Region:Global

Author(s):Rebecca

Product Code:KRAA2431

Pages:91

Published On:August 2025

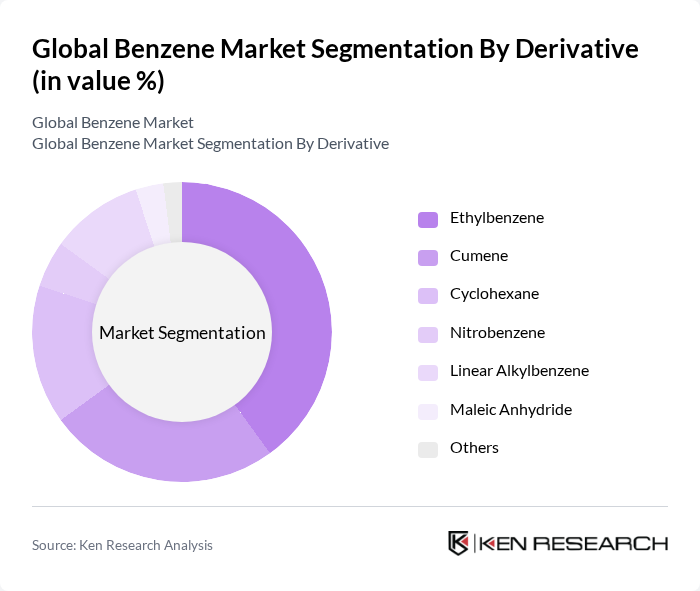

By Derivative:The benzene market can be segmented based on its derivatives, which include Ethylbenzene, Cumene, Cyclohexane, Nitrobenzene, Linear Alkylbenzene, Maleic Anhydride, and Others. Ethylbenzene is the leading derivative, primarily due to its extensive use in the production of styrene, a key component in plastics, packaging, and synthetic rubber. Cumene is also significant, as it is primarily used in the production of phenol and acetone, which are vital for resins, adhesives, and various industrial applications. The growing demand for lightweight materials and advanced polymers in automotive and construction sectors further supports the dominance of these derivatives .

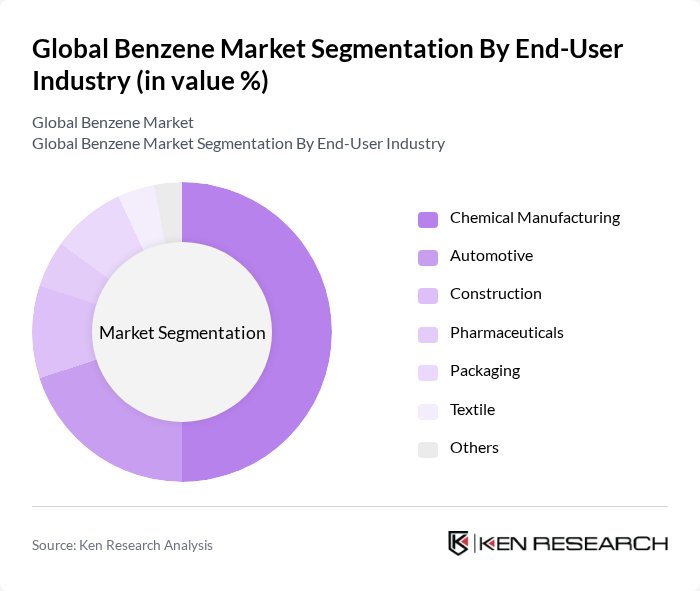

By End-User Industry:The benzene market is also segmented by end-user industries, including Chemical Manufacturing, Automotive, Construction, Pharmaceuticals, Packaging, Textile, and Others. The chemical manufacturing sector dominates the market, as benzene is a fundamental building block for a wide range of chemicals and materials, including plastics, resins, and synthetic fibers. The automotive industry follows, driven by the demand for lightweight materials, advanced coatings, and engineering plastics. Packaging and construction sectors also contribute significantly due to the use of benzene derivatives in insulation, adhesives, and protective materials .

The Global Benzene Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, ExxonMobil Chemical Company, Chevron Phillips Chemical Company LLC, Shell plc, China Petroleum & Chemical Corporation (Sinopec), INEOS Group, LyondellBasell Industries N.V., Repsol S.A., TotalEnergies SE, Formosa Plastics Corporation, Mitsubishi Chemical Corporation, LG Chem Ltd., Huntsman Corporation, Westlake Corporation, PTT Global Chemical Public Company Limited, Reliance Industries Limited, Dow Inc., and Marathon Petroleum Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the benzene market in None appears promising, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt green chemistry initiatives, the demand for bio-based benzene is expected to rise. Additionally, the expansion into emerging markets, particularly in Asia-Pacific, will provide new growth avenues. Companies are likely to invest in innovative production technologies to enhance efficiency and reduce environmental impact, positioning themselves favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Derivative | Ethylbenzene Cumene Cyclohexane Nitrobenzene Linear Alkylbenzene Maleic Anhydride Others |

| By End-User Industry | Chemical Manufacturing Automotive Construction Pharmaceuticals Packaging Textile Others |

| By Application | Plastics Synthetic Fibers Rubber Solvents Detergents Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America Europe Asia Pacific Middle East & Africa Latin America |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-based Pricing Others |

| By Regulatory Compliance | Environmental Compliance Safety Compliance Quality Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Benzene Production Facilities | 100 | Plant Managers, Production Supervisors |

| End-User Industries (Plastics, Resins) | 80 | Procurement Managers, Product Development Leads |

| Regulatory Bodies and Compliance | 50 | Regulatory Affairs Specialists, Environmental Compliance Officers |

| Market Analysts and Consultants | 70 | Industry Analysts, Market Research Consultants |

| Academic and Research Institutions | 40 | Research Scientists, Chemical Engineering Professors |

The Global Benzene Market is valued at approximately USD 66 billion, driven by increasing demand for benzene derivatives across various industries, including automotive, construction, packaging, and pharmaceuticals.