Region:Global

Author(s):Dev

Product Code:KRAD0512

Pages:99

Published On:August 2025

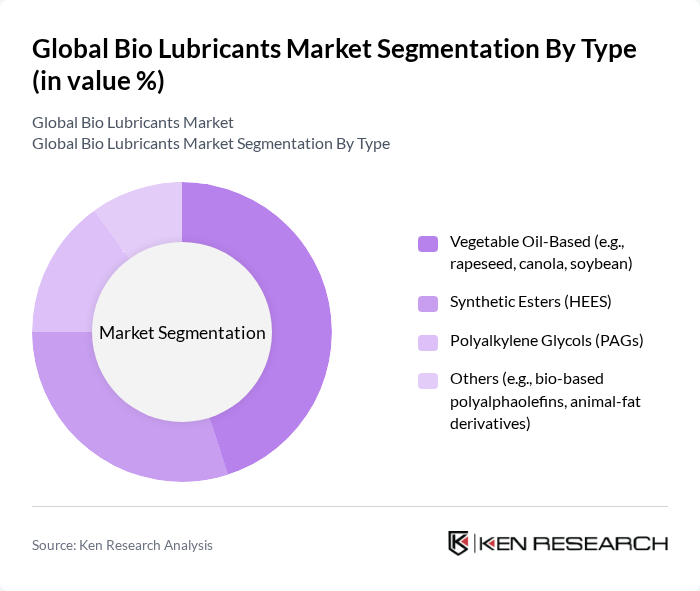

By Type:The bio lubricants market is segmented into four main types: Vegetable Oil-Based, Synthetic Esters, Polyalkylene Glycols, and Others. Among these, Vegetable Oil-Based lubricants are gaining traction due to their renewable nature and biodegradability. They are widely used in various applications, including automotive and industrial sectors, owing to their excellent lubricating properties and lower environmental impact. Synthetic Esters are also popular, particularly in high-performance applications, due to their superior thermal stability and lubricating efficiency; HEES fluids are widely adopted where biodegradable hydraulic oils are needed. The Others category includes bio-based polyalphaolefins and animal-fat derivatives, which are emerging as viable alternatives in niche markets, alongside innovations in green base oils and additive chemistries to improve oxidative stability and cold flow.

By End-User:The bio lubricants market is segmented by end-user into Automotive and Transportation, Industrial Machinery and Manufacturing, Marine and Ports, Agriculture, Forestry, and Construction, and Power Generation. The Automotive and Transportation sector is the largest consumer of bio lubricants, driven by efforts to reduce environmental impact, adoption of environmentally acceptable lubricants in sensitive areas, and OEM and fleet initiatives; EVs also require specialized greases and fluids where bio-based options are increasingly offered. Industrial Machinery and Manufacturing also represent a significant portion of the market, as companies seek to enhance operational efficiency while minimizing environmental impact, supported by plant-level sustainability targets and regulations. The Marine and Ports segment is growing due to the demand for environmentally acceptable lubricants (EALs) mandated for vessel general permits and sensitive waterways, where biodegradability and low toxicity are critical selection criteria.

The Global Bio Lubricants Market is characterized by a dynamic mix of regional and international players. Leading participants such as RSC Bio Solutions, Renewable Lubricants, Inc., FUCHS SE, TotalEnergies SE, Klüber Lubrication (a brand of Freudenberg), Shell plc, BP p.l.c. (Castrol), ExxonMobil, Chevron Corporation, PANOLIN AG, Condat, BioBlend Renewable Resources, LLC, Nye Lubricants, Croda International Plc, Cargill, Incorporated contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bio lubricants market appears promising, driven by increasing environmental awareness and regulatory support. As industries transition towards sustainable practices, the adoption of bio lubricants is expected to accelerate. Innovations in product formulations and enhanced performance characteristics will likely attract more users. Additionally, the growing trend of e-commerce in lubricant sales will facilitate easier access to bio lubricant products, further expanding market reach and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Vegetable Oil-Based (e.g., rapeseed, canola, soybean) Synthetic Esters (HEES) Polyalkylene Glycols (PAGs) Others (e.g., bio-based polyalphaolefins, animal-fat derivatives) |

| By End-User | Automotive and Transportation (ICE, EV, off-highway) Industrial Machinery and Manufacturing Marine and Ports (including EALs) Agriculture, Forestry, and Construction Power Generation (wind, hydro, others) |

| By Application | Engine Oils and Driveline Fluids Hydraulic Fluids (HETG/HEES/HEPG) Metalworking and Greases Gear Oils, Chainsaw Oils, Compressor and Turbine Oils |

| By Distribution Channel | Direct Sales (OEMs and industrial accounts) Online and E-procurement Distributors and Value-Added Resellers Others |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Nordics, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Southeast Asia) Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging (IBCs, drums) Retail Packaging (pails, cans) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Bio Lubricants | 110 | Product Managers, Automotive Engineers |

| Industrial Bio Lubricants | 90 | Operations Managers, Maintenance Supervisors |

| Marine Bio Lubricants | 60 | Fleet Managers, Environmental Compliance Officers |

| Agricultural Bio Lubricants | 70 | Agricultural Engineers, Farm Equipment Operators |

| Bio Lubricants in Renewable Energy | 50 | Renewable Energy Engineers, Sustainability Consultants |

The Global Bio Lubricants Market is valued at approximately USD 3.2 to 3.3 billion, driven by increasing environmental regulations and a growing demand for sustainable, eco-friendly products across various industries.