Region:Global

Author(s):Dev

Product Code:KRAD0467

Pages:88

Published On:August 2025

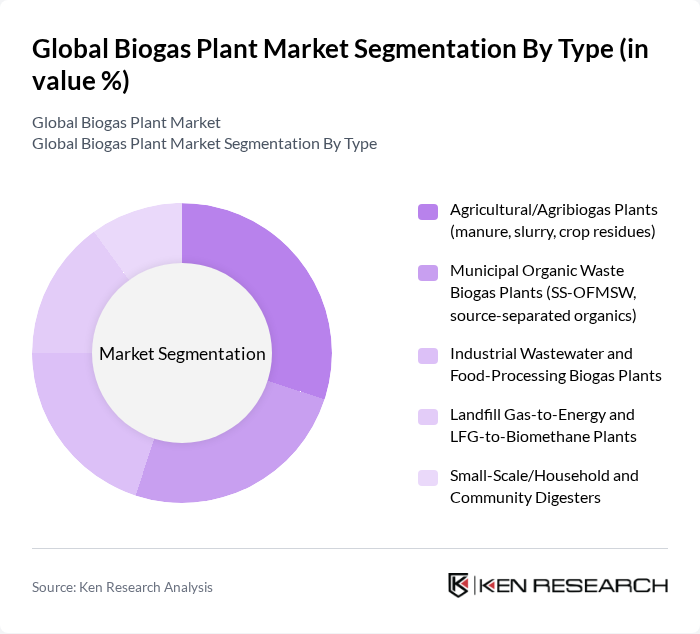

By Type:The biogas plant market can be segmented into various types, including Agricultural/Agribiogas Plants, Municipal Organic Waste Biogas Plants, Industrial Wastewater and Food-Processing Biogas Plants, Landfill Gas-to-Energy and LFG-to-Biomethane Plants, and Small-Scale/Household and Community Digesters. Each of these segments plays a crucial role in the overall market dynamics, with specific applications and target audiences.

By End-User:The end-user segmentation includes Utilities and Independent Power Producers (IPP), Agriculture and Livestock Farms, Food & Beverage and Industrial Manufacturers, and Municipalities and Waste Management Operators. Each end-user category has distinct needs and applications for biogas, influencing the market's growth and development.

The Global Biogas Plant Market is characterized by a dynamic mix of regional and international players. Leading participants such as EnviTec Biogas AG, WELTEC BIOPOWER GmbH, BTS Biogas S.r.l. (BTS Biogas), Bioenergy DevCo (BDC), Greenlane Renewables Inc., Gasum Oy, Nature Energy Biogas A/S (a Shell company), SUEZ Recycling & Recovery, Veolia Environnement S.A., Hitachi Zosen Inova AG, Schmack Biogas GmbH (Viessmann Group), Bioenergieanlagen Planner GmbH (formerly Biogas Nord), DVO, Inc., PlanET Biogas Group GmbH, TotalEnergies SE (TotalEnergies BioGas & RNG) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the biogas plant market appears promising, driven by increasing global energy demands and a strong push for sustainable practices. As countries implement stricter emission reduction targets, biogas is positioned to play a crucial role in the energy mix. Furthermore, the integration of biogas with other renewable sources, such as solar and wind, is expected to enhance energy reliability and efficiency. This synergy will likely foster innovation and investment, paving the way for a more resilient energy infrastructure.

| Segment | Sub-Segments |

|---|---|

| By Type | Agricultural/Agribiogas Plants (manure, slurry, crop residues) Municipal Organic Waste Biogas Plants (SS-OFMSW, source-separated organics) Industrial Wastewater and Food-Processing Biogas Plants Landfill Gas-to-Energy and LFG-to-Biomethane Plants Small-Scale/Household and Community Digesters |

| By End-User | Utilities and Independent Power Producers (IPP) Agriculture and Livestock Farms Food & Beverage and Industrial Manufacturers Municipalities and Waste Management Operators |

| By Application | Electricity and Combined Heat & Power (CHP) Process/Space Heat and Steam Biomethane/RNG for Grid Injection Vehicle Fuel (Bio-CNG/L-CBG) On-site Power for Wastewater Treatment Works |

| By Investment Source | Project Finance and SPVs Corporate/Balance-Sheet Investment Public-Private Partnerships (PPP) Government Grants and Subsidy Schemes |

| By Policy Support | Feed-in Tariffs and Contracts for Difference Renewable Gas/Low-Carbon Fuel Standards and RINs Renewable Energy Certificates/Guarantees of Origin Net Metering and Grid Access Incentives |

| By Technology | Wet AD: CSTR, Plug-Flow Dry/High-Solids AD and Batch Digesters Co-Digestion Systems (sewage sludge + organics/manure) Biogas Upgrading: Water/Amine/PSA/Membrane/Cryo Digestate Treatment: Separation, Drying, Composting |

| By Distribution Mode | Direct EPC/OEM Sales Developer and IPP Offtake Contracts Distributors and System Integrators Utility Interconnection/Grid Injection Agreements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Biogas Plants | 90 | Farm Owners, Agricultural Engineers |

| Municipal Solid Waste Biogas Projects | 70 | City Planners, Waste Management Officials |

| Industrial Biogas Applications | 60 | Plant Managers, Environmental Compliance Officers |

| Biogas Technology Providers | 50 | Technology Developers, Sales Executives |

| Regulatory and Policy Frameworks | 40 | Policy Makers, Regulatory Affairs Specialists |

The Global Biogas Plant Market is valued at approximately USD 4.5 billion, driven by investments in renewable energy, government incentives for sustainable waste management, and growing environmental awareness. Europe leads in installed capacity, supported by robust policy frameworks.