Region:Global

Author(s):Shubham

Product Code:KRAA1757

Pages:97

Published On:August 2025

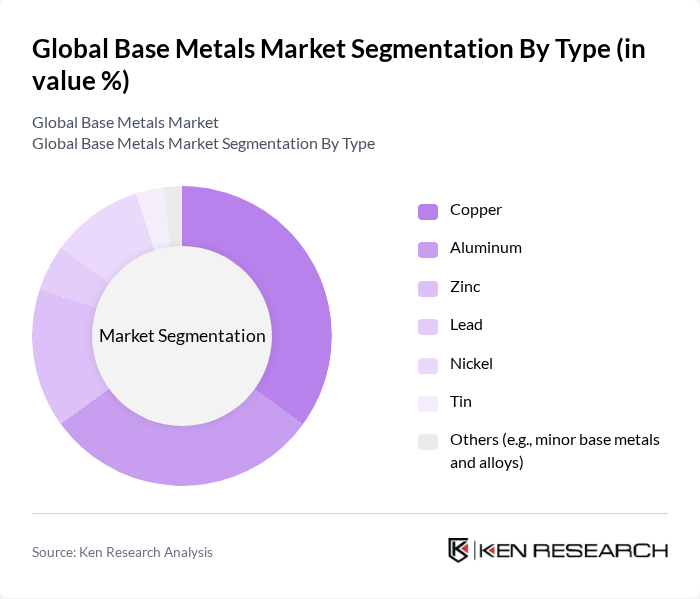

By Type:The base metals market is segmented into copper, aluminum, zinc, lead, nickel, tin, and others. Copper and aluminum are widely used: copper in power grids, electrical wiring, renewables, and electronics; aluminum in transportation and construction, favored for lightweighting in automotive and aerospace. Copper has led revenue share in recent industry analyses, while aluminum is the most consumed metal by volume across many use cases .

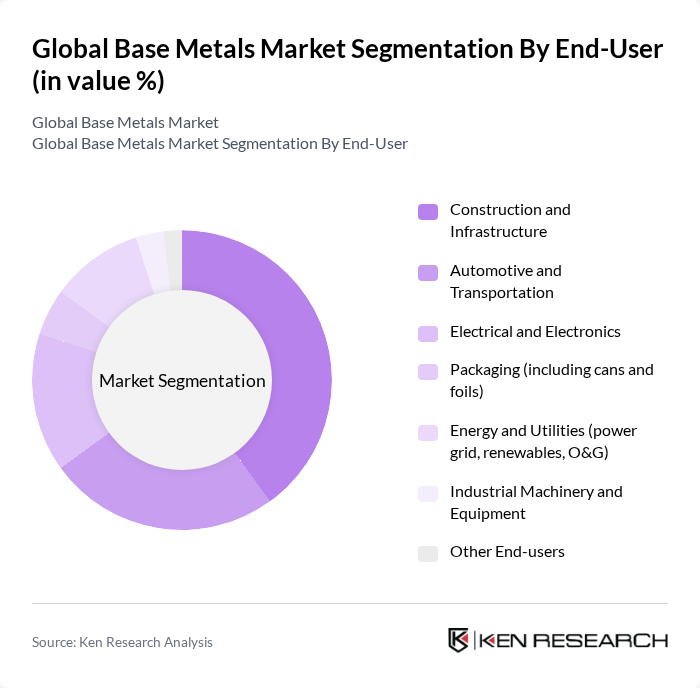

By End-User:End-user segments include construction and infrastructure, automotive and transportation, electrical and electronics, packaging, energy and utilities, industrial machinery and equipment, and other end-users. Construction and infrastructure remain the largest consumers given ongoing urbanization and public works. Automotive and transportation are significant, with electric vehicles increasing intensity of copper (in motors and wiring) and greater aluminum usage for lightweighting; grid expansion and renewables further lift electrical and energy-sector demand for base metals .

The Global Base Metals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BHP Group, Rio Tinto, Glencore, Vale S.A., Freeport-McMoRan Inc., Southern Copper Corporation, Antofagasta plc, Teck Resources Limited, First Quantum Minerals Ltd., Hindalco Industries Limited, Norsk Hydro ASA, ArcelorMittal, CMOC Group Limited (formerly China Molybdenum Co., Ltd.), Nornickel (MMC Norilsk Nickel PJSC), Sumitomo Metal Mining Co., Ltd., Aluminum Corporation of China Limited (Chalco), Rusal (United Company RUSAL), KAZ Minerals, Codelco (Corporación Nacional del Cobre de Chile), South32 Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the base metals market in None appears promising, driven by increasing demand from key sectors such as construction and electric vehicles. As technological advancements continue to enhance production efficiency, companies are likely to invest in innovative processes. Additionally, the push for sustainable practices will drive investments in recycling and alternative materials, creating a dynamic landscape. Overall, the market is expected to adapt to challenges while capitalizing on emerging opportunities, ensuring robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Copper Aluminum Zinc Lead Nickel Tin Others (e.g., minor base metals and alloys) |

| By End-User | Construction and Infrastructure Automotive and Transportation Electrical and Electronics Packaging (including cans and foils) Energy and Utilities (power grid, renewables, O&G) Industrial Machinery and Equipment Other End-users |

| By Application | Electrical Conductors and Wiring Plumbing and HVAC Structural and Fabricated Components Sheet, Extrusions, and Rolled Products Casting and Foundry Batteries and Energy Storage Others |

| By Distribution Channel | Direct Contracts/Off-take Agreements Distributors/Metal Service Centers Exchanges and Brokers (e.g., LME/COMEX-linked) Online B2B Platforms Retail/Spot Purchases |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Source | Primary (Mining) Secondary (Recycled) |

| By Quality Grade | LME-Grade/Exchange Deliverable High-Purity/Refined Industrial/Foundry Grades |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Copper Market Insights | 100 | Procurement Managers, Industry Analysts |

| Aluminum Production Trends | 80 | Operations Directors, Supply Chain Managers |

| Zinc Demand Forecasting | 70 | Market Researchers, Product Managers |

| Steel Industry Applications | 90 | Manufacturing Executives, Quality Control Managers |

| Recycling and Sustainability Practices | 60 | Sustainability Officers, Environmental Compliance Managers |

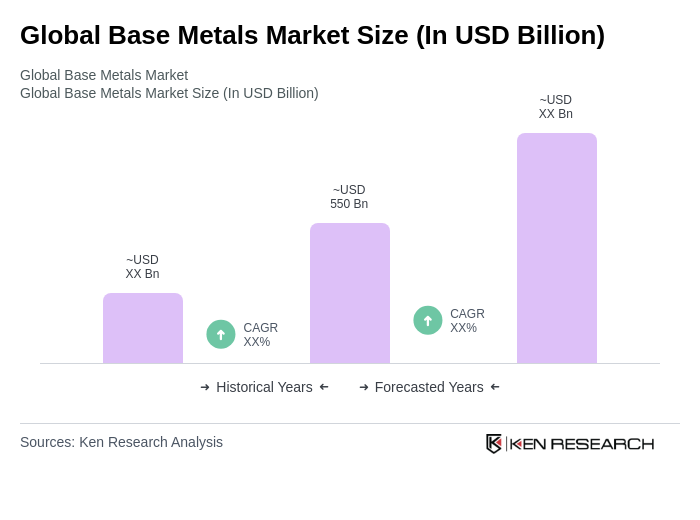

The Global Base Metals Market is valued at approximately USD 550 billion, driven by demand in sectors such as construction, automotive, electrical and electronics, and energy transition applications. This valuation is based on a five-year historical analysis.