Region:Global

Author(s):Dev

Product Code:KRAB0652

Pages:97

Published On:August 2025

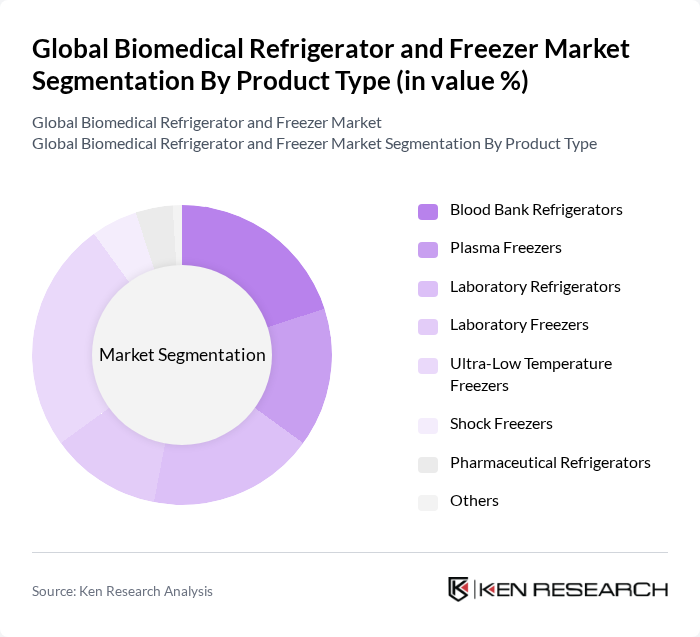

By Product Type:The product type segmentation includes various categories of biomedical refrigeration and freezer units designed for specific applications. The leading sub-segment is the Ultra-Low Temperature Freezers, which are essential for storing biological samples, vaccines, and pharmaceuticals at extremely low temperatures. The demand for these units is driven by the increasing need for long-term storage solutions in research and clinical settings, as well as the expansion of biobanking and gene therapy applications. Other notable sub-segments include Blood Bank Refrigerators and Laboratory Refrigerators, which are also witnessing significant growth due to the rising number of blood donation centers, research laboratories, and the growing focus on safe storage of temperature-sensitive products .

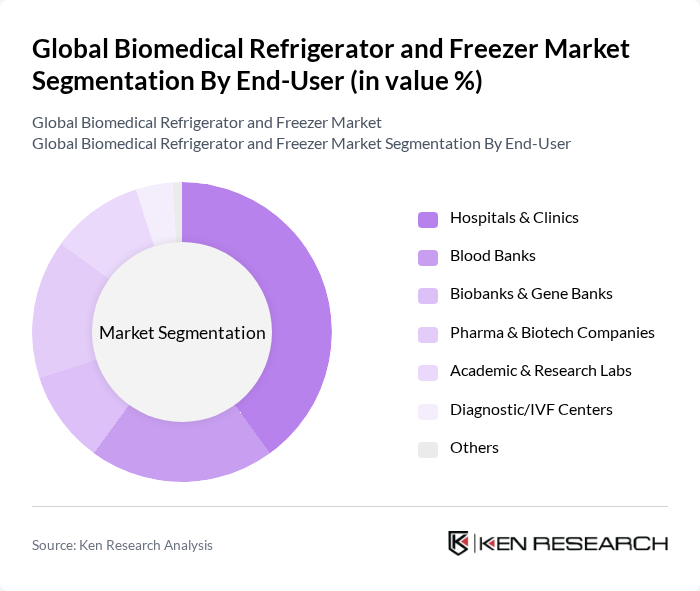

By End-User:The end-user segmentation highlights the various sectors utilizing biomedical refrigeration and freezer solutions. Hospitals and Clinics represent the largest segment, driven by the need for reliable storage of vaccines, blood products, and other temperature-sensitive materials. Blood Banks and Pharma & Biotech Companies also play significant roles, as they require specialized refrigeration solutions to maintain the integrity of their products. The increasing number of diagnostic centers and academic research labs, along with the growth in biobanking and gene therapy research, further contributes to the expansion of this market segment .

The Global Biomedical Refrigerator and Freezer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Haier Biomedical, Panasonic Healthcare Co., Ltd., Eppendorf AG, B Medical Systems S.à r.l., Follett Products LLC, Helmer Scientific Inc., Liebherr Group, Aegis Scientific, Inc., VWR International, LLC (Avantor), SANYO Electric Co., Ltd. (now Panasonic Biomedical), Bionics Scientific Technologies (P) Ltd., Labcold Limited, PHCbi (PHC Holdings Corporation), Vestfrost Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the biomedical refrigerator and freezer market appears promising, driven by increasing healthcare investments and technological innovations. As healthcare systems expand, particularly in developing regions, the demand for reliable storage solutions will continue to rise. Additionally, the integration of smart technologies and energy-efficient models will likely enhance operational efficiency, addressing both environmental concerns and regulatory compliance. This evolving landscape presents significant opportunities for manufacturers to innovate and capture emerging market segments.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Blood Bank Refrigerators Plasma Freezers Laboratory Refrigerators Laboratory Freezers Ultra-Low Temperature Freezers Shock Freezers Pharmaceutical Refrigerators Others |

| By End-User | Hospitals & Clinics Blood Banks Biobanks & Gene Banks Pharma & Biotech Companies Academic & Research Labs Diagnostic/IVF Centers Others |

| By Application | Vaccine Storage Blood Storage Sample Preservation Pharmaceutical Storage Biopharmaceutical Storage Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores Others |

| By Region | North America (United States, Canada, Mexico) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) Others |

| By Price Range | Low Range Mid Range High Range |

| By Technology | Compressor-based Refrigeration Absorption/Adsorption Refrigeration Magnetic Refrigeration Stirling Engine Refrigeration Thermoelectric Refrigeration Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Biomedical Equipment Procurement | 120 | Procurement Managers, Biomedical Engineers |

| Laboratory Refrigeration Needs | 90 | Lab Managers, Research Scientists |

| Pharmaceutical Storage Solutions | 60 | Pharmacy Directors, Quality Assurance Managers |

| Biobanking and Sample Storage | 50 | Biobank Managers, Research Coordinators |

| Vaccine Storage Requirements | 70 | Public Health Officials, Vaccine Program Managers |

The Global Biomedical Refrigerator and Freezer Market is valued at approximately USD 4.9 billion, driven by the increasing demand for temperature-sensitive products in healthcare, including vaccines and blood products, as well as advancements in biopharmaceuticals and storage technologies.