Region:Global

Author(s):Dev

Product Code:KRAB0630

Pages:97

Published On:August 2025

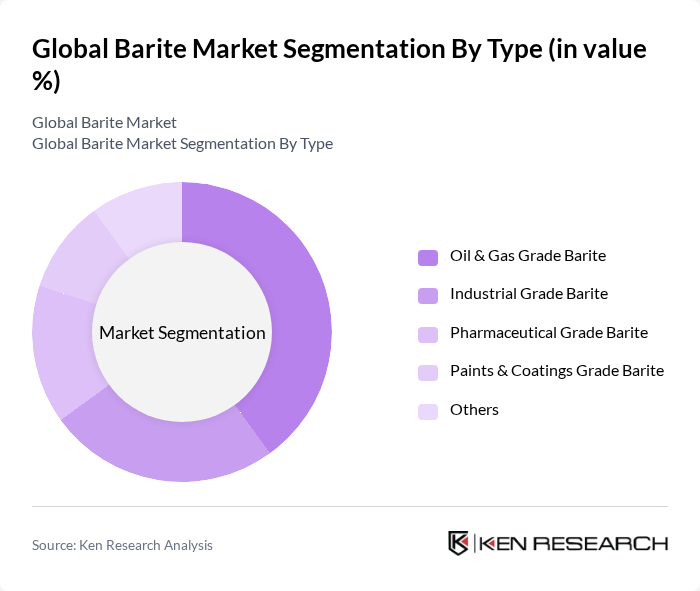

By Type:The market is segmented into Oil & Gas Grade Barite, Industrial Grade Barite, Pharmaceutical Grade Barite, Paints & Coatings Grade Barite, and Others. Oil & Gas Grade Barite is primarily used as a weighting agent in drilling fluids to control well pressure and prevent blowouts. Industrial Grade Barite is utilized in manufacturing, glass, and ceramics for its high density and chemical inertness. Pharmaceutical Grade Barite is used as a filler in medications and radiology, while Paints & Coatings Grade Barite enhances opacity and brightness in pigments. The 'Others' segment includes applications in rubber, plastics, and radiation shielding .

The Oil & Gas Grade Barite segment dominates the market due to its essential role in drilling operations, where it is used to control pressure and maintain wellbore stability. The ongoing expansion of oil and gas exploration, especially in North America and the Middle East, continues to drive demand for this grade. Industrial Grade Barite is also experiencing growth, supported by increased use in manufacturing, construction, and chemical industries, though it remains secondary to the oil and gas segment .

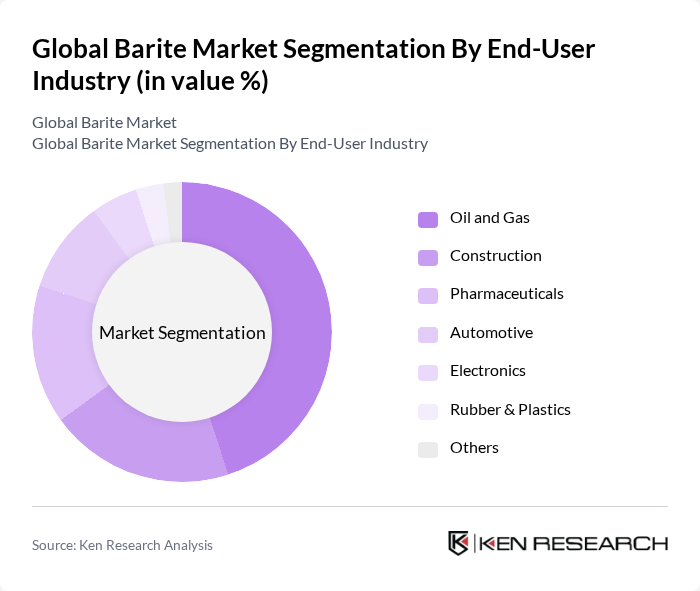

By End-User Industry:The market is segmented by end-user industries, including Oil and Gas, Construction, Pharmaceuticals, Automotive, Electronics, Rubber & Plastics, and Others. Oil and Gas utilizes barite primarily in drilling fluids. Construction uses barite in cement and concrete for its density and chemical stability. Pharmaceuticals employ barite as a filler and in radiology. Automotive and Electronics sectors use barite for its insulating and density properties, while Rubber & Plastics benefit from its role as a filler and pigment extender .

The Oil and Gas industry remains the dominant end-user, accounting for the largest share of barite consumption due to its indispensable function in drilling fluids. Construction follows, driven by infrastructure development and the need for high-density materials in cement and concrete. Pharmaceuticals, Automotive, and Electronics sectors also contribute to demand, leveraging barite's inertness, density, and radiopacity .

The Global Barite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Halliburton, Schlumberger Limited, Baker Hughes Company, BariteWorld, Milwhite, Inc., The Schaefer Group, Andhra Pradesh Mineral Development Corporation (APMDC), Excalibar Minerals LLC, International Earth Products LLC, Anglo Pacific Group PLC, Barium & Chemicals, Inc., Redstar Enterprises Limited, China Shenhua Energy Company Limited, KMC Group, and TMC Barite Mining & Processing contribute to innovation, geographic expansion, and service delivery in this space.

The future of the barite market appears promising, driven by technological advancements in extraction methods and a growing emphasis on sustainable practices. As industries increasingly adopt eco-friendly mining techniques, the demand for high-quality barite is expected to rise. Additionally, the expansion into emerging markets, particularly in Asia and Africa, will create new opportunities for growth. Companies that invest in innovation and strategic partnerships will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Oil & Gas Grade Barite Industrial Grade Barite Pharmaceutical Grade Barite Paints & Coatings Grade Barite Others |

| By End-User Industry | Oil and Gas Construction Pharmaceuticals Automotive Electronics Rubber & Plastics Others |

| By Application | Drilling Fluids Paints and Coatings Rubber Manufacturing Plastics Filler Medical Devices Electronics Components Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Quality | High Purity Barite Standard Barite Low Purity Barite |

| By Price Range | Low Price Range Medium Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Industry | 100 | Drilling Engineers, Procurement Managers |

| Construction Sector | 80 | Project Managers, Material Suppliers |

| Pharmaceutical Applications | 60 | Quality Control Managers, R&D Scientists |

| Industrial Minerals Market | 50 | Market Analysts, Product Managers |

| Environmental Impact Studies | 40 | Environmental Consultants, Regulatory Affairs Specialists |

The Global Barite Market is valued at approximately USD 1.6 billion, driven by increasing demand for barite in various applications, particularly as a weighting agent in drilling fluids for oil and gas exploration.