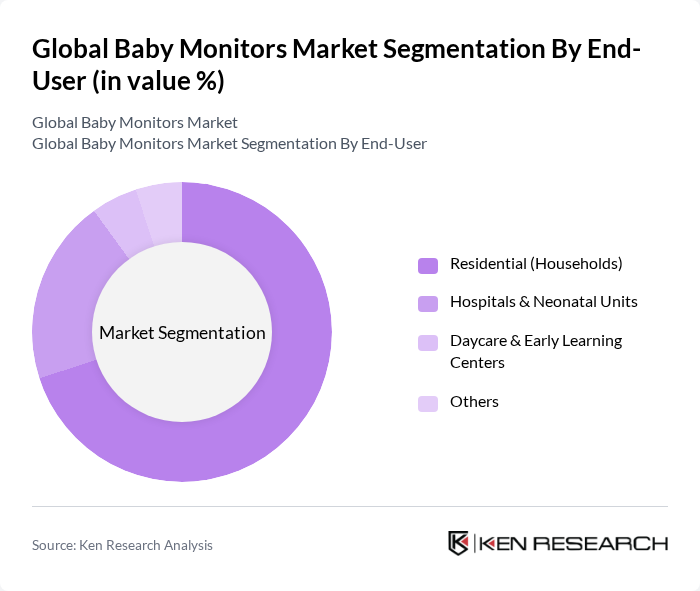

By End-User:The end-user segmentation includes residential (households), hospitals & neonatal units, daycare & early learning centers, and others. Theresidentialsegment dominates, driven by working-parent schedules, smart home adoption, and app-based remote monitoring expectations for at-home care . Hospitals and neonatal units also contribute, particularly for systems with vital sign or movement/breathing tracking capabilities .

The Global Baby Monitors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Motorola Nursery (formerly Hubble Connected, licensed by Motorola), Philips Avent (Koninklijke Philips N.V.), Summer Infant, Inc. (Summer), Nanit, Inc., Owlet Baby Care, Inc., Angelcare Monitors Inc., VTech Communications, Inc. (VTech Holdings Limited), Babysense (Hisense Ltd.), iBaby Labs, Inc., Lollipop (Masterwork Aoitek Co., Ltd.), Miku, Inc., HelloBaby, Chicco (Artsana S.p.A.), Graco (Newell Brands), Arlo Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the baby monitors market appears promising, driven by ongoing technological advancements and increasing consumer demand for enhanced safety features. As manufacturers continue to innovate, integrating AI and machine learning into their products, the market is likely to see a surge in smart monitoring solutions. Additionally, the expansion into emerging markets will provide new growth avenues, as families seek reliable and affordable monitoring options to ensure their children's safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Audio Monitors Video Monitors Smart/App-Enabled Monitors Wearable Monitors Movement/Breathing Monitors |

| By End-User | Residential (Households) Hospitals & Neonatal Units Daycare & Early Learning Centers Others |

| By Distribution Channel | Online Retail (Marketplaces, Brand.com) Offline Retail (Specialty, Super/Hypermarkets, Pharmacies) Direct/B2B (Healthcare, Institutional) Others |

| By Price Range | Budget (Sub-$100) Mid-Range ($100–$250) Premium ($250+) |

| By Features | Night Vision & HD Video Two-Way Communication Temperature/Humidity & Sleep Tracking AI Analytics (Cry/Sound Detection, Face Detection) Non-Wi-Fi/RF (DECT/ FHSS) vs Wi?Fi Connectivity |

| By Technology | Audio Monitoring Video Monitoring Hybrid (Video + Movement/Breathing) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Audio Baby Monitors | 100 | Parents of infants, Caregivers |

| Video Baby Monitors | 120 | Parents of toddlers, Childcare providers |

| Smart Baby Monitors | 80 | Tech-savvy parents, Early adopters |

| Market Trends and Preferences | 150 | Expectant parents, Parenting bloggers |

| Safety Features and Concerns | 90 | Pediatricians, Child safety experts |

The Global Baby Monitors Market is valued at approximately USD 1.5 billion, with recent estimates ranging from USD 1.5 to USD 1.65 billion. This growth is attributed to factors such as increased parental awareness of child safety and advancements in technology.