Region:Global

Author(s):Dev

Product Code:KRAD0388

Pages:87

Published On:August 2025

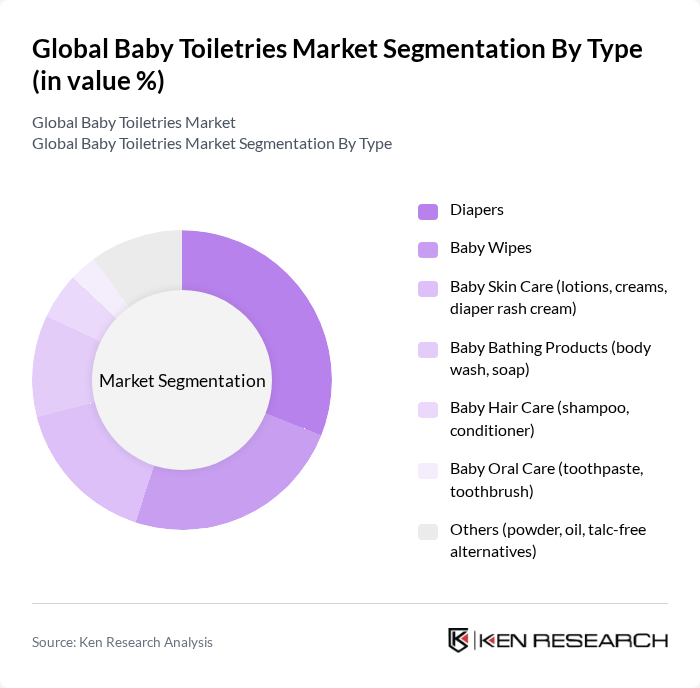

By Type:The market is segmented into various types of baby toiletries, including diapers, baby wipes, baby skin care products (such as lotions, creams, and diaper rash cream), baby bathing products (like body wash and soap), baby hair care (including shampoo and conditioner), baby oral care (toothpaste and toothbrush), and other products (such as powder, oil, and talc-free alternatives). Among these, diapers and baby wipes are the most dominant segments due to their essential nature in daily baby care routines .

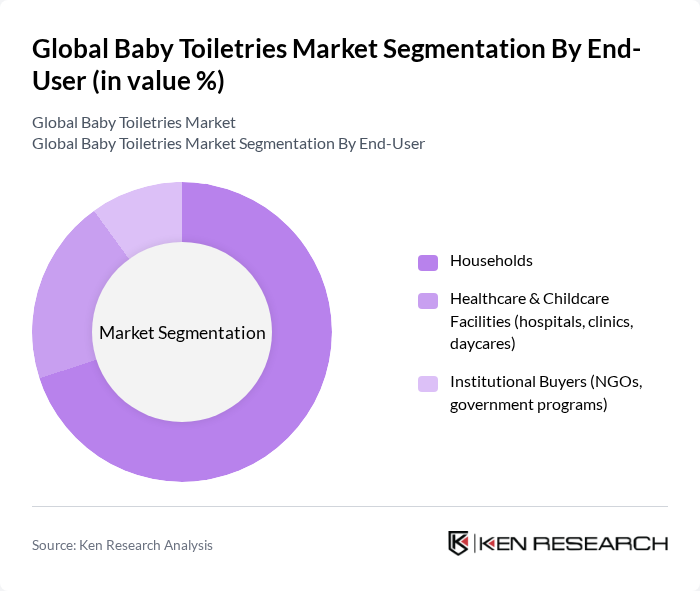

By End-User:The market is segmented based on end-users, which include households, healthcare and childcare facilities (such as hospitals, clinics, and daycares), and institutional buyers (like NGOs and government programs). Households represent the largest segment, driven by the increasing number of young families and the growing awareness of baby hygiene, with e?commerce and premiumization reinforcing at?home purchasing behavior .

The Global Baby Toiletries Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co. (Pampers), Johnson & Johnson (Johnson’s, Aveeno Baby), Unilever (Dove Baby), Kimberly-Clark Corporation (Huggies), Colgate-Palmolive Company (Elmex Kids, Tom’s of Maine Kids), Beiersdorf AG (NIVEA Baby), Reckitt Benckiser Group plc (Dettol, Mead Johnson Nutrition), Kao Corporation (Merries, Bioré U), Pigeon Corporation, Unicharm Corporation (Moony, MamyPoko), The Honest Company, Inc., Mustela (Laboratoires Expanscience), Weleda AG (Weleda Baby Calendula), Himalaya Wellness Company (Himalaya BabyCare), Dabur India Limited (Dabur Baby), Artsana S.p.A. (Chicco), California Baby, Sebapharma GmbH & Co. KG (Sebamed Baby), First Quality Enterprises, Inc. (Cuties), Hengan International Group Co., Ltd. (Q·Mo Baby) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the baby toiletries market appears promising, driven by evolving consumer preferences and technological advancements. As parents increasingly seek products that align with their values, the demand for organic and eco-friendly options is expected to rise. Additionally, the integration of technology in product development, such as smart baby care solutions, will likely enhance consumer engagement. Companies that adapt to these trends will be well-positioned to capture market share and foster brand loyalty in an increasingly competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Diapers Baby Wipes Baby Skin Care (lotions, creams, diaper rash cream) Baby Bathing Products (body wash, soap) Baby Hair Care (shampoo, conditioner) Baby Oral Care (toothpaste, toothbrush) Others (powder, oil, talc-free alternatives) |

| By End-User | Households Healthcare & Childcare Facilities (hospitals, clinics, daycares) Institutional Buyers (NGOs, government programs) |

| By Distribution Channel | Hypermarkets/Supermarkets Chemist & Pharmacy Stores E-commerce Specialty Baby Stores Others (convenience stores, wholesale) |

| By Ingredient Type | Natural Organic Conventional/Synthetic |

| By Packaging Type | Bottles Tubes Jars Pouches/Refills Wipe Canisters/Soft Packs |

| By Price Range | Premium Mid-range Budget |

| By Brand Type | Established Brands Private Labels/Store Brands Indie/Natural Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Baby Toiletries Retail Sales | 150 | Retail Managers, Category Buyers |

| Consumer Preferences in Baby Care | 140 | Parents of infants and toddlers |

| Product Development Insights | 100 | R&D Managers, Product Managers |

| Market Trends in Organic Baby Products | 80 | Health and Wellness Experts, Pediatricians |

| Distribution Channel Effectiveness | 120 | Logistics Coordinators, Supply Chain Analysts |

The Global Baby Toiletries Market is valued at approximately USD 113.33 billion, with diapers being the largest product category. The market is experiencing growth due to premiumization trends in wipes and skin care segments, driven by innovation and sustainability features.