Global Bicomponent Fiber Market Overview

- The Global Bicomponent Fiber Market is valued at USD 2.4 billion, based on a five?year historical analysis. This growth is primarily driven by the increasing demand for high-performance textiles in applications such as personal hygiene products, medical textiles, automotive interiors, filtration media, and industrial uses. The versatility of bicomponent fibers, which combine different polymers to enhance properties like strength, softness, and thermal bonding, has led to their widespread adoption across multiple sectors. The market is further propelled by the rising preference for sustainable and biodegradable fibers, especially in hygiene and healthcare segments, and the growing use of advanced fibers in automotive and filtration applications .

- Key players in this market are concentrated in regions such as North America, Europe, and Asia-Pacific. Countries like the United States, Germany, and China dominate due to their advanced manufacturing capabilities, strong textile industries, and significant investments in research and development. These regions are also home to major textile manufacturers that leverage bicomponent fibers for innovative product development .

- Recent regulatory initiatives in the European Union have focused on sustainable textile production, including guidelines that encourage the use of eco-friendly bicomponent fibers. These regulations are driving manufacturers to adopt greener practices and materials, enhancing the market’s focus on sustainability and reducing environmental impact .

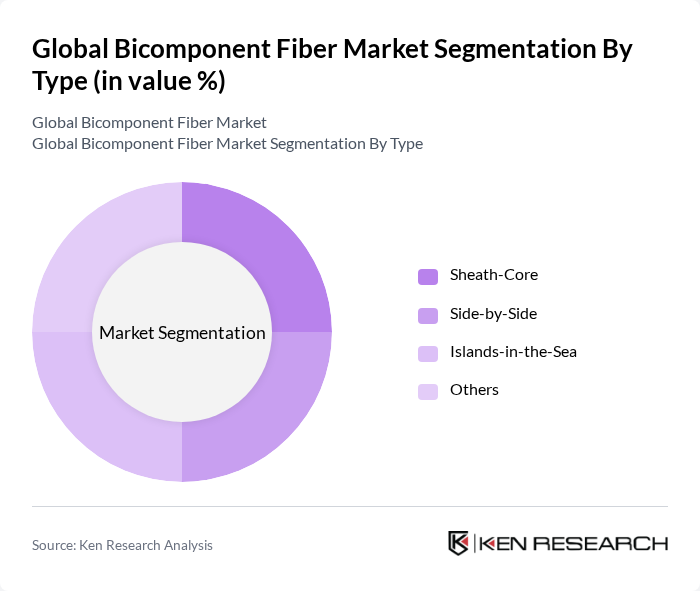

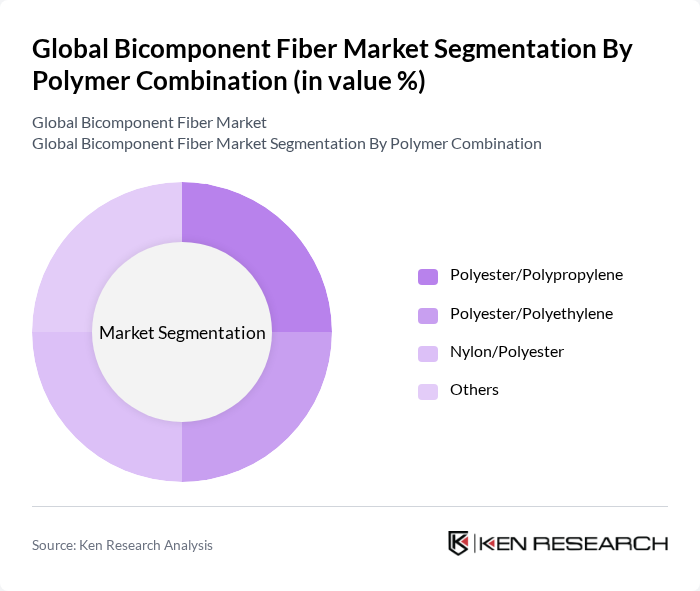

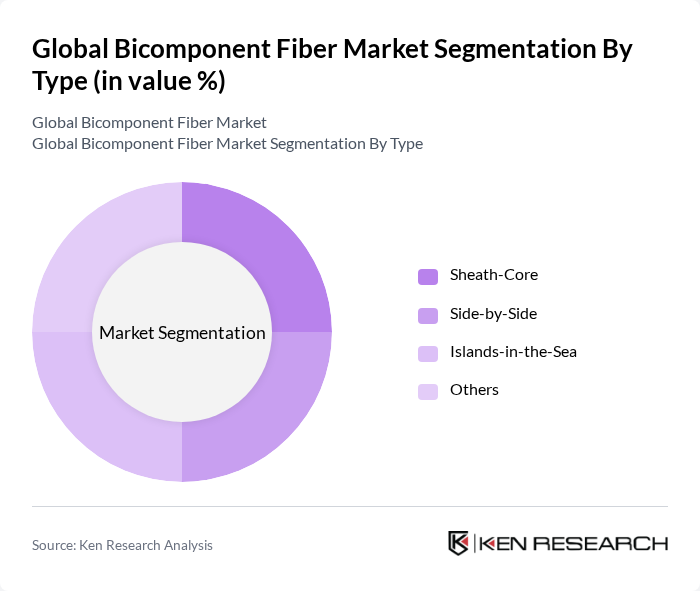

Global Bicomponent Fiber Market Segmentation

By Type:The market is segmented into various types of bicomponent fibers, including Sheath-Core, Side-by-Side, Islands-in-the-Sea, and Others. Among these, the Sheath-Core type is particularly dominant due to its ability to provide enhanced properties such as improved strength, durability, and thermal bonding, making it highly sought after in applications like nonwoven fabrics, hygiene products, and filtration media. The Side-by-Side type is also gaining traction, especially in the production of specialized textiles that require unique performance characteristics such as elasticity and softness .

By Polymer Combination:The market is also segmented based on polymer combinations, including Polyester/Polypropylene, Polyester/Polyethylene, Nylon/Polyester, and Others. The Polyester/Polypropylene combination leads the market due to its cost-effectiveness, easy processability, and excellent performance in nonwoven fabrics for hygiene and filtration products. The Nylon/Polyester combination is gaining popularity for its superior strength, durability, and suitability for demanding industrial and textile applications .

Global Bicomponent Fiber Market Competitive Landscape

The Global Bicomponent Fiber Market is characterized by a dynamic mix of regional and international players. Leading participants such as FiberVisions Corporation, Kolon Industries, Inc., Huvis Corporation, Hyosung Corporation, Toray Industries, Inc., Teijin Limited, Far Eastern New Century Corporation, Freudenberg Group, Asahi Kasei Corporation, Lenzing AG, Mitsubishi Chemical Corporation, Eastman Chemical Company, Berry Global, Inc., Indorama Ventures Public Company Limited, Jiangsu Sanfangxiang Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Global Bicomponent Fiber Market Industry Analysis

Growth Drivers

- Increasing Demand for Sustainable Textiles:The global sustainable textile market is projected to reach $8.25 billion by 2025, driven by consumer preferences for eco-friendly products. In future, 66% of consumers expressed a willingness to pay more for sustainable clothing, indicating a robust demand for sustainable fibers. Bicomponent fibers, known for their recyclability and reduced environmental impact, are well-positioned to meet this growing consumer demand, enhancing their market presence significantly.

- Advancements in Fiber Technology:The global fiber technology market is expected to grow to $1.5 billion by 2025, with innovations in bicomponent fiber production leading the way. Recent developments, such as improved spinning techniques and enhanced fiber properties, have resulted in higher performance and durability. For instance, the introduction of biodegradable bicomponent fibers has attracted significant interest, as they align with the increasing focus on sustainability and performance in textiles, driving market growth.

- Rising Applications in Nonwoven Fabrics:The nonwoven fabric market is projected to reach $50 billion by 2025, with bicomponent fibers playing a crucial role in this expansion. These fibers are increasingly utilized in hygiene products, medical applications, and filtration systems due to their unique properties. For example, the demand for disposable medical products surged to $12 billion in future, highlighting the potential for bicomponent fibers to capture significant market share in nonwoven applications, further driving industry growth.

Market Challenges

- High Production Costs:The production cost of bicomponent fibers can be up to 30% higher than traditional fibers, primarily due to advanced manufacturing processes and raw material expenses. In future, the average cost of producing high-quality bicomponent fibers was approximately $3.50 per kilogram, which poses a significant barrier for manufacturers. This cost disparity can limit market penetration, especially in price-sensitive segments, hindering overall growth in the bicomponent fiber market.

- Limited Awareness Among End-Users:Despite the advantages of bicomponent fibers, awareness among end-users remains low, particularly in emerging markets. A survey conducted in future revealed that only 40% of textile manufacturers were familiar with bicomponent fibers and their benefits. This lack of knowledge can impede adoption rates, as manufacturers may opt for more traditional fibers, thereby stalling the growth potential of bicomponent fibers in various applications and markets.

Global Bicomponent Fiber Market Future Outlook

The future of the bicomponent fiber market appears promising, driven by increasing consumer demand for sustainable textiles and technological advancements. As manufacturers innovate and improve production processes, the cost of bicomponent fibers is expected to decrease, making them more accessible. Additionally, the integration of smart textiles and customization trends will likely enhance the appeal of bicomponent fibers, positioning them favorably in the evolving textile landscape. This dynamic environment presents significant opportunities for growth and expansion in various sectors.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets, particularly in Asia-Pacific, are witnessing rapid urbanization and rising disposable incomes. The textile industry in these regions is projected to grow by 7% annually, creating substantial opportunities for bicomponent fibers. Manufacturers can capitalize on this trend by establishing local production facilities, thereby reducing costs and increasing market penetration in these high-growth areas.

- Innovations in Fiber Blending Techniques:The development of advanced fiber blending techniques is opening new avenues for bicomponent fibers. Innovations such as co-extrusion and melt-blending are enhancing the performance characteristics of these fibers, making them suitable for diverse applications. This technological progress is expected to drive demand, as manufacturers seek to create high-performance textiles that meet evolving consumer preferences and industry standards.