Region:Global

Author(s):Geetanshi

Product Code:KRAA0090

Pages:99

Published On:August 2025

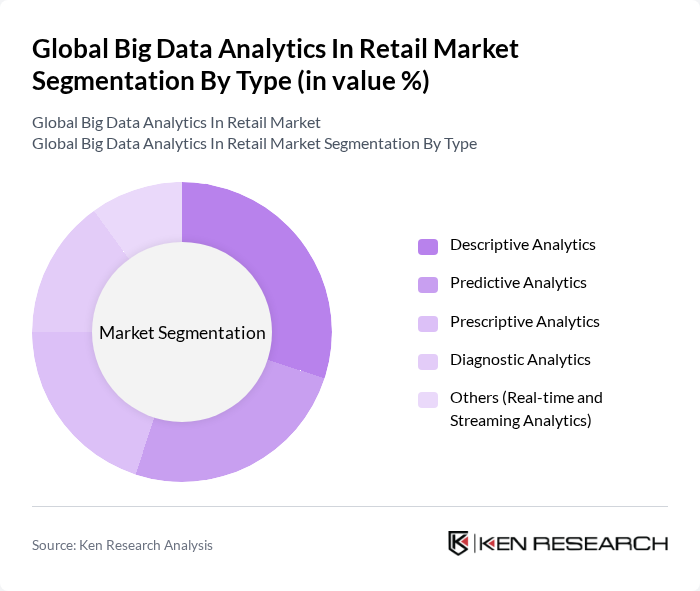

By Type:The market is segmented into four types of analytics: Descriptive Analytics, Predictive Analytics, Prescriptive Analytics, and Diagnostic Analytics. Descriptive Analytics is currently the leading sub-segment, as it helps retailers understand historical data and consumer behavior, enabling them to make informed decisions. Predictive Analytics follows closely, allowing retailers to forecast trends and customer preferences, which is crucial for inventory management and marketing strategies. The adoption of prescriptive and diagnostic analytics is rising as retailers seek to optimize decision-making and identify root causes of business outcomes .

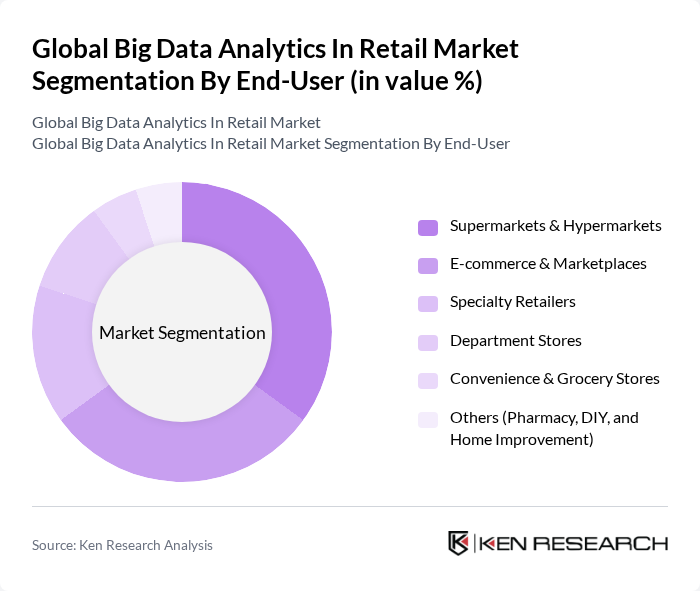

By End-User:The end-user segmentation includes Supermarkets & Hypermarkets, Specialty Retailers, E-commerce Companies, and Department Stores. E-commerce Companies are leading this segment due to the rapid growth of online shopping and the need for data analytics to enhance customer experiences and optimize supply chains. Supermarkets & Hypermarkets also significantly contribute to the market as they leverage analytics for inventory management and customer insights. The adoption of analytics among specialty retailers and department stores is also increasing, driven by the need to differentiate through personalized services and efficient operations .

The Global Big Data Analytics in Retail Marketing Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAP SE, Oracle Corporation, Microsoft Corporation, SAS Institute Inc., Teradata Corporation, Qlik Technologies Inc., Google Cloud (Alphabet Inc.), Amazon Web Services (AWS), Salesforce, Inc., Alteryx, Inc., MicroStrategy Incorporated, Informatica Inc., Tableau Software (Salesforce), Hitachi Vantara Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of big data analytics in retail is poised for significant transformation, driven by technological advancements and evolving consumer expectations. Retailers are increasingly leveraging AI and machine learning to enhance data analysis capabilities, enabling real-time insights and predictive analytics. As e-commerce continues to expand, the integration of big data analytics will become essential for retailers to remain competitive. Furthermore, the focus on personalized marketing strategies will likely intensify, fostering deeper customer engagement and loyalty in the retail sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Descriptive Analytics Predictive Analytics Prescriptive Analytics Diagnostic Analytics |

| By End-User | Supermarkets & Hypermarkets Specialty Retailers E-commerce Companies Department Stores |

| By Application | Customer Segmentation & Personalization Inventory & Supply Chain Optimization Sales Forecasting & Demand Planning Marketing Campaign Management |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Data Source | Point of Sale (POS) Data Social Media & Web Data Customer Feedback & Loyalty Programs Mobile & Sensor Data |

| By Region | North America Europe Asia-Pacific Rest of World |

| By Business Size | Large Enterprises Medium Enterprises Small Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Grocery Retail Analytics | 100 | Data Analysts, IT Managers |

| Apparel Retail Insights | 80 | Marketing Directors, Business Intelligence Analysts |

| Electronics Retail Data Usage | 70 | Operations Managers, Data Scientists |

| Omnichannel Retail Strategies | 90 | eCommerce Managers, Customer Experience Officers |

| Consumer Behavior Analytics | 60 | Market Researchers, Retail Strategists |

The Global Big Data Analytics in Retail Market is valued at approximately USD 6.3 billion, driven by the increasing adoption of data-driven decision-making processes among retailers to enhance customer experiences and optimize operations.