Region:Global

Author(s):Dev

Product Code:KRAB0671

Pages:91

Published On:August 2025

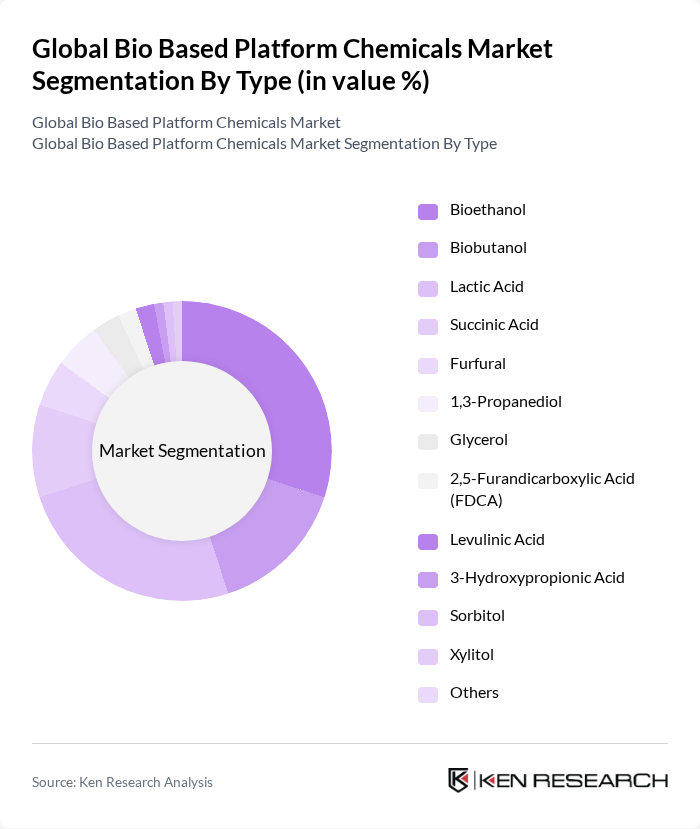

By Type:The bio-based platform chemicals market is segmented into Bioethanol, Biobutanol, Lactic Acid, Succinic Acid, Furfural, 1,3-Propanediol, Glycerol, 2,5-Furandicarboxylic Acid (FDCA), Levulinic Acid, 3-Hydroxypropionic Acid, Sorbitol, Xylitol, and Others. Among these, Bioethanol and Lactic Acid are leading subsegments, driven by their extensive use in the food and beverage industry, as well as in the production of biodegradable plastics and sustainable packaging. Lactic acid is particularly prominent in bioplastics, while bioethanol is widely used as a renewable fuel and chemical feedstock .

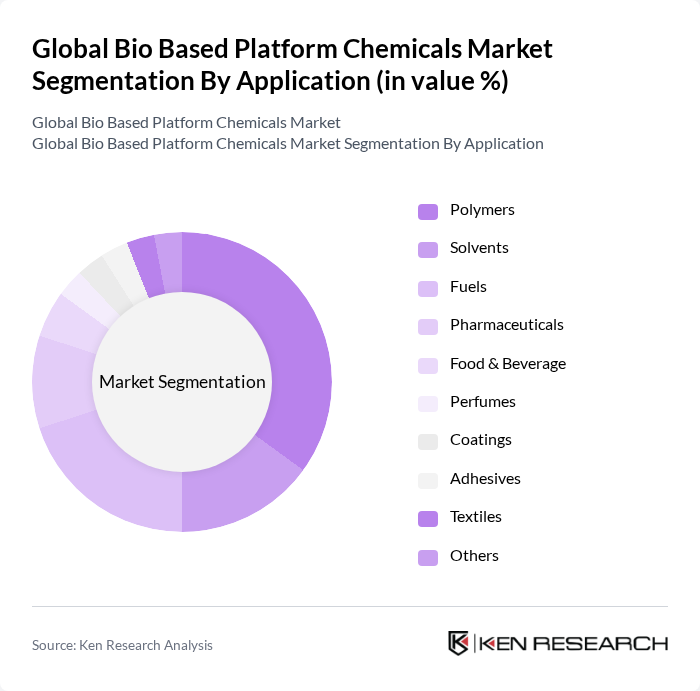

By Application:The applications of bio-based platform chemicals include Polymers, Solvents, Fuels, Pharmaceuticals, Food & Beverage, Perfumes, Coatings, Adhesives, Textiles, and Others. The polymers segment is dominant, supported by the surging demand for biodegradable plastics and sustainable packaging in industries such as food and beverage, consumer goods, and healthcare. Fuels and solvents also represent significant applications, reflecting the shift towards renewable energy sources and green chemistry solutions .

The Global Bio Based Platform Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, DuPont de Nemours, Inc., Cargill, Incorporated, Novozymes A/S, DSM-Firmenich AG, BioAmber Inc., Genomatica, Inc., Braskem S.A., NatureWorks LLC, Green Biologics Ltd., LanzaTech Global, Inc., Corbion N.V., Avantium N.V., Algenol Biotech LLC, Mitsubishi Chemical Group Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bio-based platform chemicals market appears promising, driven by increasing regulatory support and consumer demand for sustainable products. As governments worldwide implement stricter environmental regulations, the shift towards bio-based alternatives is expected to accelerate. Additionally, advancements in production technologies will likely enhance efficiency and reduce costs, making bio-based chemicals more competitive. The integration of digital technologies in production processes will further streamline operations, paving the way for innovative solutions and market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Bioethanol Biobutanol Lactic Acid Succinic Acid Furfural ,3-Propanediol Glycerol ,5-Furandicarboxylic Acid (FDCA) Levulinic Acid Hydroxypropionic Acid Sorbitol Xylitol Others |

| By Application | Polymers Solvents Fuels Pharmaceuticals Food & Beverage Perfumes Coatings Adhesives Textiles Others |

| By End-User | Packaging Automotive Consumer Goods Construction Agriculture Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Product Form | Liquid Solid Gas |

| By Sustainability Certification | USDA Organic EU Ecolabel Cradle to Cradle Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bio-based Plastics Production | 100 | Production Managers, Sustainability Directors |

| Renewable Solvents Market | 60 | Product Development Managers, Chemical Engineers |

| Surfactants in Personal Care | 55 | Brand Managers, Regulatory Affairs Specialists |

| Bio-based Chemicals in Agriculture | 70 | Agronomists, Supply Chain Managers |

| Consumer Goods Sustainability Initiatives | 65 | Corporate Sustainability Officers, Marketing Managers |

The Global Bio Based Platform Chemicals Market is valued at approximately USD 17.5 billion, reflecting a significant growth trend driven by the demand for sustainable alternatives to traditional petrochemical products and advancements in production technologies.