Region:Global

Author(s):Shubham

Product Code:KRAC0650

Pages:93

Published On:August 2025

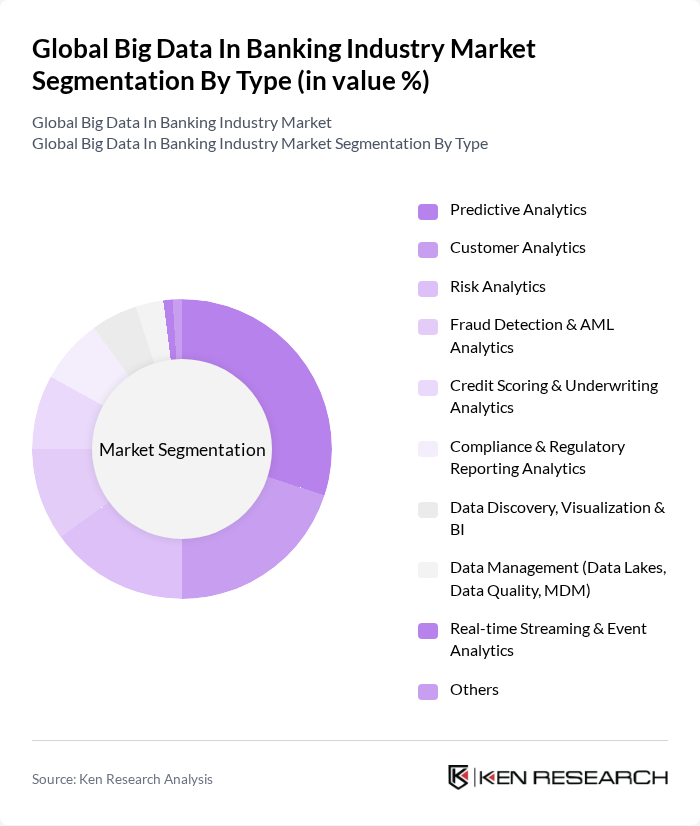

By Type:The market is segmented into various types, including Predictive Analytics, Customer Analytics, Risk Analytics, Fraud Detection & AML Analytics, Credit Scoring & Underwriting Analytics, Compliance & Regulatory Reporting Analytics, Data Discovery, Visualization & BI, Data Management (Data Lakes, Data Quality, MDM), Real-time Streaming & Event Analytics, and Others. Among these, Predictive Analytics is currently dominating the market due to its ability to forecast trends and behaviors, enabling banks to make informed decisions and enhance customer engagement. Banks increasingly deploy predictive models for next-best-offer, churn reduction, credit risk early-warning, and fraud prevention as analytics maturity rises .

By End-User:The end-user segmentation includes Retail Banks, Corporate & Commercial Banks, Investment Banks, Credit Unions & Community Banks, Asset & Wealth Management Firms, Payment Service Providers & Fintechs, Insurance Companies, and Others. Retail Banks are leading this segment, driven by their need to enhance customer service and operational efficiency through data-driven insights, including personalization, omnichannel engagement, and proactive risk controls in retail portfolios .

The Global Big Data In Banking Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, SAS Institute Inc., Oracle Corporation, Microsoft Corporation, SAP SE, FICO (Fair Isaac Corporation), Teradata Corporation, Informatica Inc., TIBCO Software Inc., QlikTech International AB (Qlik), Alteryx, Inc., Databricks, Inc., Snowflake Inc., Amazon Web Services, Inc. (AWS), Google Cloud (Google LLC), Cloudera, Inc., Palantir Technologies Inc., Experian plc, Moody’s Analytics, Inc., Expero, Inc. contribute to innovation, geographic expansion, and service delivery in this space. Banks are prioritizing cloud data platforms, AI/ML model ops, and real-time fraud/risk analytics as key investment areas, with North America remaining the largest adopter and Asia-Pacific accelerating .

The future of big data in the banking industry is poised for transformative growth, driven by technological advancements and evolving consumer expectations. As banks increasingly adopt real-time analytics and AI-driven solutions, the focus will shift towards enhancing customer engagement and operational efficiency. Additionally, the integration of cloud-based platforms will facilitate seamless data management, enabling banks to harness insights more effectively. This evolution will likely lead to a more competitive landscape, where agility and innovation become paramount for success in the banking sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Customer Analytics Risk Analytics Fraud Detection & AML Analytics Credit Scoring & Underwriting Analytics Compliance & Regulatory Reporting Analytics Data Discovery, Visualization & BI Data Management (Data Lakes, Data Quality, MDM) Real-time Streaming & Event Analytics Others |

| By End-User | Retail Banks Corporate & Commercial Banks Investment Banks Credit Unions & Community Banks Asset & Wealth Management Firms Payment Service Providers & Fintechs Insurance Companies Others |

| By Application | Customer Relationship Management & Personalization Risk Management (Liquidity, Market, Credit) Marketing Optimization & Next-Best-Action Compliance Management & Regulatory Reporting Operational Efficiency & Process Automation Fraud Detection, AML & Financial Crime Treasury & Cash Management Analytics Collections & Recoveries Analytics Others |

| By Deployment Mode | On-Premises Cloud (Public, Private) Hybrid |

| By Data Source | Transactional & Payments Data Customer & CRM Data Social & Web Data Market & Trading Data Open Banking & Third-Party Data Device/IoT & Channel Telemetry Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Pricing Model | Subscription-Based (SaaS) Pay-As-You-Go (Usage-Based) License-Based (Perpetual/Term) Outcome-Based / Value-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Analytics | 120 | Data Analysts, Marketing Managers |

| Corporate Banking Data Solutions | 100 | Risk Managers, Financial Analysts |

| Investment Banking Big Data Applications | 80 | Portfolio Managers, Compliance Officers |

| Fraud Detection Systems | 70 | Fraud Analysts, IT Security Managers |

| Customer Experience Enhancement | 90 | Customer Experience Managers, Product Development Leads |

The Global Big Data in Banking Industry market is valued at approximately USD 5.7 billion, reflecting a significant increase in the adoption of big data analytics for risk management, fraud detection, and customer analytics within the banking sector.