Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0034

Pages:93

Published On:August 2025

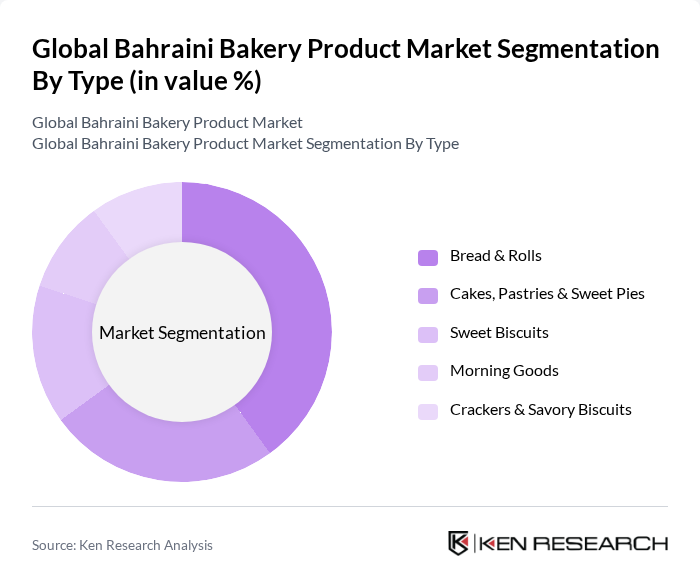

By Type:The bakery product market can be segmented into various types, including Bread & Rolls, Cakes, Pastries & Sweet Pies, Sweet Biscuits, Morning Goods, and Crackers & Savory Biscuits. Among these, Bread & Rolls dominate the market due to their staple status in daily diets and their versatility in meal preparation. The increasing trend of artisanal bread and health-focused options, such as whole grain and gluten-free varieties, further drives this segment's growth .

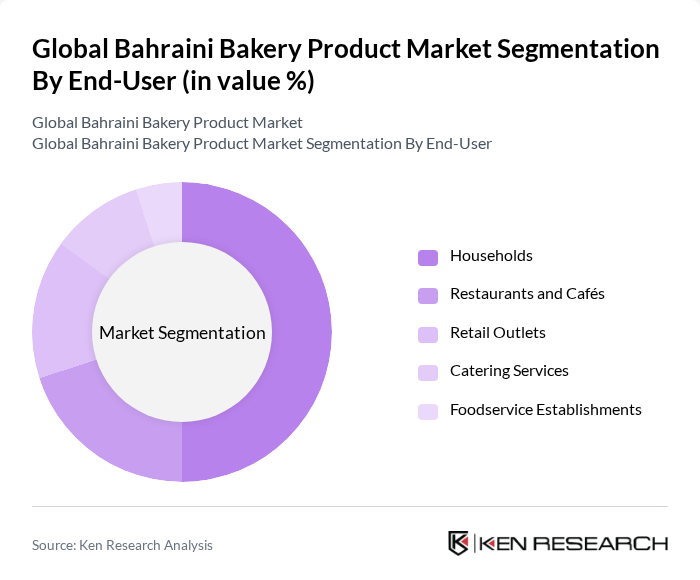

By End-User:The end-user segmentation includes Households, Restaurants and Cafés, Retail Outlets, Catering Services, and Foodservice Establishments. Households represent the largest segment, driven by the increasing trend of home cooking and baking, especially during festive seasons. The convenience of ready-to-eat bakery products also appeals to busy families, further solidifying this segment's dominance .

The Global Bahraini Bakery Product Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ahlia Bakery, Bahrain Bakery, Al Mufeed Bakery, Al Jazeera Bakery, Al Makan Bakery, Al Mufeed Sweets, Al Mahrusa Bakery, Al Qudra Bakery, Al Noor Bakery, Al Fawzi Bakery, Al Razi Bakery, Al Hekma Bakery, Al Saffar Bakery, Al Ameen Bakery, Al Ahlam Bakery, Al Abraaj Bakeries, Zainal Bakery, Al Manar Bakery contribute to innovation, geographic expansion, and service delivery in this space.

The Bahraini bakery market is poised for dynamic growth, driven by evolving consumer preferences and technological advancements. The increasing integration of digital platforms for sales and marketing will enhance customer engagement and streamline operations. Additionally, the focus on health and sustainability will likely lead to innovative product offerings, catering to the growing demand for organic and gluten-free options. As the market adapts to these trends, it is expected to attract new investments and foster collaborations within the food service industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Bread & Rolls Cakes, Pastries & Sweet Pies Sweet Biscuits Morning Goods Crackers & Savory Biscuits |

| By End-User | Households Restaurants and Cafés Retail Outlets Catering Services Foodservice Establishments |

| By Distribution Channel | Hypermarkets/Supermarkets Specialist Stores Convenience/Grocery Stores Online Stores Other Distribution Channels |

| By Packaging Type | Plastic Packaging Paper Packaging Glass Packaging Metal Packaging Others |

| By Flavor | Sweet Savory Spicy Others |

| By Occasion | Festivals and Celebrations Daily Consumption Special Events Others |

| By Price Range | Premium Mid-Range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bakery Outlets | 60 | Bakery Owners, Store Managers |

| Consumer Preferences Survey | 120 | Regular Bakery Customers, Food Enthusiasts |

| Food Service Sector Insights | 50 | Restaurant Managers, Catering Service Providers |

| Health-Conscious Bakery Products | 40 | Nutritionists, Health Food Advocates |

| Bakery Supply Chain Analysis | 45 | Suppliers, Distributors, Logistics Managers |

The Global Bahraini Bakery Product Market is valued at approximately USD 620 million, reflecting a significant growth trend driven by consumer demand for convenience foods and healthier eating options.