Region:Global

Author(s):Dev

Product Code:KRAB0387

Pages:99

Published On:August 2025

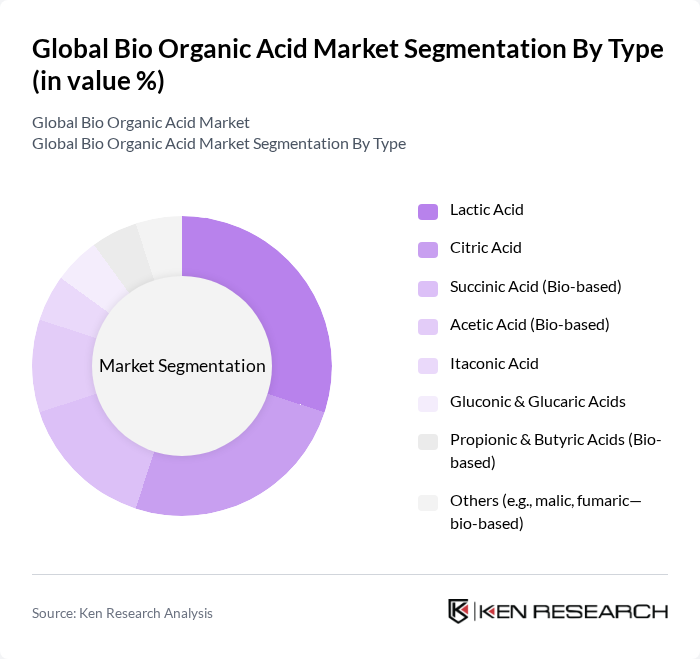

By Type:The market is segmented into various types of bio organic acids, including lactic acid, citric acid, succinic acid (bio-based), acetic acid (bio-based), itaconic acid, gluconic & glucaric acids, propionic & butyric acids (bio-based), and others such as malic and fumaric acids. Among these, lactic acid and citric acid are the most prominent due to their extensive applications in food and beverage, pharmaceuticals, and personal care products. The increasing consumer preference for natural and organic ingredients is driving the demand for these acids, making them the leading subsegments in the market.

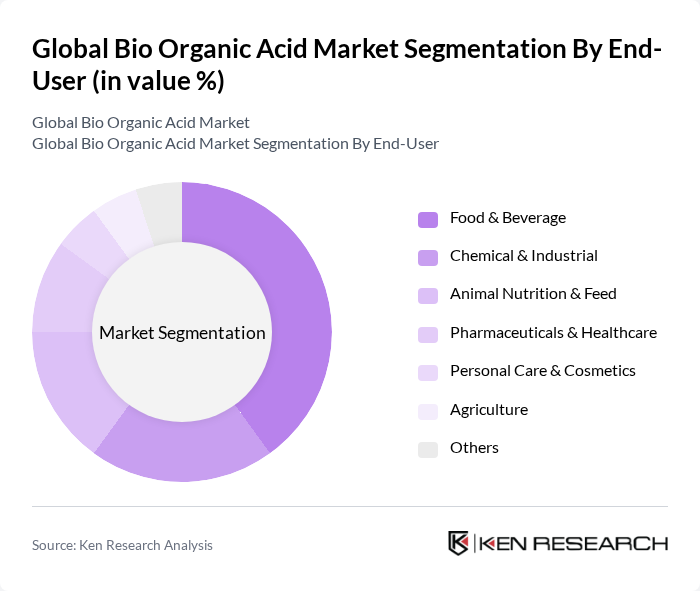

By End-User:The end-user segmentation includes food & beverage, chemical & industrial, animal nutrition & feed, pharmaceuticals & healthcare, personal care & cosmetics, agriculture, and others. The food & beverage sector is the largest consumer of bio organic acids, driven by the rising demand for natural preservatives and flavoring agents. Additionally, the pharmaceutical industry is increasingly utilizing these acids for drug formulation and production, further solidifying their importance in the market.

The Global Bio Organic Acid Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Cargill, Incorporated, DuPont de Nemours, Inc., Corbion N.V., Archer Daniels Midland Company (ADM), Genomatica, Inc., NatureWorks LLC, Mitsubishi Chemical Group Corporation, Evonik Industries AG, Novozymes A/S (Novonesis), DSM-Firmenich AG, LCY Biosciences Inc., GC Innovation America (PTTGC Group), BlueBioTech International GmbH, LanzaTech Global, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bio organic acid market appears promising, driven by increasing consumer demand for sustainable products and innovations in production technologies. As industries continue to prioritize eco-friendly practices, the adoption of bio organic acids is expected to rise significantly. Furthermore, the expansion of the organic food sector and the growing trend towards natural ingredients will likely create new avenues for market growth, fostering a more sustainable and competitive landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Lactic Acid Citric Acid Succinic Acid (Bio-based) Acetic Acid (Bio-based) Itaconic Acid Gluconic & Glucaric Acids Propionic & Butyric Acids (Bio-based) Others (e.g., malic, fumaric—bio-based) |

| By End-User | Food & Beverage Chemical & Industrial (including polymers, solvents, coatings) Animal Nutrition & Feed Pharmaceuticals & Healthcare Personal Care & Cosmetics Agriculture (crop protection, soil enhancers) Others |

| By Application | Preservatives & Antimicrobials Acidulants & Flavoring Agents pH Regulators & Buffering Agents Monomers/Intermediates for Biopolymers & Solvents Nutraceuticals & Supplements Others |

| By Distribution Channel | Direct/B2B (Contract & Offtake) Distributors & Traders Online/Brokerage Platforms Wholesalers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Source | Biomass/Starch & Sugars Molasses & Agro-industrial Residue Gaseous Feedstocks (e.g., CO, CO2 via gas fermentation) Others (mixed substrates) |

| By Production Pathway | Fermentation (bacterial/yeast/fungal) Enzymatic/Biocatalysis Hybrid Bio-Refinery Routes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Applications | 120 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Uses | 90 | Regulatory Affairs Managers, R&D Scientists |

| Agricultural Sector Insights | 60 | Agronomists, Crop Scientists |

| Industrial Applications | 70 | Operations Managers, Supply Chain Analysts |

| Consumer Products Sector | 80 | Marketing Managers, Product Line Directors |

The Global Bio Organic Acid Market is valued at approximately USD 10 billion, driven by the increasing demand for bio-based products across various sectors, including food and beverage, pharmaceuticals, and industrial applications.