Region:Global

Author(s):Dev

Product Code:KRAB0422

Pages:92

Published On:August 2025

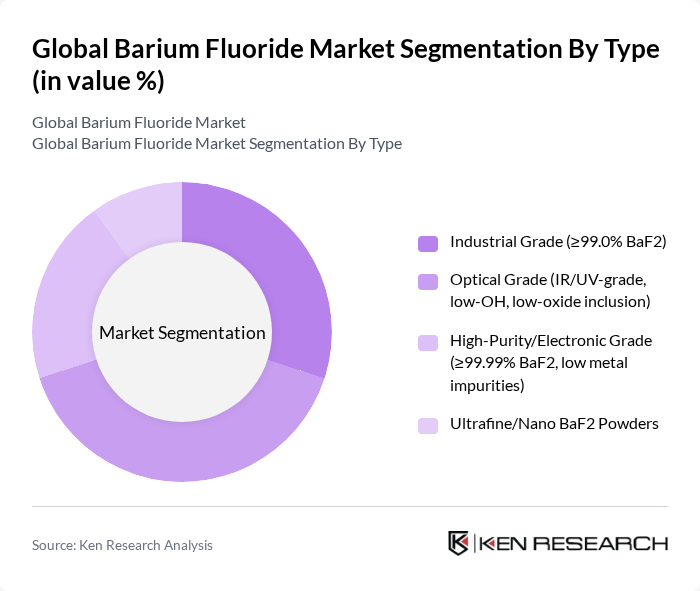

By Type:

The barium fluoride market is segmented into four main types: Industrial Grade (?99.0% BaF2), Optical Grade (IR/UV-grade, low-OH, low-oxide inclusion), High-Purity/Electronic Grade (?99.99% BaF2, low metal impurities), and Ultrafine/Nano BaF2 Powders. Among these, the Optical Grade segment is currently leading the market due to its extensive use in optical components such as lenses and prisms for IR and UV transmission, and for scintillation detection in security and nuclear applications . The demand for high-quality optical materials in telecommunications, aerospace and defense, and scientific instrumentation drives this segment's growth . The Industrial Grade segment also holds a significant share, primarily used in aluminum metallurgy as a flux and in welding consumables and frits .

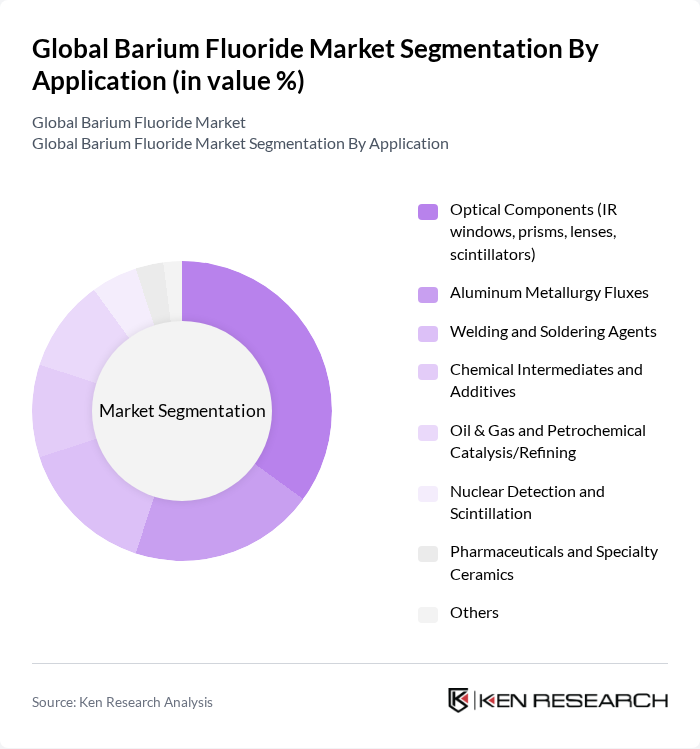

By Application:

The applications of barium fluoride are diverse, including Optical Components (IR windows, prisms, lenses, scintillators), Aluminum Metallurgy Fluxes, Welding and Soldering Agents, Chemical Intermediates and Additives, Oil & Gas and Petrochemical Catalysis/Refining, Nuclear Detection and Scintillation, Pharmaceuticals and Specialty Ceramics, and Others. The Optical Components segment is the most dominant, driven by the increasing demand for high-performance optical materials across infrared imaging, spectroscopy, laser systems, and radiation detection . The Oil & Gas and petrochemical sector also contributes through usage in refining and catalytic environments, while aluminum metallurgy remains a core end-use due to BaF2’s role as a flux and process aid .

The Global Barium Fluoride Market is characterized by a dynamic mix of regional and international players. Leading participants such as Solvay S.A., American Elements, Barium & Chemicals, Inc., Alfa Aesar (part of Thermo Fisher Scientific), Thermo Fisher Scientific Inc., Merck KGaA (including Sigma-Aldrich), Strem Chemicals, Inc. (a part of Ascensus Specialties), Tokyo Chemical Industry Co., Ltd. (TCI), GFS Chemicals, Inc., Materion Corporation, Jiangxi Tianxin Chemical Co., Ltd., Hubei Xinyuan Chemical Co., Ltd., Hunan Nonferrous Barium Technology Co., Ltd., Yunnan Fluorine Industry Group Co., Ltd., Sinochem Lantian Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the barium fluoride market appears promising, driven by technological advancements and increasing applications across various industries. As manufacturers adopt sustainable production practices, the market is likely to witness a shift towards eco-friendly alternatives. Additionally, the growing demand for high-purity barium fluoride in specialized applications, such as medical imaging and laser technology, will further enhance market dynamics, creating new avenues for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Industrial Grade (?99.0% BaF2) Optical Grade (IR/UV-grade, low-OH, low-oxide inclusion) High-Purity/Electronic Grade (?99.99% BaF2, low metal impurities) Ultrafine/Nano BaF2 Powders |

| By Application | Optical Components (IR windows, prisms, lenses, scintillators) Aluminum Metallurgy Fluxes Welding and Soldering Agents Chemical Intermediates and Additives Oil & Gas and Petrochemical Catalysis/Refining Nuclear Detection and Scintillation Pharmaceuticals and Specialty Ceramics Others |

| By End-User | Optical and Photonics Manufacturers Aluminum and Metallurgical Industries Electronics and Semiconductor Oil & Gas / Refining Defense & Aerospace Healthcare & Medical Imaging Others |

| By Distribution Channel | Direct Sales (Manufacturers to OEMs) Distributors/Channel Partners Online/Direct-to-Lab Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Commodity Grade Pricing (Industrial) Specialty Grade Pricing (Optical) Ultra-High-Purity Pricing (Electronic/Research) |

| By Packaging Type | Bulk Packaging (drums, supersacks) Small Packaging (bottles, jars for labs) Vacuum/Desiccant Packaging (moisture-protected) Custom Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Optical Glass Manufacturers | 100 | Production Managers, Quality Control Supervisors |

| Pharmaceutical Companies | 80 | Research Scientists, Regulatory Affairs Managers |

| Electronics Component Producers | 90 | Product Development Engineers, Supply Chain Managers |

| Academic Research Institutions | 70 | Research Professors, Laboratory Technicians |

| Industrial Chemical Suppliers | 60 | Sales Directors, Market Analysts |

The Global Barium Fluoride Market is valued at approximately USD 360 million, based on a five-year historical analysis. This valuation reflects the increasing demand for optical components and advancements in the electronics sector.