Region:Global

Author(s):Rebecca

Product Code:KRAD0243

Pages:99

Published On:August 2025

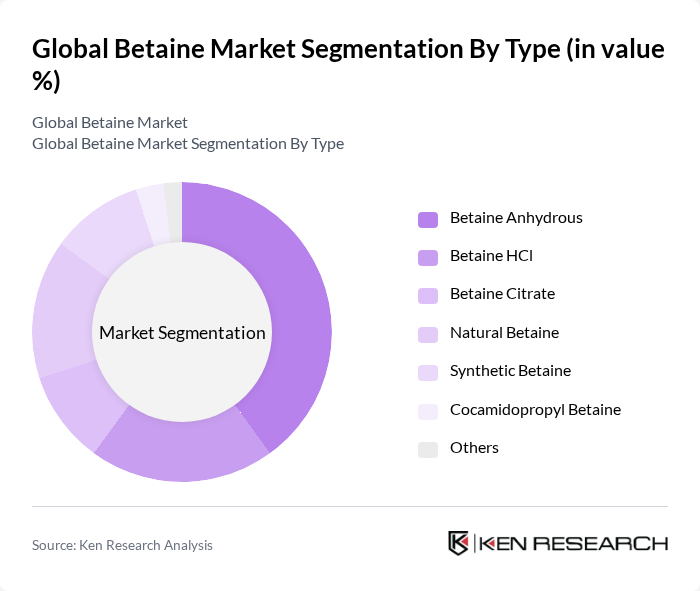

By Type:The betaine market is segmented into various types, including Betaine Anhydrous, Betaine HCl, Betaine Citrate, Natural Betaine, Synthetic Betaine, Cocamidopropyl Betaine, and Others. Among these,Betaine Anhydrousis the most dominant due to its extensive use in animal feed and dietary supplements, driven by its health benefits and cost-effectiveness. The increasing trend towards natural and organic products has also bolstered the demand forNatural Betaine, which is gaining traction in personal care applications .

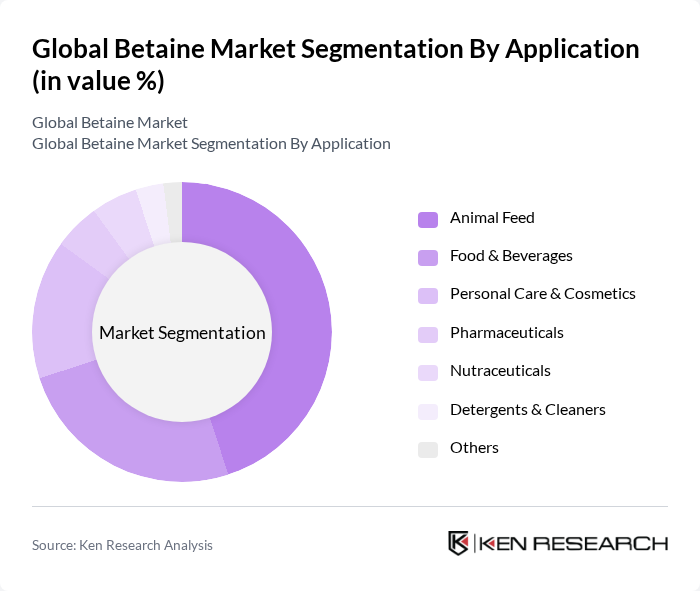

By Application:The applications of betaine are diverse, including Animal Feed, Food & Beverages, Personal Care & Cosmetics, Pharmaceuticals, Nutraceuticals, Detergents & Cleaners, and Others. TheAnimal Feedsegment holds the largest share, driven by the increasing demand for high-quality animal nutrition and the growing livestock industry. Additionally, the Food & Beverages sector is witnessing a rise in the use of betaine as a flavor enhancer and functional ingredient, further propelling market growth .

The Global Betaine Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., AMINO GmbH, Solvay S.A., Evonik Industries AG, Associated British Foods plc, United Sugars Corporation, Zibo Qianhui Chemical Co., Ltd., Sunwin Chemicals, The Dow Chemical Company, Kao Corporation, Huzhou Huilong Chemical Co., Ltd., Chengdu Huilong Chemical Co., Ltd., Merck KGaA, Nutreco N.V., Stepan Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the betaine market appears promising, driven by increasing consumer demand for natural and health-oriented products. As the trend towards sustainable production continues, companies are likely to invest in eco-friendly sourcing and manufacturing processes. Additionally, advancements in technology will facilitate the development of innovative betaine products tailored to specific consumer needs, enhancing market competitiveness. The focus on personalized nutrition and wellness will further propel the adoption of betaine in various applications, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Betaine Anhydrous Betaine HCl Betaine Citrate Natural Betaine Synthetic Betaine Cocamidopropyl Betaine Others |

| By Application | Animal Feed Food & Beverages Personal Care & Cosmetics Pharmaceuticals Nutraceuticals Detergents & Cleaners Others |

| By End-User | Agriculture Food Industry Cosmetic & Personal Care Industry Nutraceutical Industry Chemical Industry Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low Price Medium Price High Price |

| By Product Form | Powder Liquid Granules Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Applications | 100 | Product Developers, Quality Assurance Managers |

| Animal Feed Sector | 80 | Nutritionists, Feed Formulators |

| Cosmetics & Personal Care | 70 | Formulators, Brand Managers |

| Pharmaceutical Applications | 60 | Research Scientists, Regulatory Affairs Specialists |

| Industrial Applications | 40 | Process Engineers, Supply Chain Managers |

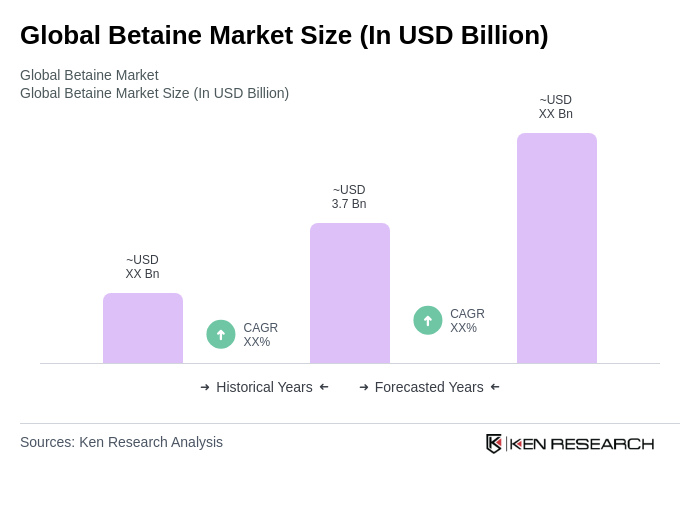

The Global Betaine Market is valued at approximately USD 3.7 billion, driven by increasing demand across various sectors such as animal feed, personal care, and food and beverages, alongside rising awareness of its health benefits.