Region:Global

Author(s):Geetanshi

Product Code:KRAB0161

Pages:81

Published On:August 2025

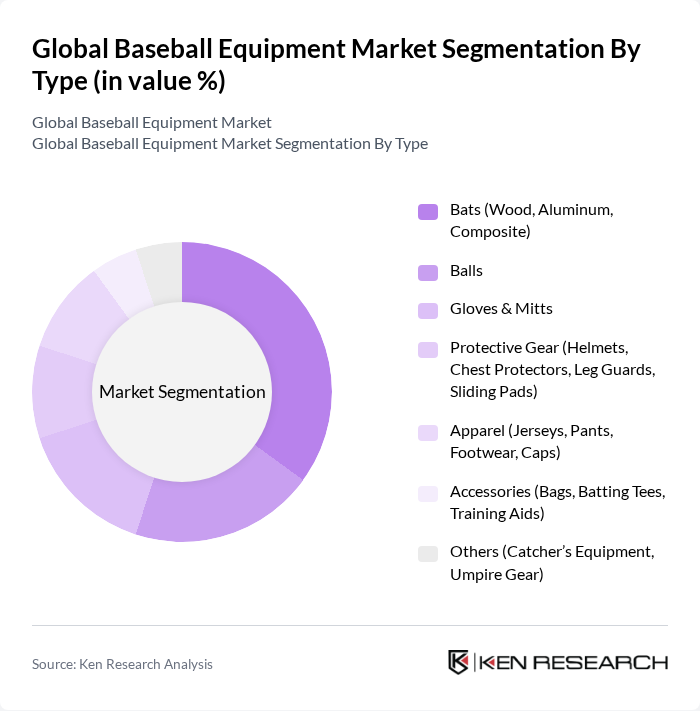

By Type:The market is segmented into various types of equipment, including bats, balls, gloves & mitts, protective gear, apparel, accessories, and others. Each sub-segment caters to different needs and preferences of players, from professional athletes to casual participants. The bats segment, in particular, has seen significant innovation, with advancements in materials such as composite and hybrid designs, and ergonomic improvements enhancing both performance and safety. Protective gear and apparel segments are also experiencing growth due to increased emphasis on player safety and comfort, driven by regulatory standards and consumer demand.

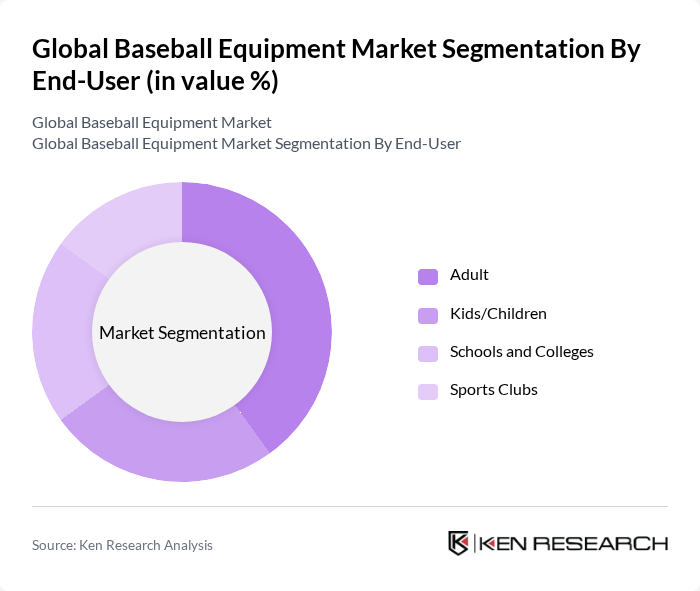

By End-User:The end-user segmentation includes adults, kids/children, schools and colleges, and sports clubs. Each segment has unique requirements and purchasing behaviors, with schools and colleges often purchasing in bulk for teams, while adults may seek high-performance gear for personal use. The kids/children segment is particularly driven by parental purchases for youth leagues. The adult segment continues to hold the largest share, supported by recreational and professional participation, while youth participation is rising due to grassroots programs and increased awareness of health and fitness.

The Global Baseball Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rawlings Sporting Goods Company, Inc., Wilson Sporting Goods Co., Easton Diamond Sports, LLC, Mizuno Corporation, Louisville Slugger (Hillerich & Bradsby Co.), Under Armour, Inc., Nike, Inc., Adidas AG, Franklin Sports, Inc., Marucci Sports, LLC, Schutt Sports, DeMarini (a Wilson brand), Worth Sports, Combat Sports, Diamond Sports contribute to innovation, geographic expansion, and service delivery in this space.

The future of the baseball equipment market appears promising, driven by increasing youth participation and technological advancements. As communities invest more in baseball programs, the demand for quality equipment is expected to rise. Additionally, the integration of smart technology in equipment design will likely attract tech-savvy players. However, the market must navigate challenges such as competition from alternative sports and economic fluctuations that may impact consumer spending on sports gear.

| Segment | Sub-Segments |

|---|---|

| By Type | Bats (Wood, Aluminum, Composite) Balls Gloves & Mitts Protective Gear (Helmets, Chest Protectors, Leg Guards, Sliding Pads) Apparel (Jerseys, Pants, Footwear, Caps) Accessories (Bags, Batting Tees, Training Aids) Others (Catcher’s Equipment, Umpire Gear) |

| By End-User | Adult Kids/Children Schools and Colleges Sports Clubs |

| By Sales Channel | Online Retail Stores Specialty Sports Stores Department Stores / Supermarkets & Hypermarkets Direct Sales |

| By Distribution Mode | Wholesale Distribution Retail Distribution E-commerce Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Youth Baseball Equipment Purchases | 100 | Parents, Coaches, Youth League Administrators |

| Professional Baseball Gear Insights | 60 | Professional Players, Team Managers, Equipment Managers |

| Retail Market Trends | 50 | Sports Retailers, Store Managers, Sales Representatives |

| Consumer Preferences in Baseball Equipment | 80 | Amateur Players, Coaches, Sports Enthusiasts |

| Market Entry Strategies for New Brands | 40 | Brand Managers, Marketing Directors, Product Developers |

The Global Baseball Equipment Market is valued at approximately USD 16.5 billion, reflecting a significant growth trend driven by increased participation in baseball across various demographics and advancements in equipment technology.