Region:Global

Author(s):Rebecca

Product Code:KRAA1452

Pages:89

Published On:August 2025

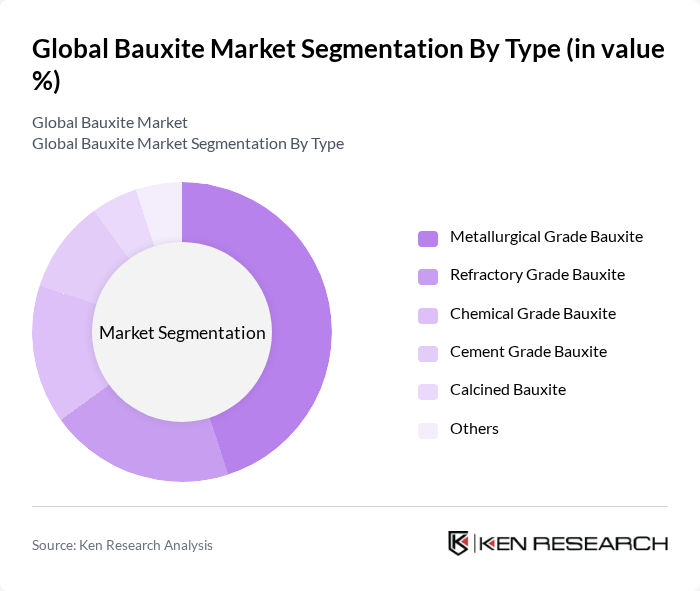

By Type:The bauxite market is segmented into metallurgical grade, refractory grade, chemical grade, cement grade, calcined bauxite, and others. Metallurgical grade bauxite is the most dominant segment due to its essential role in aluminum production. The rising demand for aluminum, driven by its lightweight properties and versatility in applications such as transportation, packaging, and construction, makes metallurgical grade bauxite a critical component in the industry .

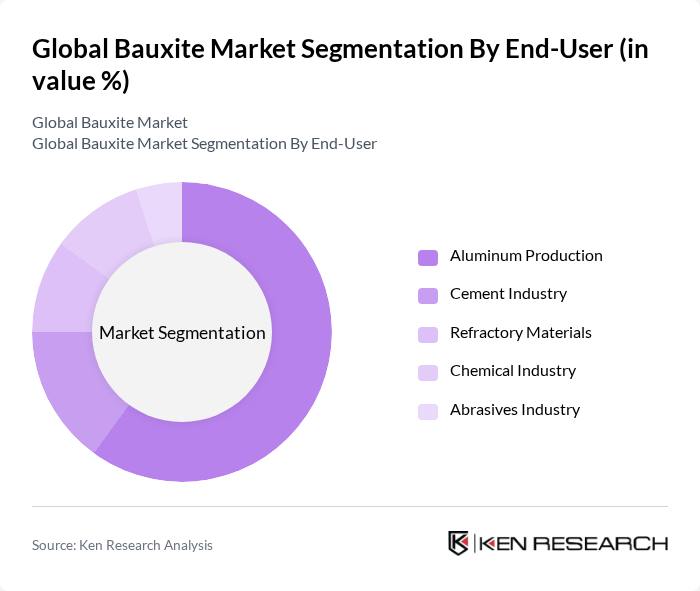

By End-User:The end-user segmentation of the bauxite market includes aluminum production, cement industry, refractory materials, chemical industry, and abrasives industry. The aluminum production segment is the largest consumer of bauxite, as it is the primary raw material for aluminum smelting. Growth in the automotive, aerospace, and packaging sectors—which increasingly utilize aluminum for its lightweight, corrosion-resistant, and high-strength properties—continues to drive demand in this segment .

The Global Bauxite Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcoa Corporation, Rio Tinto Group, Norsk Hydro ASA, Emirates Global Aluminium, China Hongqiao Group Limited, South32 Limited, United Company RUSAL, Compagnie des Bauxites de Guinée, Gencor Limited, Australian Bauxite Limited, Bosai Minerals Group Co., Ltd., AGB2A (Guinea), Jamaica Bauxite Mining Limited, Henan Shenhuo Group Co., Ltd., and Vedanta Resources Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the bauxite market in None appears promising, driven by the increasing demand for aluminum in various sectors, particularly in infrastructure and automotive applications. As technological advancements continue to enhance mining efficiency, the industry is likely to see improved sustainability practices. Additionally, the growing emphasis on recycling and circular economy initiatives will further shape the market landscape, encouraging investments in innovative processing methods and sustainable mining practices, ultimately supporting long-term growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Metallurgical Grade Bauxite Refractory Grade Bauxite Chemical Grade Bauxite Cement Grade Bauxite Calcined Bauxite Others |

| By End-User | Aluminum Production Cement Industry Refractory Materials Chemical Industry Abrasives Industry |

| By Application | Aluminum Smelting Abrasives Cement Production Refractory Applications Water Treatment |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Medium Price High Price |

| By Quality Grade | High-Grade Bauxite Medium-Grade Bauxite Low-Grade Bauxite |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bauxite Mining Operations | 100 | Mining Engineers, Operations Managers |

| Bauxite Processing Facilities | 60 | Plant Managers, Quality Control Supervisors |

| Aluminium Production Companies | 70 | Procurement Managers, Production Managers |

| Environmental Compliance in Mining | 50 | Environmental Officers, Compliance Managers |

| Market Analysts and Consultants | 40 | Industry Analysts, Market Research Specialists |

The Global Bauxite Market is valued at approximately USD 27.5 billion, driven by the increasing demand for aluminum across various industries, including automotive, aerospace, construction, and electronics.