Region:Global

Author(s):Geetanshi

Product Code:KRAC0006

Pages:89

Published On:August 2025

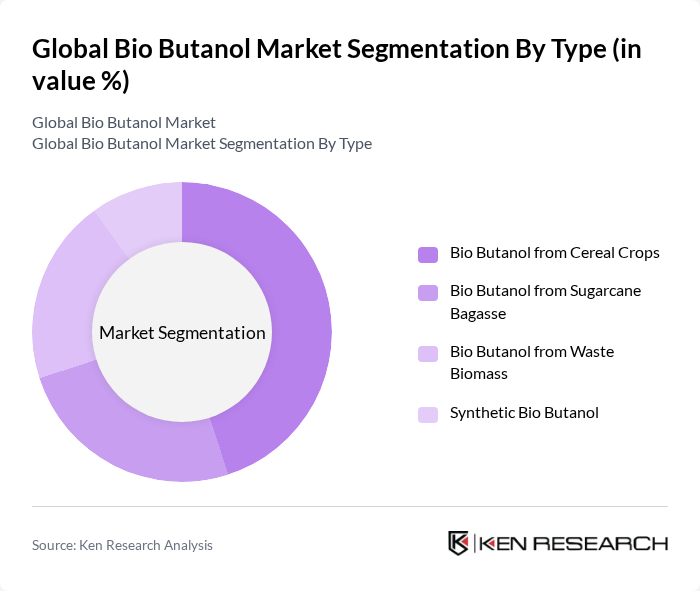

By Type:The market is segmented into four main types: Bio Butanol from Cereal Crops, Bio Butanol from Sugarcane Bagasse, Bio Butanol from Waste Biomass, and Synthetic Bio Butanol. Among these, Bio Butanol from Cereal Crops is currently the leading subsegment due to its widespread availability and established production processes. The increasing focus on sustainable agricultural practices and the use of food crops for biofuel production are driving this segment's growth. Additionally, advancements in fermentation and microbial engineering technologies are enhancing the efficiency and yield of bio butanol production from cereal crops .

By End-User Industry:The end-user industries for bio butanol include Transportation (Automotive, Aviation), Construction, Medical & Pharmaceuticals, Power Generation, and Personal Care Products. The Transportation sector is the dominant segment, driven by the increasing adoption of biofuels in vehicles and aviation. The push for greener alternatives in transportation fuels, coupled with government incentives for biofuel usage, is significantly boosting this segment. Additionally, the growing trend of sustainable practices in the automotive industry and the use of bio butanol as a drop-in fuel are further enhancing the demand for bio butanol .

The Global Bio Butanol Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gevo, Inc., Butamax Advanced Biofuels LLC, Green Biologics Ltd., Cobalt Technologies, BioAmber Inc., BASF SE, DuPont de Nemours, Inc., Mitsubishi Chemical Corporation, LanzaTech, Inc., Aemetis, Inc., Abengoa, Celtic Renewables Ltd., Cathay Industrial Biotech Ltd., Eastman Chemical Company, GranBio, Metabolic Explorer, Phytonix Corporation, Working Bugs LLC, Clariant AG, Novozymes A/S, Evonik Industries AG, Archer Daniels Midland Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bio butanol market appears promising, driven by increasing environmental regulations and a global push for sustainable energy solutions. As countries strive to meet emission reduction targets, the adoption of bio butanol is expected to rise significantly. Furthermore, advancements in production technologies will likely enhance efficiency and reduce costs, making bio butanol more competitive. The automotive sector's growing interest in biofuels will also contribute to market expansion, positioning bio butanol as a key player in the renewable energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Bio Butanol from Cereal Crops Bio Butanol from Sugarcane Bagasse Bio Butanol from Waste Biomass Synthetic Bio Butanol |

| By End-User Industry | Transportation (Automotive, Aviation) Construction Medical & Pharmaceuticals Power Generation Personal Care Products |

| By Application | Acrylates Acetates Glycol Ethers Plasticizers Biofuel Other Applications |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, United Kingdom, Italy, France, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (Saudi Arabia, South Africa, Rest of Middle East & Africa) |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Policy Support | Subsidies Tax Incentives Grants for Research |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bio Butanol Production Facilities | 100 | Plant Managers, Production Supervisors |

| End-User Industries (Automotive) | 80 | Procurement Managers, Product Development Engineers |

| Research Institutions and Universities | 50 | Research Scientists, Academic Professors |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

| Biofuel Trade Associations | 40 | Industry Analysts, Association Directors |

The Global Bio Butanol Market is valued at approximately USD 15.9 billion, driven by the increasing demand for biofuels and advancements in production technologies. This growth reflects a significant shift towards sustainable energy sources and cleaner alternatives to fossil fuels.