Global Bioenergy Market Overview

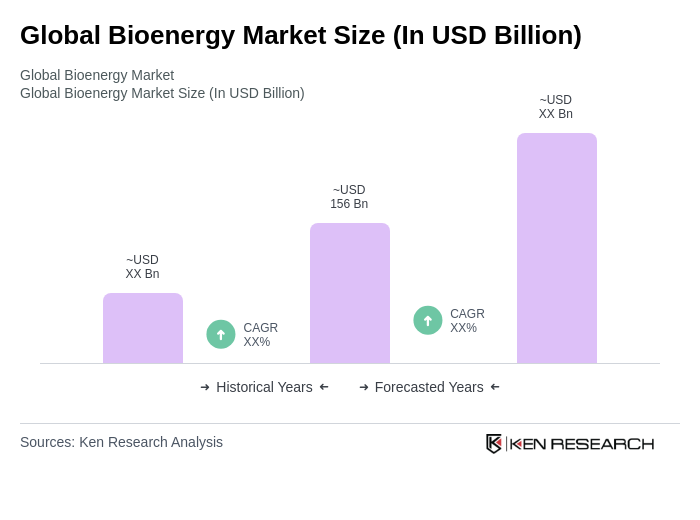

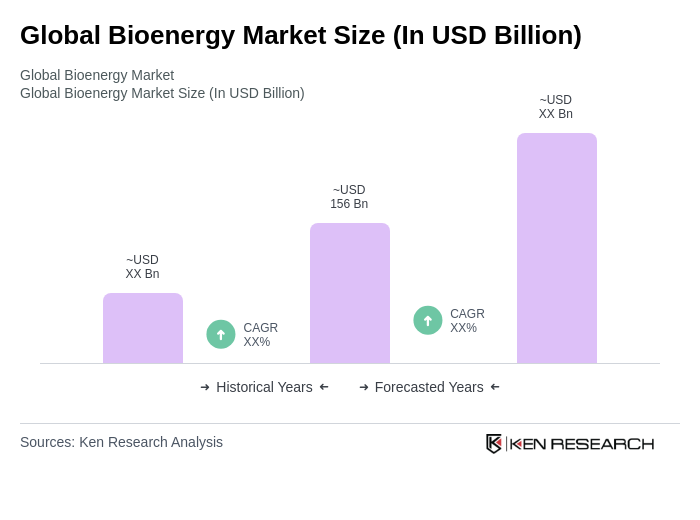

- The Global Bioenergy Market is valued at USD 156 billion, based on a five-year historical analysis. This growth is primarily driven by increasing demand for renewable energy sources, government policies promoting sustainable energy, and advancements in bioenergy technologies. The market has seen a significant rise in investments aimed at reducing carbon emissions, the expansion of bioenergy applications in transportation and power generation, and enhanced energy security initiatives. Key trends also include technological improvements in biomass conversion and the integration of bioenergy into national energy strategies, particularly in North America and Europe .

- Key players in this market include the United States, Brazil, and Germany. The United States leads due to its vast agricultural resources and advanced biofuel production technologies. Brazil benefits from its established sugarcane ethanol industry and supportive government policies, while Germany's strong commitment to renewable energy targets and innovative biomass conversion technologies further solidifies its position in the market .

- In 2023, the European Union implemented the Renewable Energy Directive II (Directive (EU) 2018/2001), issued by the European Parliament and the Council. This directive mandates that at least 32% of the EU's energy consumption must come from renewable sources by 2030. The regulation establishes binding national targets, sustainability criteria for bioenergy feedstocks, and compliance mechanisms, thereby promoting the use of bioenergy and reducing greenhouse gas emissions across member states .

Global Bioenergy Market Segmentation

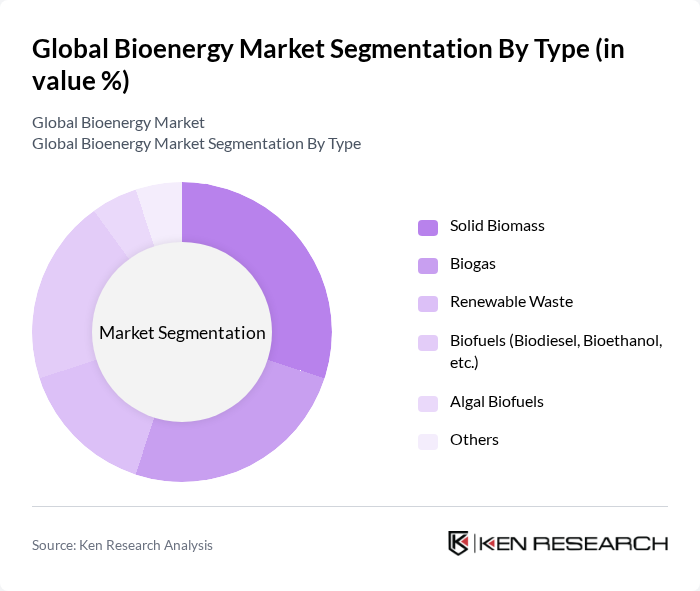

By Type:The bioenergy market can be segmented into various types, including Solid Biomass, Biogas, Renewable Waste, Biofuels (Biodiesel, Bioethanol, etc.), Algal Biofuels, and Others. Each type serves different applications and industries, such as electricity generation, heating, transportation fuels, and industrial processes, contributing to the overall market dynamics .

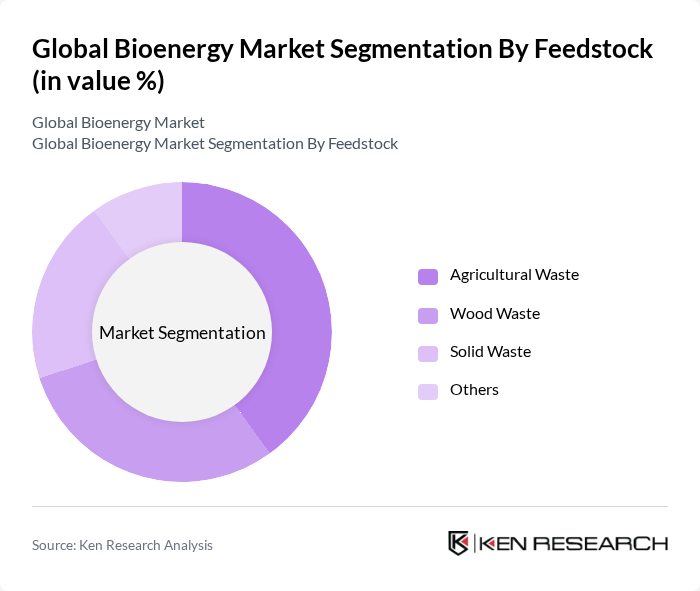

By Feedstock:The feedstock segment includes Agricultural Waste, Wood Waste, Solid Waste, and Others. Each feedstock type plays a crucial role in the production of bioenergy, influencing the market's supply chain, sustainability practices, and regional adoption patterns. Agricultural waste and wood waste are the most widely used, while solid waste and other organic materials are increasingly utilized as technology advances .

Global Bioenergy Market Competitive Landscape

The Global Bioenergy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Archer Daniels Midland Company, POET, LLC, Novozymes A/S, Renewable Energy Group, Inc., Green Plains Inc., Drax Group plc, Abengoa Bioenergy, Valero Energy Corporation, Babcock & Wilcox Enterprises, Inc., Ørsted A/S, Hitachi Zosen Corporation, Pacific BioEnergy Corporation, Enerkem Inc., Aemetis, Inc., Clariant AG contribute to innovation, geographic expansion, and service delivery in this space.

Global Bioenergy Market Industry Analysis

Growth Drivers

- Increasing Demand for Renewable Energy:The global shift towards renewable energy sources is evident, with the International Energy Agency reporting that renewable energy consumption reached approximately 3,000 terawatt-hours (TWh) in future. This surge is driven by countries aiming to reduce reliance on fossil fuels, with bioenergy accounting for approximately 10% of the total energy mix. The demand for cleaner energy solutions is projected to continue rising, particularly in regions like None, where energy diversification is a priority.

- Government Incentives and Subsidies:In future, governments worldwide are expected to allocate over $200 billion in subsidies for renewable energy projects, including bioenergy. These financial incentives are crucial for fostering investment in bioenergy infrastructure and technology. For instance, the U.S. Department of Energy has earmarked $50 million specifically for bioenergy research and development, encouraging innovation and reducing the financial burden on companies in None looking to expand their bioenergy capabilities.

- Technological Advancements in Bioenergy Production:The bioenergy sector is witnessing significant technological innovations, with investments in advanced biofuel production technologies projected to exceed $30 billion in future. These advancements enhance efficiency and reduce production costs, making bioenergy more competitive. For example, the development of second-generation biofuels, derived from non-food biomass, is gaining traction, with production facilities in None expected to increase output by 15% annually, further driving market growth.

Market Challenges

- High Initial Investment Costs:The bioenergy sector faces substantial initial investment costs, with estimates indicating that establishing a bioenergy plant can require upwards of $3 million to $5 million per megawatt of capacity. This financial barrier can deter new entrants and limit expansion opportunities for existing players in None. Additionally, the long payback periods associated with bioenergy projects can further complicate financing, making it challenging for companies to secure necessary funding.

- Regulatory Hurdles and Compliance Issues:Navigating the complex regulatory landscape poses significant challenges for bioenergy companies. In None, compliance with stringent environmental regulations can lead to delays and increased operational costs. For instance, the average time to obtain necessary permits for bioenergy projects can exceed 12 to 24 months, hindering timely market entry. Furthermore, evolving regulations may require continuous adaptation, adding to the operational burden for companies in the sector.

Global Bioenergy Market Future Outlook

The future of the bioenergy market in None appears promising, driven by increasing investments in sustainable energy solutions and technological advancements. As countries strive to meet carbon neutrality goals, bioenergy is expected to play a pivotal role in the energy transition. The integration of digital technologies and decentralized energy systems will further enhance efficiency and accessibility, fostering a more resilient energy landscape. Continued government support and public awareness of sustainability will likely accelerate growth in this sector.

Market Opportunities

- Expansion into Emerging Markets:Emerging markets present significant opportunities for bioenergy growth, with demand for renewable energy sources projected to increase by 20% annually. Countries in None are focusing on diversifying their energy portfolios, creating a favorable environment for bioenergy investments. This expansion can lead to enhanced energy security and reduced dependence on fossil fuels, benefiting both local economies and the global environment.

- Development of Advanced Biofuels:The development of advanced biofuels, particularly those derived from waste materials, is gaining traction. With the global biofuel market expected to reach $150 billion in future, companies in None can capitalize on this trend by investing in innovative production technologies. This shift not only addresses sustainability concerns but also provides a competitive edge in the growing renewable energy landscape.