Region:Global

Author(s):Rebecca

Product Code:KRAA1364

Pages:93

Published On:August 2025

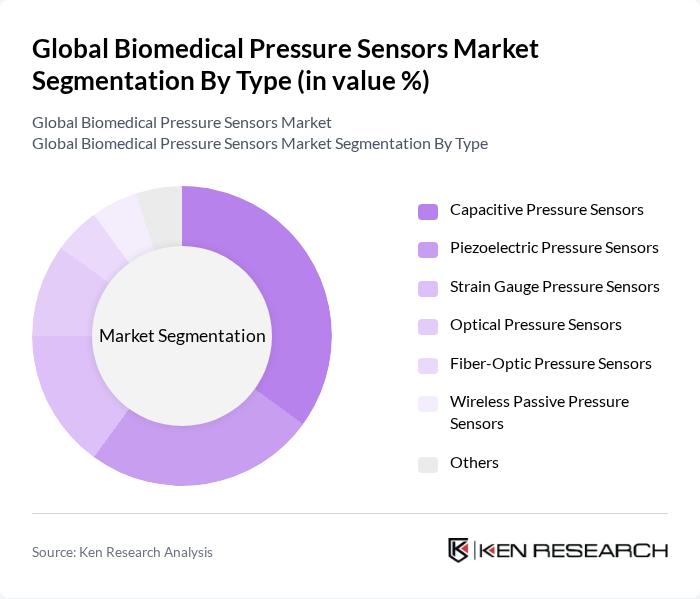

By Type:The market is segmented into various types of pressure sensors, including capacitive, piezoelectric, strain gauge, optical, fiber-optic, wireless passive, and others. Capacitive pressure sensors remain the leading segment due to their high sensitivity, stability, and accuracy, making them ideal for critical medical applications such as blood pressure monitoring and respiratory devices. Piezoelectric sensors are also experiencing strong demand, particularly for applications requiring dynamic pressure measurement and rapid response, such as in cardiac and neurological monitoring. Optical and fiber-optic sensors are gaining traction for their immunity to electromagnetic interference and suitability in MRI environments, while wireless passive sensors are emerging in implantable and wearable medical devices .

By End-User:The end-user segmentation includes hospitals, diagnostic laboratories, home healthcare, research institutions, ambulatory surgical centers, and others. Hospitals are the dominant end-user segment, driven by the high volume of surgical procedures, the need for continuous patient monitoring, and the integration of advanced sensor-based medical devices. Home healthcare is witnessing significant growth due to the increasing adoption of remote patient monitoring, the aging global population, and the shift toward decentralized healthcare delivery. Diagnostic laboratories and research institutions are also important segments, leveraging pressure sensors for precision diagnostics and experimental applications .

The Global Biomedical Pressure Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Siemens AG, Medtronic plc, Bosch Sensortec GmbH, TE Connectivity Ltd., NXP Semiconductors N.V., Analog Devices, Inc., STMicroelectronics N.V., Sensirion AG, First Sensor AG, Infineon Technologies AG, Omron Corporation, Druck, a Baker Hughes business, Ametek, Inc., Kistler Instrumente AG, Smiths Medical (ICU Medical, Inc.), Edwards Lifesciences Corporation, Merit Medical Systems, Inc., MEMS AG, NovaSensor (Amphenol Advanced Sensors) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the biomedical pressure sensors market appears promising, driven by ongoing technological innovations and an increasing focus on personalized medicine. As healthcare systems evolve, the integration of IoT technologies will enhance real-time monitoring capabilities, improving patient care. Additionally, the shift towards home healthcare solutions will further stimulate demand for portable and user-friendly pressure sensors, enabling patients to manage their health more effectively from home, thus expanding market reach and accessibility.

| Segment | Sub-Segments |

|---|---|

| By Type | Capacitive Pressure Sensors Piezoelectric Pressure Sensors Strain Gauge Pressure Sensors Optical Pressure Sensors Fiber-Optic Pressure Sensors Wireless Passive Pressure Sensors Others |

| By End-User | Hospitals Diagnostic Laboratories Home Healthcare Research Institutions Ambulatory Surgical Centers Others |

| By Application | Blood Pressure Monitoring Respiratory Monitoring Intracranial Pressure Monitoring Gastrointestinal Pressure Monitoring Intravascular Pressure Monitoring Cardiovascular Monitoring Drug Delivery Systems Others |

| By Component | Sensors Transmitters Display Units Software Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Price Range | Low Price Range Mid Price Range High Price Range Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wearable Health Monitoring Devices | 100 | Biomedical Engineers, Product Development Managers |

| Surgical Pressure Sensors | 80 | Surgeons, Operating Room Coordinators |

| Diagnostic Equipment Manufacturers | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Telemedicine Applications | 50 | Healthcare IT Managers, Telehealth Coordinators |

| Research Institutions and Universities | 40 | Academic Researchers, Lab Managers |

The Global Biomedical Pressure Sensors Market is valued at approximately USD 4.5 billion, driven by factors such as the rising prevalence of chronic diseases and advancements in sensor technology that enhance the accuracy and reliability of medical devices.