Region:Global

Author(s):Dev

Product Code:KRAD0354

Pages:84

Published On:August 2025

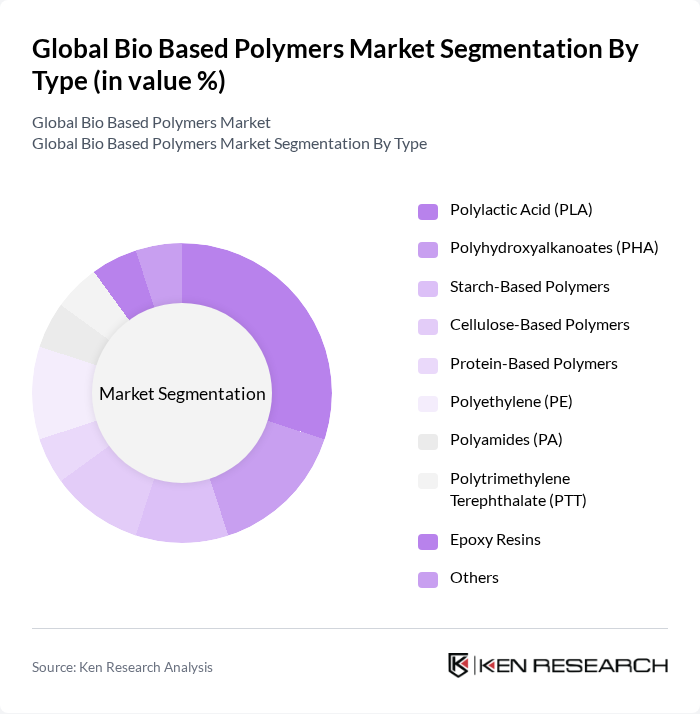

By Type:The bio-based polymers market is segmented into various types, including Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Starch-Based Polymers, Cellulose-Based Polymers, Protein-Based Polymers, Polyethylene (PE), Polyamides (PA), Polytrimethylene Terephthalate (PTT), Epoxy Resins, and Others. Among these, Polylactic Acid (PLA) remains a leading subsegment due to its versatility, biodegradability, and wide application in packaging and consumer goods. The increasing focus on biodegradable materials and regulatory support for compostable plastics have further propelled PLA's market share .

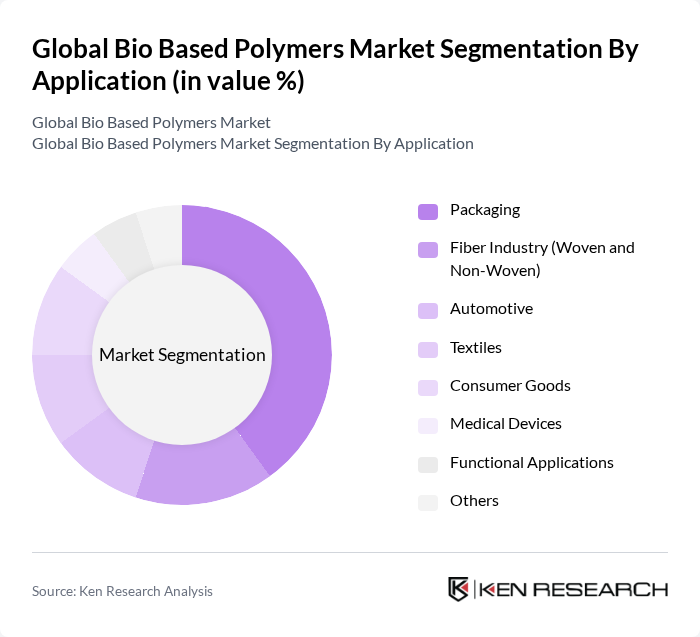

By Application:Applications of bio-based polymers include Packaging, Fiber Industry (Woven and Non-Woven), Automotive, Textiles, Consumer Goods, Medical Devices, Functional Applications, and Others. The Packaging segment dominates, driven by the rising demand for sustainable packaging solutions and increasing regulatory pressure to reduce single-use plastics. The adoption of bio-based polymers in automotive and textiles is also growing due to their lightweight, durable, and environmentally friendly properties .

The Global Bio Based Polymers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, NatureWorks LLC, DuPont de Nemours, Inc., Novamont S.p.A., Braskem S.A., TotalEnergies Corbion bv, Mitsubishi Chemical Group Corporation, Green Dot Bioplastics, Inc., Bio-on S.p.A., FKuR Kunststoff GmbH, Trellis Earth Products, Inc., Tetra Pak International S.A., Arkema S.A., Solvay S.A., Eastman Chemical Company, Dow Inc., Biome Bioplastics Ltd., PTT Global Chemical Public Company Limited, Biotec GmbH & Co. KG, Mapei S.p.A., DAIKIN Industries, Ltd., Toray Industries, Inc., KURARAY CO., LTD., Plantic Technologies Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bio-based polymers market appears promising, driven by increasing consumer demand for sustainable products and supportive government policies. As technological advancements continue to lower production costs and improve efficiency, the market is expected to witness significant growth. Additionally, the ongoing shift towards a circular economy will further enhance the adoption of bio-based materials, as industries seek to reduce their environmental impact and meet regulatory requirements. Collaboration between stakeholders will be crucial in overcoming existing challenges and unlocking new opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Polylactic Acid (PLA) Polyhydroxyalkanoates (PHA) Starch-Based Polymers Cellulose-Based Polymers Protein-Based Polymers Polyethylene (PE) Polyamides (PA) Polytrimethylene Terephthalate (PTT) Epoxy Resins Others |

| By Application | Packaging Fiber Industry (Woven and Non-Woven) Automotive Textiles Consumer Goods Medical Devices Functional Applications Others |

| By End-User | Food and Beverage Healthcare Electronics Agriculture Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Retail Stores Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe) Asia-Pacific (Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa) |

| By Price Range | Economy Mid-Range Premium |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 100 | Product Managers, Sustainability Coordinators |

| Automotive Applications of Bio-based Polymers | 60 | R&D Engineers, Procurement Managers |

| Textile Sector Adoption Rates | 50 | Design Managers, Supply Chain Analysts |

| Consumer Goods Market Trends | 80 | Marketing Directors, Product Development Leads |

| Regulatory Impact Assessment | 40 | Compliance Officers, Policy Analysts |

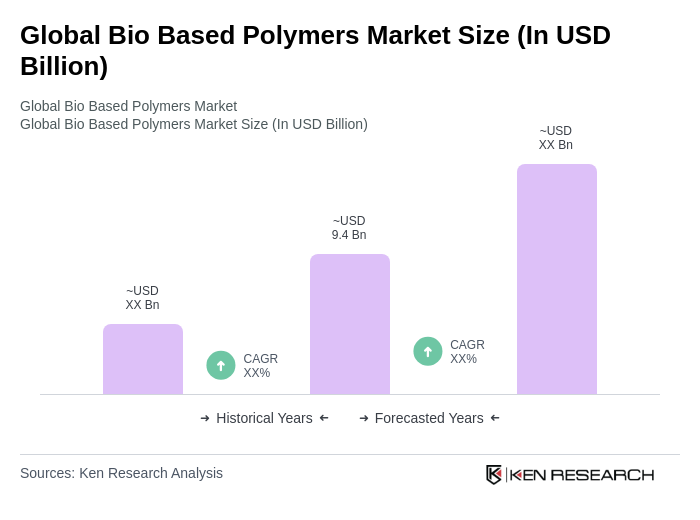

The Global Bio Based Polymers Market is valued at approximately USD 9.4 billion, reflecting a significant growth trend driven by consumer demand for sustainable materials and advancements in biopolymer technologies.