Region:Global

Author(s):Dev

Product Code:KRAA9481

Pages:86

Published On:November 2025

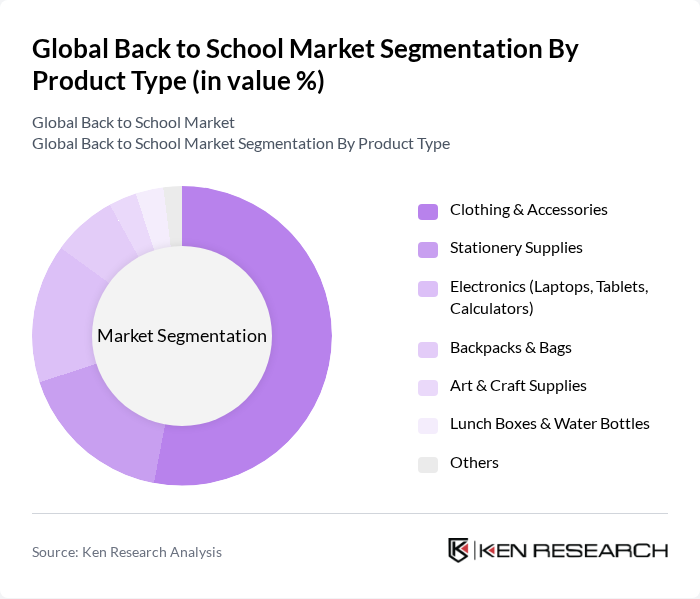

By Product Type:The product type segmentation includes various categories such as Clothing & Accessories, Stationery Supplies, Electronics (Laptops, Tablets, Calculators), Backpacks & Bags, Art & Craft Supplies, Lunch Boxes & Water Bottles, and Others. Among these, Clothing & Accessories currently hold the largest market share, reflecting the essential nature of uniforms and apparel in educational settings. Stationery Supplies and Electronics are also significant segments, with the latter experiencing the fastest growth due to the proliferation of e-learning and the need for reliable digital devices. Consumers increasingly favor quality and branded products, and the rise of hybrid learning has further boosted demand for laptops and tablets .

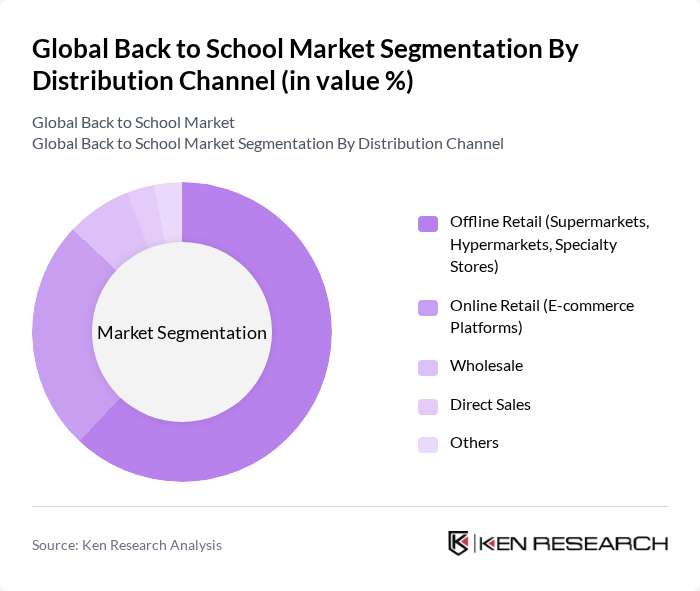

By Distribution Channel:The distribution channel segmentation encompasses Offline Retail (Supermarkets, Hypermarkets, Specialty Stores), Online Retail (E-commerce Platforms), Wholesale, Direct Sales, and Others. Offline Retail remains the dominant channel, benefiting from immediate product access and established consumer habits. However, Online Retail has seen significant growth, driven by the convenience of shopping from home, exclusive online promotions, and the increasing penetration of e-commerce platforms. The shift in consumer behavior toward digital channels is expected to continue, although traditional retail still plays a crucial role .

The Global Back to School Market is characterized by a dynamic mix of regional and international players. Leading participants such as Staples Inc., Office Depot, Inc., Walmart Inc., Target Corporation, Amazon.com, Inc., Best Buy Co., Inc., Costco Wholesale Corporation, BIC Group, Crayola LLC, MeadWestvaco Corporation (now part of WestRock Company), 3M Company, Faber-Castell AG, Papeteries de Genval, S&S Worldwide, Inc., Elmer's Products, Inc., Kmart Corporation, TJ Maxx (The TJX Companies, Inc.), Dixon Ticonderoga Company, ACCO Brands Corporation, Pentel Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the back-to-school market appears promising, driven by technological advancements and evolving consumer preferences. As digital learning tools become more integrated into educational curricula, demand for innovative products will likely increase. Additionally, the trend towards personalization in school supplies is expected to gain traction, allowing brands to cater to individual student needs. Companies that adapt to these trends and invest in sustainable practices will be well-positioned to thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Clothing & Accessories Stationery Supplies Electronics (Laptops, Tablets, Calculators) Backpacks & Bags Art & Craft Supplies Lunch Boxes & Water Bottles Others |

| By Distribution Channel | Offline Retail (Supermarkets, Hypermarkets, Specialty Stores) Online Retail (E-commerce Platforms) Wholesale Direct Sales Others |

| By Consumer Demographics | Age Group (Children, Teens, College Students) Income Level (Low, Middle, High) Geographic Location (Urban, Rural) Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Focused Customers Others |

| By Seasonal Demand | Pre-Back to School Season Mid-Year Purchases Post-Season Sales Others |

| By Product Quality | Premium Products Mid-Range Products Budget Products Others |

| By Eco-Friendliness | Sustainable Products Conventional Products Others |

| By Region | North America (US, Canada) Europe (Germany, France, UK, Spain, Italy, Rest of Europe) Asia Pacific (China, Japan, South Korea, India, Australia, Rest of APAC) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Parent Spending Habits | 120 | Parents of school-aged children |

| School Supply Retailers | 60 | Store Managers, Retail Buyers |

| Educational Institutions | 50 | School Administrators, Purchasing Officers |

| Student Preferences | 80 | High School and College Students |

| Market Trends Analysis | 40 | Market Analysts, Industry Experts |

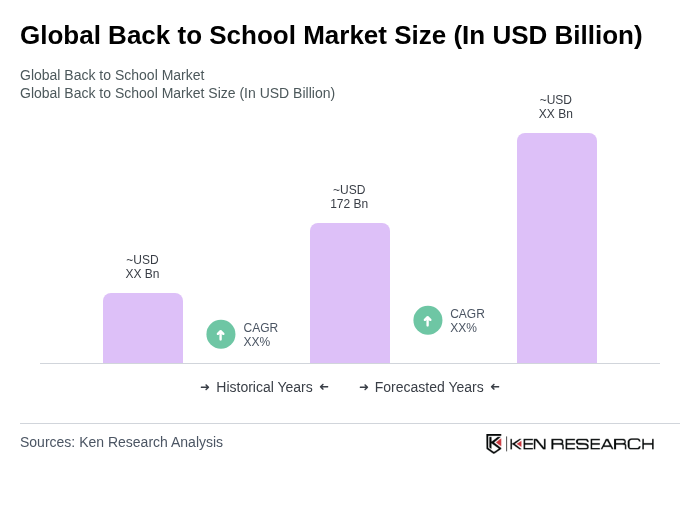

The Global Back to School Market is valued at approximately USD 172 billion, reflecting a significant growth driven by increasing enrollment rates, rising disposable incomes, and the normalization of blended learning models.