Region:Global

Author(s):Geetanshi

Product Code:KRAC0153

Pages:94

Published On:August 2025

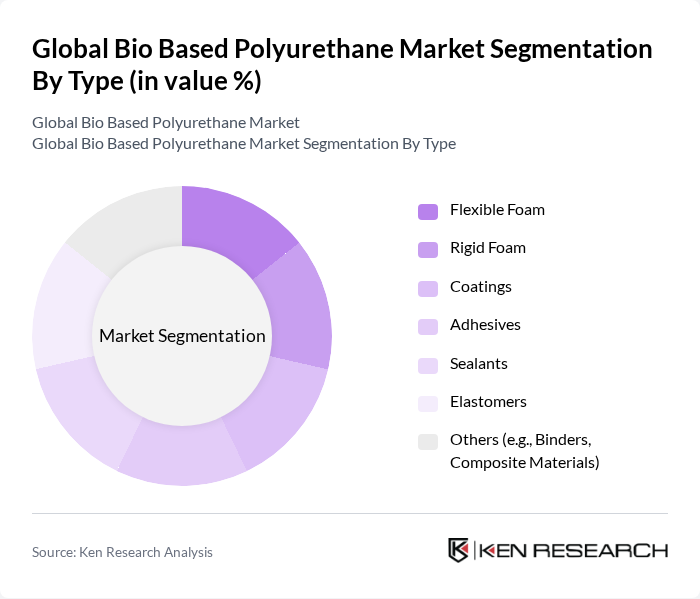

By Type:The bio-based polyurethane market is segmented into flexible foam, rigid foam, coatings, adhesives, sealants, elastomers, and others such as binders and composite materials. Flexible foam remains the leading subsegment due to its extensive use in furniture, automotive interiors, and bedding. The demand for lightweight, comfortable, and sustainable materials in these sectors is a primary driver for flexible foam adoption .

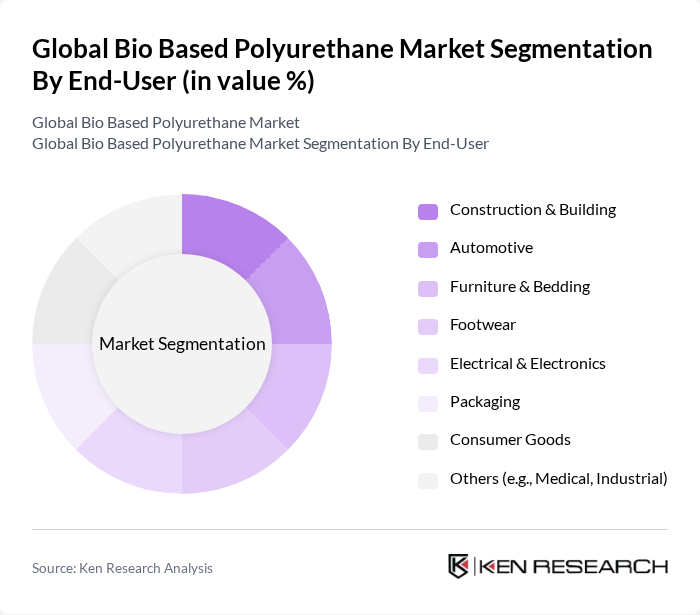

By End-User:End-user segments include automotive, construction & building, furniture & bedding, footwear, electrical & electronics, packaging, consumer goods, and others such as medical and industrial applications. The construction & building sector currently holds the largest share, driven by the demand for sustainable insulation, coatings, and sealants. Automotive is also a major end-user, propelled by the need for lightweight, energy-efficient components and stricter emission standards .

The Global Bio Based Polyurethane Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Covestro AG, Huntsman Corporation, Dow Inc., Mitsui Chemicals, Inc., Wanhua Chemical Group Co., Ltd., Reverdia, Cargill, Incorporated, Emery Oleochemicals Group, Woodbridge Foam Corporation, FoamPartner (a member of the Recticel Group), Perstorp Holding AB, Sika AG, Covestro LLC (U.S. subsidiary of Covestro AG), Lubrizol Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bio-based polyurethane market appears promising, driven by increasing consumer demand for sustainable products and supportive government policies. As technological advancements continue to lower production costs, the market is likely to see a surge in adoption across various industries. Furthermore, the emphasis on circular economy practices will encourage innovation, leading to new applications and enhanced product offerings. This evolving landscape presents a unique opportunity for stakeholders to capitalize on the growing trend towards sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Foam Rigid Foam Coatings Adhesives Sealants Elastomers Others (e.g., Binders, Composite Materials) |

| By End-User | Automotive Construction & Building Furniture & Bedding Footwear Electrical & Electronics Packaging Consumer Goods Others (e.g., Medical, Industrial) |

| By Application | Insulation Upholstery Packaging Automotive Interiors Coatings and Sealants Footwear Components Electronics Encapsulation Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Specialty Stores Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Price Range | Low Medium High |

| By Product Form | Liquid Solid Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 100 | Product Engineers, Procurement Managers |

| Construction Materials | 80 | Project Managers, Material Suppliers |

| Furniture Manufacturing | 60 | Design Engineers, Operations Managers |

| Adhesives and Coatings | 50 | R&D Managers, Quality Assurance Specialists |

| Consumer Goods | 70 | Product Development Managers, Marketing Directors |

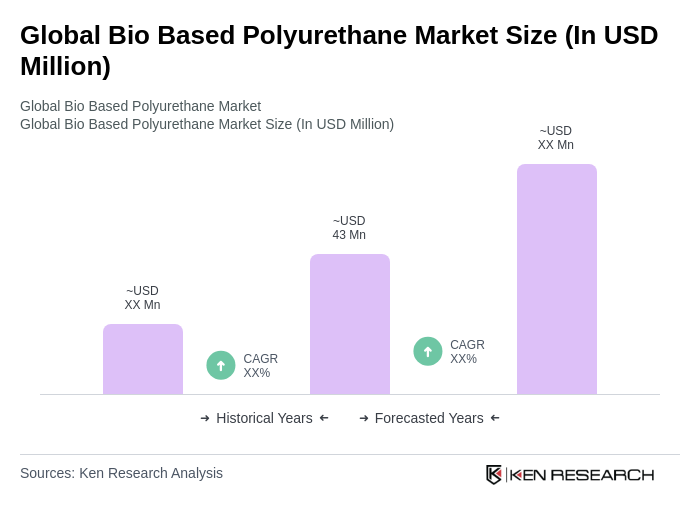

The Global Bio Based Polyurethane Market is valued at approximately USD 43 million, reflecting a growing trend towards sustainable materials in various industries, including automotive, construction, and furniture.