Region:Global

Author(s):Dev

Product Code:KRAC0466

Pages:84

Published On:August 2025

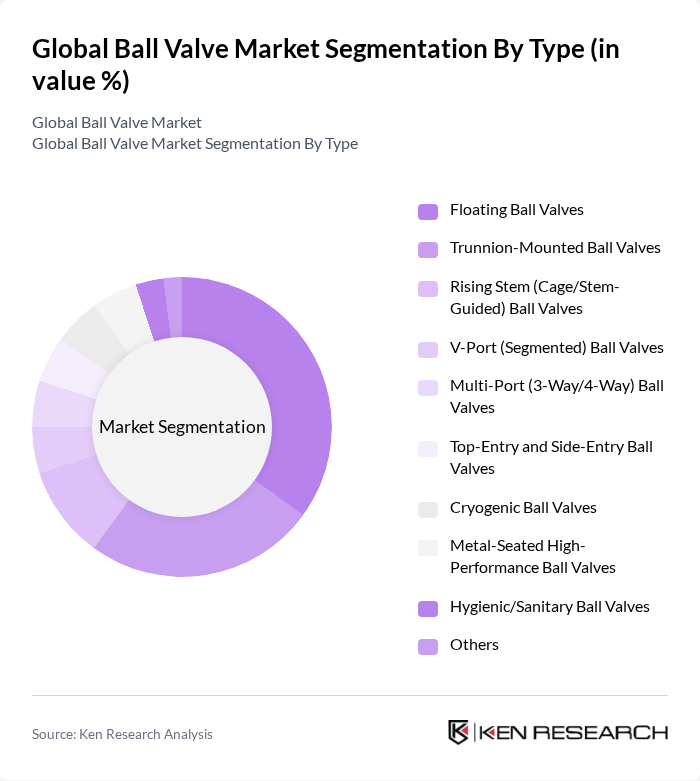

By Type:The ball valve market is segmented into various types, including Floating Ball Valves, Trunnion-Mounted Ball Valves, Rising Stem (Cage/Stem-Guided) Ball Valves, V-Port (Segmented) Ball Valves, Multi-Port (3-Way/4-Way) Ball Valves, Top-Entry and Side-Entry Ball Valves, Cryogenic Ball Valves, Metal-Seated High-Performance Ball Valves, Hygienic/Sanitary Ball Valves, and Others. Among these, Floating Ball Valves are widely used for general on/off duties due to simplicity and cost-effectiveness, while Trunnion-Mounted Ball Valves address higher-pressure and larger-bore applications with improved sealing; cryogenic and metal-seated variants are gaining traction in LNG, hydrogen, and severe service owing to temperature extremes and fugitive-emissions performance.

By End-User:The ball valve market is segmented by end-user industries, including Oil & Gas (Upstream, Midstream, Downstream), Water & Wastewater Utilities, Power Generation (Thermal, Nuclear, Renewables Balance-of-Plant), Chemical & Petrochemical, Pharmaceuticals & Food Processing, Pulp & Paper, HVAC & Building Services, Mining & Metals, and Others. The Oil & Gas sector is the largest consumer of ball valves, driven by the need for efficient flow control in exploration, production, and transportation processes. The Water & Wastewater Utilities sector is also significant, as municipalities increasingly invest in infrastructure upgrades to ensure safe and reliable water supply systems.

The Global Ball Valve Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emerson Electric Co. (Fisher, Vanessa, KTM), Flowserve Corporation (Durco, Valbart), Valmet Corporation (incl. Neles heritage), KITZ Corporation, Crane Company (Crane ChemPharma & Energy), Honeywell International Inc. (Honeywell Process Solutions), Pentair plc, Parker Hannifin Corporation (Veriflo), AVK Holding A/S, Georg Fischer AG (GF Piping Systems), Swagelok Company, SAMSON AG (Cera?System, Starline), Bray International, Inc., Velan Inc., IMI plc (IMI Critical Engineering), Valcor Engineering Corporation, Bonney Forge Corporation, Neway Valve (Suzhou) Co., Ltd., Zhejiang Sanhua Intelligent Controls Co., Ltd. (Sanhua), Zhejiang SUPCON Technology Co., Ltd. (SUPCON Valves) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ball valve market appears promising, driven by technological advancements and increasing automation in industrial processes. The integration of IoT technologies is expected to enhance monitoring and control capabilities, leading to improved efficiency and reduced operational costs. Additionally, the growing emphasis on sustainability will likely push manufacturers to innovate eco-friendly valve solutions, aligning with global energy efficiency goals and regulatory standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Floating Ball Valves Trunnion-Mounted Ball Valves Rising Stem (Cage/Stem-Guided) Ball Valves V-Port (Segmented) Ball Valves Multi-Port (3-Way/4-Way) Ball Valves Top-Entry and Side-Entry Ball Valves Cryogenic Ball Valves Metal-Seated High-Performance Ball Valves Hygienic/Sanitary Ball Valves Others |

| By End-User | Oil & Gas (Upstream, Midstream, Downstream) Water & Wastewater Utilities Power Generation (Thermal, Nuclear, Renewables Balance-of-Plant) Chemical & Petrochemical Pharmaceuticals & Food Processing Pulp & Paper HVAC & Building Services Mining & Metals Others |

| By Application | On/Off Isolation Control/Throttling Emergency Shut Down (ESD) & Safety Instrumented Systems Cryogenic/LNG Service Abrasive/High-Temperature Service Others |

| By Material | Stainless Steel (304/316 and Duplex/Super Duplex) Carbon Steel & Low-Temperature Carbon Steel Alloy & Exotic Metals (Inconel, Hastelloy, Titanium) Bronze/Brass Thermoplastics (PVC, CPVC, PVDF, PP) Lined (PTFE/PFA) and Coated Others |

| By Size | Small (up to 2 inches) Medium (2 to 6 inches) Large (over 6 inches) Extra-Large (? 24 inches) |

| By Actuation | Manual Electric Actuated Pneumatic Actuated Hydraulic Actuated Electro?Pneumatic (Smart Positioners) |

| By Sales Channel | Direct (Projects/EPCs & Key Accounts) Distributors/Channel Partners Online & E-Procurement OEM/Skid Builder Integration Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector | 120 | Procurement Managers, Operations Directors |

| Water Treatment Facilities | 90 | Plant Managers, Environmental Engineers |

| Power Generation Plants | 80 | Maintenance Supervisors, Project Engineers |

| Manufacturing Industries | 70 | Production Managers, Quality Control Officers |

| Construction Projects | 60 | Site Managers, Procurement Officers |

The Global Ball Valve Market is valued at approximately USD 13.8 billion, reflecting a significant growth trend driven by the increasing demand for efficient fluid control systems across various industries, including oil and gas, water and wastewater, and chemicals.