Region:Global

Author(s):Dev

Product Code:KRAA1657

Pages:93

Published On:August 2025

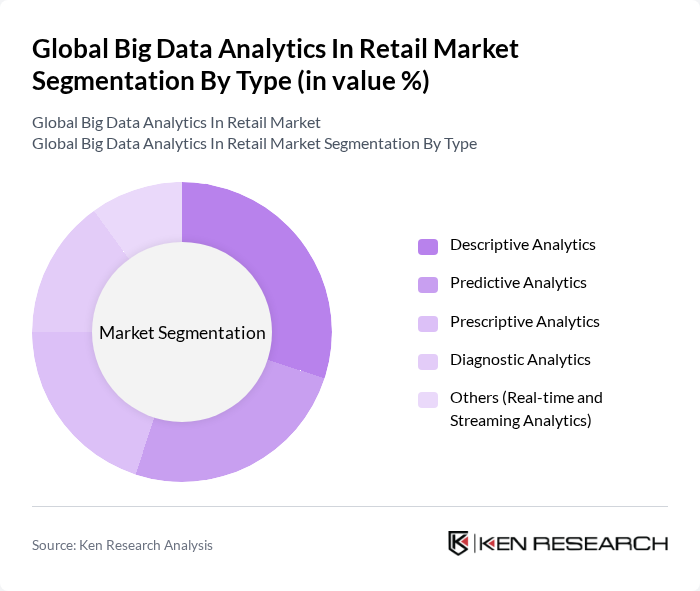

By Type:The market is segmented into various types of analytics, including Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, Diagnostic Analytics, and Others (Real-time and Streaming Analytics). Each type serves distinct purposes, from understanding past behaviors to forecasting future trends.

Among these, Descriptive Analytics is the leading sub-segment, as it provides retailers with insights into historical data, helping them understand customer behavior and sales trends. This type of analytics is crucial for inventory management and marketing strategies, allowing retailers to make informed decisions based on past performance. The increasing volume of data generated by retail transactions further enhances the relevance of descriptive analytics in the market.

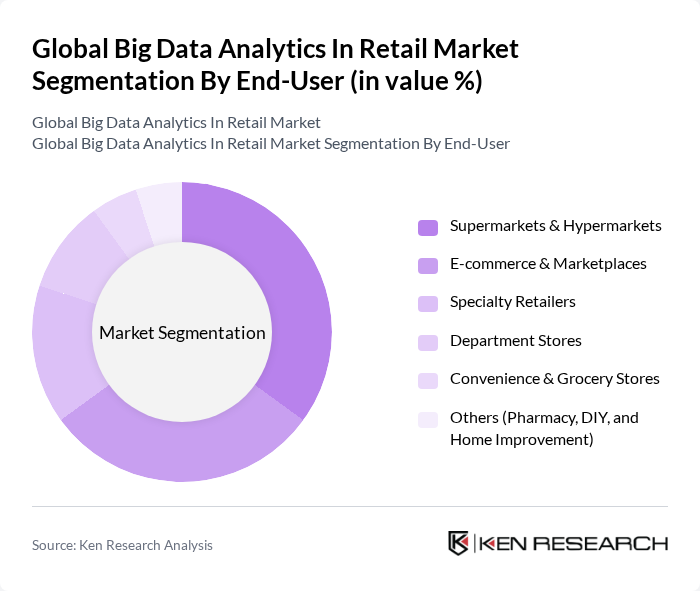

By End-User:The end-user segmentation includes Supermarkets & Hypermarkets, E-commerce & Marketplaces, Specialty Retailers, Department Stores, Convenience & Grocery Stores, and Others (Pharmacy, DIY, and Home Improvement). Each end-user category utilizes big data analytics to enhance operational efficiency and customer satisfaction.

Supermarkets & Hypermarkets dominate the market due to their vast customer base and extensive product offerings. They leverage big data analytics to optimize supply chain management, enhance customer loyalty programs, and personalize marketing efforts. The ability to analyze large volumes of transaction data allows these retailers to make data-driven decisions that significantly improve operational efficiency and customer satisfaction.

The Global Big Data Analytics in Retail Marketing Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAP SE, Oracle Corporation, Microsoft Corporation, SAS Institute Inc., Teradata Corporation, QlikTech International AB (Qlik), MicroStrategy Incorporated, Alteryx, Inc., Databricks, Inc., Snowflake Inc., Google LLC (Looker, Google Cloud), Amazon Web Services, Inc. (AWS), Salesforce, Inc. (Tableau, Marketing Cloud), Adobe Inc. (Adobe Experience Platform) contribute to innovation, geographic expansion, and service delivery in this space.

The future of big data analytics in retail is poised for transformative growth, driven by technological advancements and evolving consumer expectations. Retailers are increasingly adopting AI and machine learning to enhance predictive analytics capabilities, enabling them to anticipate consumer needs more accurately. Additionally, the integration of IoT devices will provide real-time data insights, further refining inventory management and customer engagement strategies. As these trends continue to evolve, retailers will need to adapt swiftly to maintain competitive advantages in a dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics Others (Real-time and Streaming Analytics) |

| By End-User | Supermarkets & Hypermarkets E-commerce & Marketplaces Specialty Retailers Department Stores Convenience & Grocery Stores Others (Pharmacy, DIY, and Home Improvement) |

| By Application | Customer Segmentation & Personalization Inventory Optimization & Demand Forecasting Price & Promotion Optimization Marketing Mix Modeling & Attribution Fraud Detection & Loss Prevention Location & Footfall Analytics Others (Assortment Planning and Category Management) |

| By Sales Channel | Online (Web & Mobile) Offline (In-store/Brick-and-Mortar) Omnichannel Direct-to-Consumer (D2C) Others (Third-party Marketplaces) |

| By Deployment Mode | Cloud (SaaS/PaaS) On-premises Hybrid Edge/Store-level Analytics |

| By Pricing Model | Subscription (Per-user/Per-store) Usage-based (Consumption/Events) License + Maintenance Outcome-based/Value-based Freemium/Tiered |

| By Retailer Size | Large Enterprises Mid-market Small & Emerging Retailers Franchise/Multi-store Chains |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Big Data Adoption in Fashion Retail | 120 | IT Managers, Data Analysts |

| Predictive Analytics in Grocery Chains | 95 | Operations Managers, Marketing Directors |

| Customer Insights through Data Analytics | 110 | Customer Experience Managers, Business Analysts |

| Supply Chain Optimization using Big Data | 75 | Supply Chain Managers, Logistics Coordinators |

| Retail Analytics for E-commerce Platforms | 105 | E-commerce Managers, Data Scientists |

The Global Big Data Analytics in Retail Marketing Industry is valued at approximately USD 6 billion, driven by the increasing adoption of data-driven decision-making processes among retailers to enhance customer experiences and optimize operations.