Region:Global

Author(s):Shubham

Product Code:KRAA2244

Pages:82

Published On:August 2025

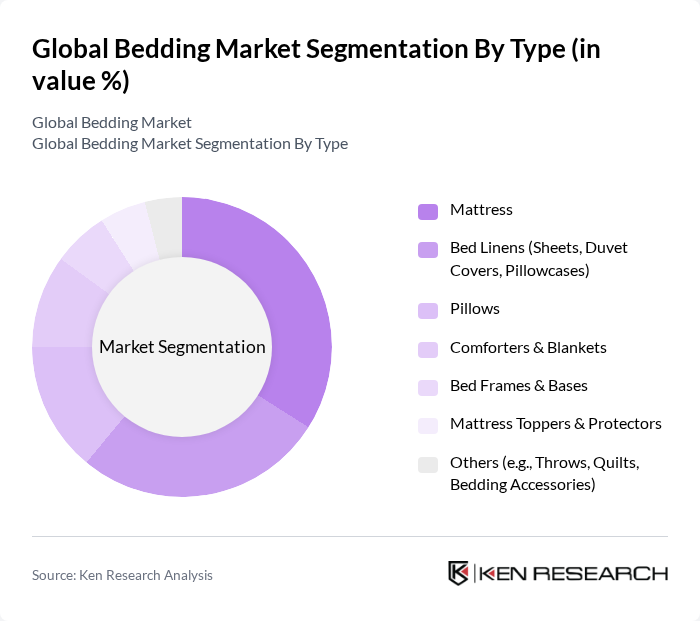

By Type:The bedding market is segmented into various types, including mattresses, bed linens, pillows, comforters & blankets, bed frames & bases, mattress toppers & protectors, and others such as throws and quilts. Among these, mattresses are the leading sub-segment, driven by innovations in materials and technology, such as memory foam, hybrid designs, and smart features that enhance comfort, support, and sleep tracking. The growing trend of online mattress sales and direct-to-consumer brands has also contributed to increased demand for this segment, as consumers seek convenience and customization .

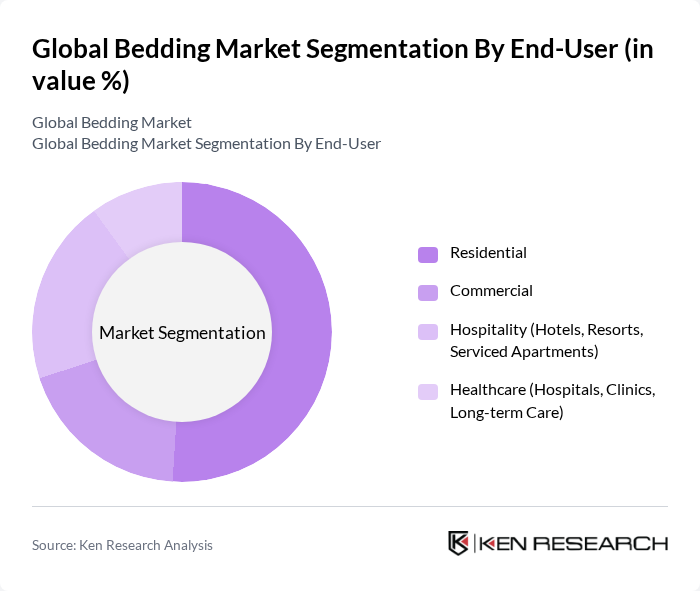

By End-User:The bedding market is categorized into residential, commercial, hospitality, and healthcare segments. The residential segment dominates the market, driven by the increasing number of households, rising urbanization, and the growing trend of home improvement and wellness-focused lifestyles. Consumers are investing more in quality bedding products to enhance their sleep experience, with a notable shift toward sustainable and premium offerings. The hospitality sector also contributes significantly, as hotels and resorts upgrade bedding to attract guests seeking luxury and comfort .

The Global Bedding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., Sleep Number Corporation, Serta Simmons Bedding, LLC, IKEA, Purple Innovation, Inc., Leggett & Platt, Incorporated, Saatva, Inc., Stearns & Foster (A Tempur Sealy Brand), Tempur-Pedic (A Tempur Sealy Brand), Zinus, Inc., Tuft & Needle (A Serta Simmons Brand), Avocado Green Brands, Inc., Nest Bedding, Inc., My Green Mattress (Quality Sleep Shop, Inc.), DreamCloud (Resident Home Inc.), Luolai Lifestyle Technology Co., Ltd., Frette S.r.l., Sferra Fine Linens, LLC, Flex Bedding Group (E.S. Kluft & Co.), Shanghai Shuixing Home Textile Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bedding market appears promising, driven by technological advancements and evolving consumer preferences. As smart bedding solutions gain traction, manufacturers are likely to invest in innovative products that enhance sleep quality. Additionally, the rise of e-commerce platforms will facilitate greater accessibility to a wider range of bedding options, catering to diverse consumer needs. Sustainability will also play a crucial role, with brands increasingly focusing on eco-friendly materials and practices to attract environmentally conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Mattress Bed Linens (Sheets, Duvet Covers, Pillowcases) Pillows Comforters & Blankets Bed Frames & Bases Mattress Toppers & Protectors Others (e.g., Throws, Quilts, Bedding Accessories) |

| By End-User | Residential Commercial Hospitality (Hotels, Resorts, Serviced Apartments) Healthcare (Hospitals, Clinics, Long-term Care) |

| By Distribution Channel | Online Retail (E-commerce Platforms, Brand Websites) Offline Retail (Supermarkets/Hypermarkets, Specialty Stores) Direct Sales Wholesale/Distributors |

| By Material | Cotton Polyester & Microfiber Memory Foam Latex Silk, Bamboo, and Other Natural Fibers Others (Blends, Synthetic Fillings) |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Brand | Established Global Brands Emerging/Regional Brands Private Labels/Store Brands |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, Australia, South Korea, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East & Africa (UAE, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bedding Sales | 100 | Store Managers, Sales Representatives |

| Consumer Preferences in Bedding | 120 | Homeowners, Renters |

| Online Bedding Purchases | 80 | E-commerce Managers, Digital Marketing Specialists |

| Luxury Bedding Market Insights | 60 | Interior Designers, High-End Retail Buyers |

| Eco-Friendly Bedding Trends | 50 | Sustainability Advocates, Product Development Managers |

The Global Bedding Market is valued at approximately USD 95 billion, driven by increasing consumer awareness of sleep health, rising disposable incomes, and a growing interest in home decor and interior design.