Region:Global

Author(s):Shubham

Product Code:KRAA1791

Pages:91

Published On:August 2025

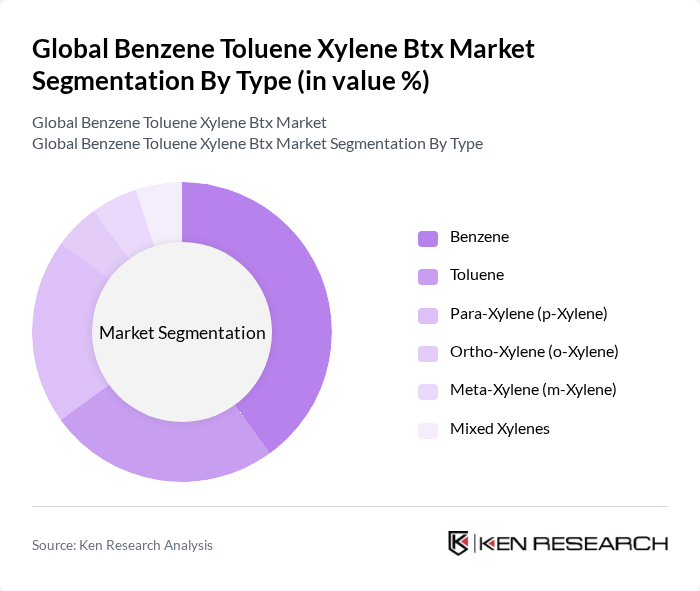

By Type:The BTX market is segmented into various types, including Benzene, Toluene, Para-Xylene (p-Xylene), Ortho-Xylene (o-Xylene), Meta-Xylene (m-Xylene), and Mixed Xylenes. Among these, Benzene is the leading sub-segment due to its extensive use in the production of styrene and phenol, which are essential for manufacturing plastics and resins. Toluene follows closely, primarily utilized in paints, coatings, and adhesives. The xylenes, particularly p-Xylene, are also significant due to their role in producing polyester fibers and resins.

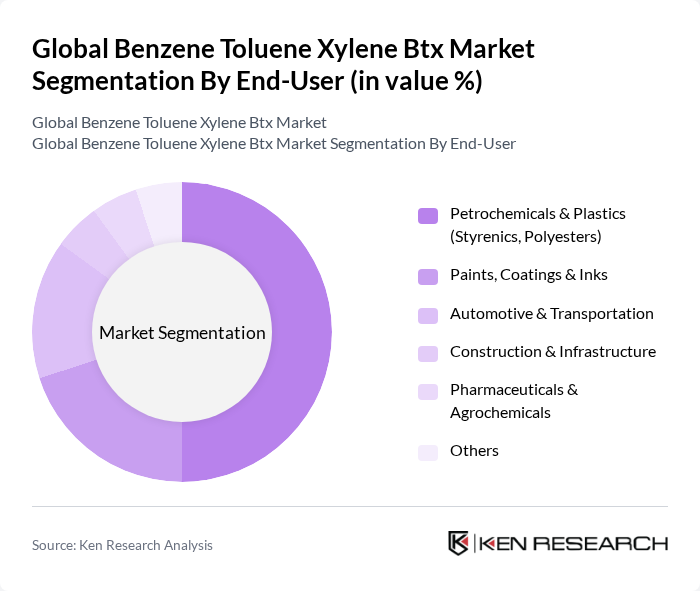

By End-User:The BTX market is further segmented by end-user industries, including Petrochemicals & Plastics (Styrenics, Polyesters), Paints, Coatings & Inks, Automotive & Transportation, Construction & Infrastructure, Pharmaceuticals & Agrochemicals, and Others. The Petrochemicals & Plastics segment dominates the market due to the high demand for styrene and polyester chain products (PTA/PET), which are essential in applications ranging from packaging to automotive components. The automotive sector also contributes to BTX derivative demand via coatings, adhesives, and fuel blending components.

The Global Benzene Toluene Xylene Btx Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, ExxonMobil Chemical Company, Shell plc, Chevron Phillips Chemical Company LLC, China Petroleum & Chemical Corporation (Sinopec), LyondellBasell Industries N.V., INEOS Group Holdings S.A., Formosa Petrochemical Corporation, Repsol S.A., TotalEnergies SE, Mitsubishi Chemical Group Corporation, PTT Global Chemical Public Company Limited, LG Chem Ltd., SABIC (Saudi Basic Industries Corporation), Reliance Industries Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the benzene, toluene, and xylene market appears promising, driven by technological advancements and a shift towards sustainable practices. As manufacturers increasingly adopt green chemistry principles, the development of bio-based alternatives is expected to gain traction. Additionally, the integration of digital technologies in production processes will enhance efficiency and reduce costs. These trends indicate a dynamic market landscape, where innovation and sustainability will play pivotal roles in shaping the industry's future.

| Segment | Sub-Segments |

|---|---|

| By Type | Benzene Toluene Para-Xylene (p-Xylene) Ortho-Xylene (o-Xylene) Meta-Xylene (m-Xylene) Mixed Xylenes |

| By End-User | Petrochemicals & Plastics (Styrenics, Polyesters) Paints, Coatings & Inks Automotive & Transportation Construction & Infrastructure Pharmaceuticals & Agrochemicals Others |

| By Application | Solvents & Thinners Gasoline Blending & Octane Boosters Intermediates for Derivatives (Ethylbenzene/Styrene, Cumene/Phenol, Cyclohexane, TDI, PTA/Polyester) Adhesives & Sealants Explosives (TNT) and Specialty Chemicals Others |

| By Distribution Channel | Direct Contracts (Producers to End-users) Traders & Distributors Spot/Commodity Exchanges Online B2B Platforms Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Contract Spot Formula/Indexed |

| By Packaging Type | Bulk (Tankers, ISO Tanks, Pipelines) Drums & IBCs Containers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Petrochemical Manufacturers | 120 | Production Managers, Chemical Engineers |

| End-User Industries (Automotive, Paints, etc.) | 90 | Procurement Managers, Product Development Heads |

| Environmental Regulatory Bodies | 40 | Policy Makers, Environmental |

The Global Benzene Toluene Xylene (BTX) market is valued at approximately USD 90 billion, with BTX volumes exceeding 135 million tons. The market is primarily driven by demand in the petrochemical sector, particularly in plastics, fibers, and solvents.